Hey Indian Guardians, do you really think about building an emergency fund? Here’s the deal: we will answer your every question, like, how can individuals strike a balance between building a robust emergency fund, cutting unnecessary expenses, automating savings, defining clear criteria, etc., so that you can build your emergency fund?

Why do we need an Emergency Fund and why is it important to have one?

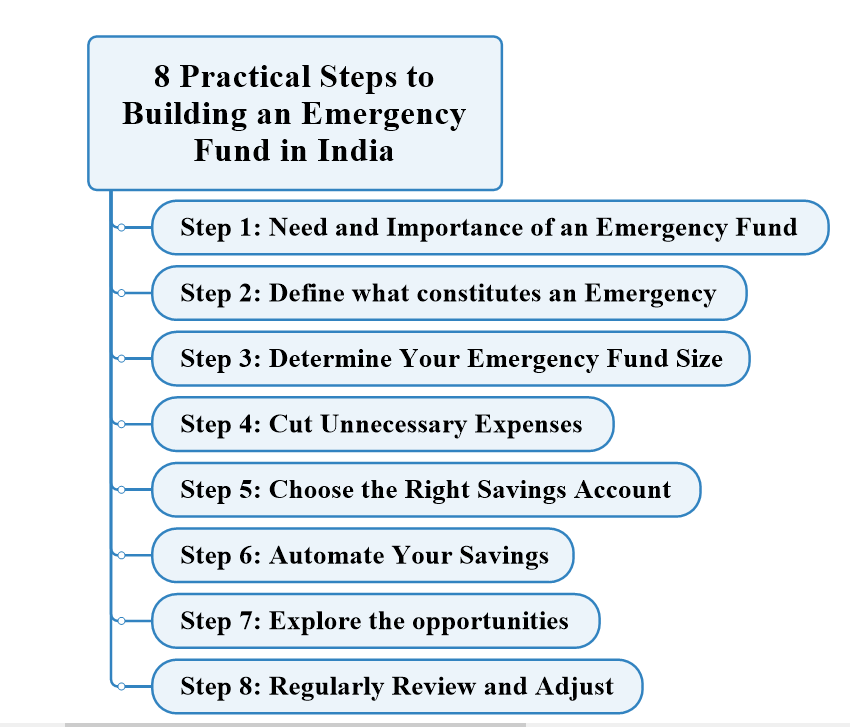

Step 1: Need and Importance of an Emergency Fund

In the dynamic and ever-evolving landscape of the Indian financial scenario, the need for a robust emergency fund stands paramount. India, a nation of diverse cultures, languages, and economic variations, presents a unique set of challenges and opportunities when it comes to financial planning. It is within this context that the importance of an emergency fund becomes not just a financial choice but a strategic necessity.

Financial preparedness plays a pivotal role in steering individuals and families through the uncertainties that can arise unexpectedly. Whether it be sudden medical expenses, unforeseen job losses, or the need to address critical home repairs, having a well-established emergency fund serves as a resilient shield against the unexpected twists and turns that life may throw our way.

In the Indian financial landscape, where the cost of living can vary significantly between regions, and the economic climate is ever-changing, the role of an emergency fund becomes even more crucial. It is not merely a financial safety net; it’s a strategic tool that empowers individuals to face challenges head-on, without compromising their long-term financial stability.

As we delve into the details of building an emergency fund tailored to the Indian context, let us acknowledge the power of financial preparedness in providing not just security but the freedom to navigate life’s uncertainties with confidence and resilience. Through careful planning and strategic execution, an emergency fund becomes a cornerstone of financial well-being, enabling individuals to withstand unforeseen circumstances and emerge stronger on the other side.

Building an Emergency Fund in India

➤ Enquire now for CWM Program ➤ Download CWM Brochure

What types of emergencies should I prepare for?

Step 2: Define what constitutes an Emergency

In the Indian context, an emergency is a situation that demands immediate attention and requires financial intervention. It’s something unexpected that can disrupt your normal life and financial stability.

Examples Include, But Are Not Limited To:

Medical Emergencies:

- Sudden health issues requiring immediate treatment or hospitalization.

- Unforeseen medical expenses that might not be covered by insurance.

Job Loss or Income Interruption:

- Unexpected job loss leading to a temporary lack of income.

- Sudden reduction in income due to unforeseen circumstances.

Unexpected Home Repairs:

- Urgent repairs needed for essential home systems (plumbing, electricity, etc.).

- Unforeseen damage to your home that requires immediate attention.

Understanding these examples helps distinguish between everyday expenses and situations that genuinely warrant tapping into your emergency fund. It’s about preparing for the unexpected in a country as diverse and dynamic as India.

What is the recommended size of an emergency fund?

Step 3: Determine Your Emergency Fund Size

- Calculate Based on Indian-Specific Considerations: Consider the cost of living in your specific region in India. Factor in housing costs, transportation, food, healthcare, and other essentials. Recognize that living expenses can vary across cities and states, so modify your calculations to your local economic context.

- Aim for 3 to 6 Months’ Worth of Living Expenses: In the dynamic Indian market, aim to build an emergency fund that covers at least 3 to 6 months’ worth of your living expenses. This duration provides a robust financial cushion to weather unexpected storms without compromising your financial stability.

- Consideration for Varied Costs: Given the diversity in living standards and costs across India, be mindful of any unique circumstances. For instance, if you have dependents or specific health considerations, adjust your emergency fund size accordingly.

By determining the appropriate size for your emergency fund, you’re customizing a safety net that aligns with the economic realities of living in India. This ensures that you’re adequately prepared for unexpected situations without being overwhelmed by financial strain.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

How can I identify and cut unnecessary expenses to contribute more to my Emergency Fund?

Step 4: Cut Unnecessary Expenses

Trimming unnecessary expenses is a key step in freeing up funds to bolster your emergency fund. Let’s navigate this process, taking into account prevalent aspects of the Indian lifestyle:

Identify Non-Essential Expenses in the Indian Lifestyle:

- Dining Out: While enjoying meals outside is part of the culture, frequent dining out can contribute significantly to expenses. Consider reducing the frequency and opt for home-cooked meals to save money and health.

- Subscription Services: Evaluate subscription services like streaming platforms, magazines, or gym memberships and identify those that are less essential and consider cancelling or downgrading to more economical plans.

- Impulse Purchases: Be mindful of impulsive spending on items that aren’t essential. Make a habit of pausing before making non-urgent purchases and reassessing their necessity.

- Transportation Costs: Explore cost-effective transportation options. Consider carpooling, using public transport, or exploring sustainable modes like cycling for short distances.

Practical Tips for Cutting Back:

- Budget Analysis: Review your budget regularly to identify areas where you can cut back. This analysis can reveal spending patterns and areas where adjustments can be made.

- Prioritize Needs Over Wants: Distinguish between needs and wants. Prioritize spending on necessities and allocate funds to your emergency fund before indulging in non-essential purchases.

- Negotiate Bills: Negotiate bills, especially for utilities and services. Explore better deals, switch providers if needed, and leverage discounts to reduce regular expenses.

- Cultural and Festive Spending: Be mindful of cultural and festive spending. While celebrations are important, finding cost-effective ways to enjoy traditions can significantly contribute to savings.

By identifying non-essential expenses and implementing practical tips for cutting back, you’re not just saving money – you’re redirecting those funds towards the growth of your emergency fund. This step requires a thoughtful approach to align your spending habits with your financial goals, enhancing your ability to tackle unexpected situations with ease. Let’s proceed with confidence, knowing that every rupee saved brings you closer to a more resilient financial future.

Where should I keep my Emergency Fund?

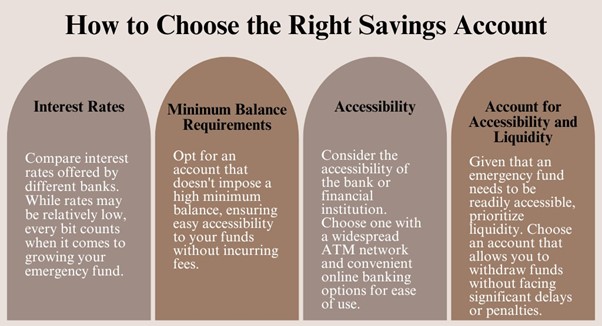

Step 5: Choose the Right Savings Account

Explore savings account offerings from different Indian banks and financial institutions. Consider both traditional banks and digital or online banks. Look for accounts that align with your preferences and financial goals.

Building an Emergency Fund in India

By carefully evaluating and choosing the right savings account, you’re laying the foundation for a secure and accessible repository for your emergency fund. This step ensures that your money is not only growing but also easily within reach when you need it.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

How can I effectively automate my savings to consistently contribute to my emergency fund?

Step 6: Automate Your Savings

Automating your savings is a game-changer in building a consistent and reliable emergency fund. Let’s explore the benefits and guide you through the process, keeping in mind the Indian audience:

Benefits of Automating Savings:

- Consistency: Automation ensures a regular and consistent contribution to your emergency fund. This consistency is key to reaching your financial goals without relying solely on manual efforts.

- Discipline: It instils financial discipline by treating savings as a non-negotiable expense. Once set up, automated transfers make saving a priority, reducing the temptation to spend before saving.

- Efficiency: Automation saves time and effort. You won’t need to remember to transfer money each month; it happens automatically, streamlining your financial management.

Automated Transfers:

- Identify Income Cycles: Understand your income cycles, whether it’s monthly, bi-monthly, or another frequency. This knowledge helps in aligning automated transfers with your cash inflow.

- Set Up Standing Instructions: Contact your bank to set up standing instructions for automated transfers. This can usually be done through online banking or by visiting your branch.

- Specify Transfer Amount and Frequency: Clearly define the amount you want to transfer and the frequency. Align this with your budget and the targeted contribution to your emergency fund.

- Monitor Regularly: While automation brings convenience, it’s essential to monitor your account regularly. Ensure that transfers are happening as scheduled and make adjustments as needed.

By automating your savings, you’re putting your emergency fund on autopilot, ensuring that it grows steadily over time. This step not only simplifies the saving process but also reinforces financial discipline, a crucial aspect of successful financial planning.

What are the important things to keep in mind while building an Emergency Fund?

Step 7: Explore the opportunities

In the diverse and dynamic economic landscape of India, building an emergency fund is crucial for enhancing your financial resilience. Let’s delve into the steps involved:

Research and Resistance:

- Identify Key Risks: Evaluate potential risks specific to the Indian economic landscape. This could include job market fluctuations, health-related uncertainties, or regional economic challenges.

- Emergency Fund Expansion: Consider expanding your emergency fund beyond the standard 3 to 6 months’ worth of living expenses, especially if you anticipate prolonged economic uncertainties.

- Explore Insurance Options: Investigate insurance options available in India. This includes health insurance, life insurance, and other policies that provide financial protection in case of unexpected events.

- Income Protection: Explore income protection plans or insurance that covers loss of income due to unforeseen circumstances. This can act as a safety net during periods of job loss or economic downturns.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Enhance Financial Resilience:

- Diversify Investments: Diversify your investment portfolio to mitigate risks. Explore a mix of assets that align with your risk tolerance and provide stability during economic uncertainties.

- Explore Government Schemes: Stay informed about government schemes and policies that offer financial support during challenging times. Familiarize yourself with eligibility criteria and application processes.

- Network and Support: Build a network of financial advisors and professionals who can provide guidance during uncertain economic times. Seek support from friends, family, or financial communities to share insights and navigate challenges collaboratively.

- Regular Financial Health Checks: Conduct regular financial health checks to assess the effectiveness of your contingency plan. Make adjustments based on changes in the economic landscape or personal circumstances.

Building a robust contingency plan ensures that you’re well-prepared to face unique challenges in the Indian economic environment. It goes beyond the emergency fund, incorporating insurance options, diversified investments, and a proactive approach to economic uncertainties. By taking these steps, you’re fortifying your financial resilience and establishing a comprehensive safety net.

How frequently should I review and adjust my Emergency Fund?

Step 8: Regularly Review and Adjust

Stress the Importance of Regularly Reviewing:

- Financial Health Checkups: Conduct regular financial health checkups. Set aside specific times, whether monthly or quarterly, to review your budget, savings, and overall financial goals.

- Track Changes in Income: Stay vigilant about changes in your income. Whether it’s a raise, a side income, or a change in employment status, adjust your savings contributions accordingly.

- Expense Adjustments: Be proactive in adjusting your budget. If certain expenses increase or decrease, reflect those changes in your budget to maintain a realistic financial plan.

- Monitor Economic Conditions: Stay informed about economic conditions in India. Changes in inflation, interest rates, or job markets may impact your financial situation. Adjust your emergency fund size and overall strategy accordingly.

Encourage Adaptation to Changes:

- Flexible Savings Goals: Embrace flexibility in your savings goals. Life is dynamic, and your financial plans should be adaptable to changes in your personal circumstances or the broader economic environment.

- Evolving Contingency Plans: Regularly revisit and update your contingency plan. As your life evolves, so should your safety nets. Explore new insurance options, revise risk management strategies, and stay current with financial opportunities.

- Continuous Learning: Be open to continuous learning about personal finance. Stay connected with financial communities, read updated resources, and adapt your strategies based on evolving financial wisdom.

- Seek Professional Advice: Consider seeking professional financial advice periodically. A financial advisor can provide insights tailored to your specific situation and help you make informed decisions.

By regularly reviewing and adjusting your emergency fund plan, you’re not just reacting to changes; you’re proactively steering your financial ship. This adaptability ensures that your financial strategy remains effective and aligned with your goals in the ever-changing economic conditions of India.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

Building an emergency fund is crucial for financial security and peace of mind. Life is unpredictable, and unforeseen expenses, such as medical emergencies or unexpected home repairs, can arise at any time. An emergency fund acts as a financial safety net, providing the means to cover these sudden costs without resorting to debt. It also proven invaluable during job loss or income interruption, offering a buffer to navigate through challenging periods. Having an emergency fund not only helps avoid financial strain but also allows for better planning and investment opportunities. It brings a sense of preparedness for economic downturns, reduces stress, and ensures the well-being of dependents. In essence, an emergency fund is a foundational element of sound financial planning, providing the flexibility and security needed to navigate life’s uncertainties.