Why are fixed deposits so crucial to the Indian investment scene? Here’s the deal: They offer a stable haven in the often unpredictable financial world. In a country where the investment landscape can sometimes be a bit chaotic, fixed deposits bring a sense of order. They are low-risk, easy to understand, and come with a guaranteed return, making them an attractive choice for those who prioritize stability and a modest yet assured income.

Introduction

In India, fixed deposits are the most widely used type of investment. FDs have long been associated with investment since they are seen as safe, offer assured returns over time, and have a variable length.

It is a type of investment product that banks and non-banking financial corporations (NBFC) provide to their clients. People use an FD to invest a specific amount of money at a predefined rate of interest for a set length of time. Although it varies from one financial institution to another, the interest rate is typically higher than that of savings accounts.

In this article, we will answer every expected question that comes into your mind while thinking about investing in fixed deposits. Now, let’s delve into the journey where your expected doubts will be answered so that you can start your investment journey with a solid, profitable plan.

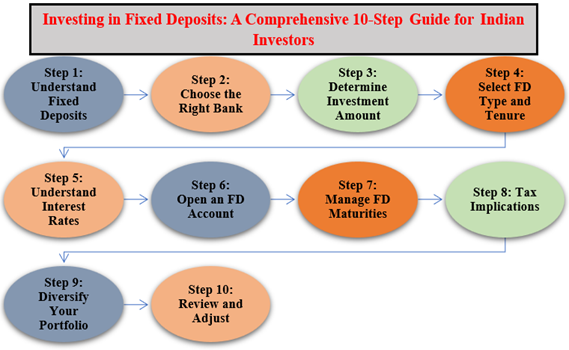

Investing in Fixed Deposits

How do fixed deposits work, including the concepts of principal, interest, and maturity?

Step 1: Understand Fixed Deposits

Definition and Basics of Fixed Deposits

- Fixed deposits are a straightforward and secure investment option offered by banks. In essence, when you opt for a fixed deposit, you are lending a specific sum of money to the bank for a predetermined period at an agreed-upon interest rate.

- These deposits are termed “fixed” because the interest rate remains constant throughout the agreed-upon tenure, providing a predictable outcome for your investment. FDs are considered a low-risk option, making them popular among those who seek stability in their financial portfolio.

Concepts of Principal, Interest, and Maturity

- Imagine you decide to invest a certain amount of money in a fixed deposit with a bank. This amount is known as the principal. The bank, in return, commits to paying you interest on this principal amount at regular intervals, as per the agreed-upon interest rate.

- The concept of maturity comes into play here. Maturity is the end of the agreed tenure, at which point the fixed deposit reaches its full term. At this juncture, you will receive the original principal amount along with the accumulated interest.

- In simpler terms, fixed deposits operate on the principle of lending money to the bank for a fixed period, and in return, the bank pays you interest, providing a clear understanding of how your investment will grow over time. Understanding these basics is the foundation for making informed decisions about fixed deposits as part of your investment strategy.

Which banks or financial institutions offer the best fixed deposit rates?”

Step 2: Choose the Right Bank

Factors to consider when selecting a bank for Fixed Deposit Investments

When it comes to choosing the right bank for your fixed-deposit investments, it’s crucial to consider several factors. Picking the right bank ensures not only the safety of your money but also plays a significant role in determining the overall success of your investment. Here are key considerations:

- Reputation and Credibility: Choosing a bank with a good track record and reputation ensures that your money is in safe hands. Check the bank’s history, reviews, and ratings to gauge its credibility. Reliable and trustworthy banks prioritize the security of your investments.

- Interest rates Offered: Different banks may offer varying interest rates on fixed deposits. Take the time to compare these rates, keeping an eye on both short-term and long-term deposit options. A slightly higher interest rate can significantly boost your returns over time.

- Customer Service and Accessibility: Consider the bank’s customer service quality and accessibility. A bank with responsive customer support and easily accessible branches or online services can make managing your fixed deposit more convenient. This becomes crucial when you need assistance or want to keep track of your investment.

How much investment should be the appropriate amount?

Step 3: Determine the investment amount.

Determining the right investment amount for your fixed deposit is a crucial step, influencing the returns you’ll receive and aligning with your financial goals. Let’s discuss some significant guidelines to help you determine your investment amount:

- Financial Goals and Objectives: Whether you are saving for a short-term expense, like a vacation, or a long-term goal, such as purchasing a home, your objectives will shape the size of your investment.

- Risk Tolerance: If you prefer a low-risk investment, you might opt for a larger fixed deposit. On the other hand, if you are comfortable with a bit more risk, you might choose a smaller investment with more liquidity.

- Income and Expenses: Ensure that the fixed deposit amount you choose doesn’t compromise your day-to-day financial stability. It’s essential to strike a balance between investing for the future and meeting current financial needs.

- Emergency Fund Consideration: Before allocating a significant sum to fixed deposits, ensure that you have a safety net to cover unforeseen expenses. This emergency fund provides liquidity and prevents the need for premature withdrawals from your fixed deposit.

- Diversification: If you have a diversified investment portfolio, consider how fixed deposits fit into the overall picture. Your investment amount should complement other investments, ensuring a well-balanced and diversified approach to wealth-building.

Consideration of Liquidity Needs

- Short-Term vs. Long-Term Goals: Align the tenure of your fixed deposit with your financial goals. Short-term goals might require more liquidity, favoring shorter-term fixed deposits. Long-term goals may allow for longer-term deposits with potentially higher interest rates.

- Emergency Fund Buffer: Factor in the need for liquidity in emergencies. Your fixed deposit should not tie up all your funds, leaving you with no accessible resources during unexpected financial challenges.

- Premature Withdrawal Consequences: Be aware of the consequences of premature withdrawal. If liquidity is a primary concern, consider banks that offer more flexible terms for early withdrawals, even though it may come with a penalty.

What are the various types and minimum and maximum tenures for a fixed deposit?

Step 4: Select FD Type and Tenure

Overview of different types of fixed deposits (Cumulative, Non-cumulative, flexible, Tax-saving, etc.)

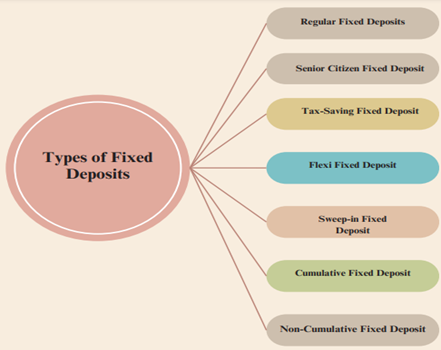

Investors in India have access to a variety of fixed deposit options, each with special characteristics and advantages. In India, the following are a few of the most popular kinds of fixed deposits:

Investing in Fixed Deposits

- Regular Fixed Deposit: This is the most popular kind of fixed deposit, in which a person invests a lump quantity of money for a predetermined amount of time and receives a predetermined interest rate. Regular fixed deposit interest rates are often greater than those of savings accounts.

- Senior Citizen Fixed Deposit: With a greater interest rate than regular fixed deposits, this kind of deposit is only intended for senior citizens. Senior citizens with fixed deposits normally have an eligibility age of 60 years or older.

- Tax-Saving Fixed Deposit: The purpose of this kind of fixed deposit is to reduce income taxes for people. Under Section 80C of the Income Tax Act, investments made in tax-saving fixed deposits are deductible from taxes. Generally, tax-saving fixed deposits have a five-year lock-in period.

- Flexi Fixed Deposit: With a Flexi fixed deposit, you can add or remove money from the account as needed and still get interest on the total amount. People can take money out of this kind of fixed deposit without violating the terms of the deposit.

- Sweep-in Fixed Deposit: An individual’s savings account is connected to a Sweep-in Fixed Deposit, which automatically transfers any excess funds to the savings account to receive a greater interest rate.

- Cumulative Fixed Deposit: When a cumulative fixed deposit matures, both the principal amount and the interest accrued are paid out, together with further reinvested funds. When compared to regular fixed deposits, this kind of deposit gives larger returns.

- Non-Cumulative Fixed Deposit: The interest accrued on the principal amount of a non-cumulative fixed deposit is disbursed regularly, such as monthly, quarterly, or annually. Those who need a consistent income from their investments can consider this kind of fixed deposit.

Guidance on choosing the Right Tenure based on Financial Objectives

- Short-Term Goals: If you have short-term goals (1-3 years), consider shorter tenures. Non-cumulative FDs with regular interest payouts may be suitable.

- Medium-Term Goals: For medium-term goals (3-5 years), a mix of cumulative and non-cumulative FDs can be considered, depending on the need for periodic returns.

- Long-Term Goals: Longer tenures (5 years and above) may be suitable for long-term goals. Cumulative FDs can help maximize returns over an extended period.

- Emergency Fund: For part of your emergency fund, consider a sweep-in FD linked to your savings account for liquidity and higher returns.

- Tax-saving Considerations: If you are looking for tax-saving options, consider tax-saving fixed deposits, but be mindful of the lock-in period.

- Flexibility Needs: Opt for flexible fixed deposits if you anticipate changes in your financial situation and need the flexibility to adjust your investments.

How are interest rates calculated on fixed deposits?

Step 5: Understand Interest Rates

- Fixed Interest Rates: In fixed deposits, the interest rate is predetermined and remains constant throughout the deposit tenure. This fixed rate ensures predictability in the returns you’ll earn.

- Simple Interest vs. Compound Interest: Interest can be calculated either as simple interest or compound interest. In simple interest, interest is calculated only on the principal amount. In compound interest, interest is calculated on both the principal and the accumulated interest, leading to higher overall returns.

- Interest Calculation Periods: The frequency at which interest is calculated can vary (quarterly, half-yearly, or annually). The more frequent the calculation, the higher the effective interest rate.

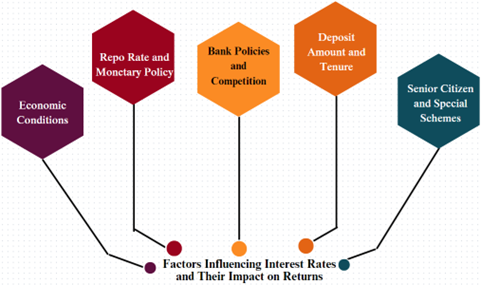

Factors Influencing Interest Rates and Their Impact on Returns

Investing in Fixed Deposits

- Economic Conditions: Economic factors, such as inflation rates and the overall economic health of the country, can influence interest rates. During periods of high inflation, banks might offer higher interest rates to attract deposits.

- Repo Rate and Monetary Policy: Central banks set the repo rate, influencing interest rates across the financial sector. Changes in the repo rate by the central bank can impact the interest rates offered by banks on fixed deposits.

- Bank Policies and Competition: Individual banks may have their own policies on setting interest rates. Competition among banks can also lead to variations in interest rates to attract depositors.

- Deposit Amount and Tenure: The amount you deposit and the tenure you choose can impact the interest rate. Larger deposits and longer tenures may qualify for higher interest rates.

- Senior Citizen and Special Schemes: Banks often offer special interest rates for senior citizens or in specific schemes. It’s worth exploring these options for potentially higher returns.

Is the process of opening a fixed deposit account simple?

Step 6: Open an FD Account

The step-by-step process of opening an FD account

There are only a few easy procedures involved in opening a fixed deposit account. We’ll walk you through the process of opening a fixed deposit account in this post, so you can get started on the path to safe and steady financial growth.

Investing in Fixed Deposits

- Step 1: Research and Compare: To open a fixed deposit account, you must first investigate and contrast your possibilities. Fixed deposit accounts come with a range of features, term options, and interest rates from different banks and financial organizations. Take into account elements including the institution’s reputation, interest rates, terms regarding early withdrawal, and customer service.

- Step 2: Choose the Type of Fixed Deposit: The second thing to do is choose the kind of fixed deposit you wish to invest in. Determine your financial objectives and unique needs before deciding on the kind of fixed deposit that best suits your needs.

- Step 3: Gather the Required Documents: The exact document requirements may vary depending on the institution and the country, like India. You will need:

- Proof of identity: A legitimate passport, driver’s license, PAN card, or other identity document issued by the government can be used as proof of identity.

- Proof of address: A utility bill, bank statement, rental agreement, or other document proving your residence address must be presented.

- Passport-sized photographs: Get ready a few current passport-sized photos; account opening applications and other paperwork could need them.

- Step 4: Visit the bank or Financial Institution: Visit the bank or other financial institution where you want to open the fixed deposit account once you have gathered all the necessary paperwork. As an alternative, some banks allow you to open a fixed deposit account online using their mobile app or website.

- Step 5: Fill out the Application Form: An application form to open a fixed deposit account will be given to you at the bank or financial institution. Provide true and comprehensive information when completing the form.

- Step 6: Deposit the Amount: You must deposit the amount you want to invest in the fixed deposit account along with the application form. Depending on the policies and procedures of the bank, this can be done by cash, check, or internet transfer.

- Step 7: Choose the Tenure: Choose the duration of your fixed deposit account. The tenure establishes how long your money will remain locked in the account. To make an informed choice, take your financial objectives, liquidity needs, and interest rate offerings into account.

- Step 8: Review and Sign the Terms and Conditions: Examine the fixed deposit account’s terms and conditions thoroughly. Considerations including early withdrawal penalties, interest payment frequency, choices for renewal, and any other features should be carefully considered. Once the terms and conditions are acceptable to you, complete the account opening process by signing the required paperwork.

- Step 9: Receive the Fixed Deposit Certificate: You will ultimately obtain a receipt or certificate for a fixed deposit. This document, which acts as evidence of your investment, includes important information about your investment, including the deposit amount, term, interest rate, and maturity date.

- Step 10: Track and Manage Your Fixed Deposit Account: As soon as your fixed deposit account is opened, it’s critical to monitor and properly manage it. Dates of maturity, interest payments, and any other pertinent data should be recorded.

Can I withdraw my money before the maturity date?

Step 7: Manage FD Maturities

Guidance on handling Matured Fixed Deposits

Congratulations on reaching the maturity of your fixed deposit! This step is crucial as it presents various opportunities for managing your funds wisely. Let’s discuss how to handle matured fixed deposits:

- Options for renewal: Banks typically offer the option to renew or rollover your fixed deposit for another term. If you’re satisfied with the current bank’s service and the prevailing interest rates, renewing the FD can be a seamless way to continue earning returns.

- Premature withdrawal considerations: If you require the money immediately, some banks allow premature withdrawals. However, be aware that this may come with a penalty, and you may receive a reduced interest rate compared to the contracted rate.

- Reinvestment strategies: Explore reinvestment options available in the market, and if interest rates have increased since you initially opened the fixed deposit, you might consider reinvesting the matured amount at the prevailing higher rates to maximize returns.

- Diversification: Instead of renewing the entire amount, you can choose to invest part of it in other financial instruments or in different fixed deposits. This strategy helps balance risk and return.

What are the tax implications related to fixed deposits in India?

Step 8: Tax Implications

Fixed deposit interest is considered a part of your taxable income in India. The interest earned is added to your total income for the financial year and taxed as per the applicable income tax slab. So, understanding the tax implications of your fixed deposit is crucial for effective financial planning. Here’s a breakdown of the key aspects related to tax when it comes to fixed deposits in India:

- TDS (Tax Deducted at Source): Currently, 10% of FD is withheld for TDS (Tax Deducted at Source). if the interest earned on FDs as a whole for a fiscal year is more than Rs. 40,000. But if the investor’s PAN is unavailable, 20% of TDS is withheld.

- Form 15G/15H: If your total income is below the taxable limit and you want to avoid TDS deduction, you can submit Form 15G (for individuals) or Form 15H (for senior citizens). These forms declare that your income is below the taxable limit, and the bank can refrain from deducting TDS.

- Form 15G or 15H is a self-declaration form that shall be submitted by the eligible person (payee) to the payer for non-deduction of tax from the specified payments.

- Tax on Premature Withdrawal: If you withdraw your fixed deposit prematurely, the interest paid may be subject to a penalty. The interest amount paid, including the penalty, is considered for taxation.

- Claiming Deductions: While the interest earned is taxable, it’s essential to explore deductions available under the Income Tax Act. For example, if you invest in a tax-saving fixed deposit, you may be eligible for deductions under Section 80C.

- Senior Citizens: Senior citizens are eligible for a higher TDS threshold, and they may also benefit from a higher interest rate. Additionally, they can claim a deduction of up to ₹50,000 under Section 80TTB of the Income Tax Act on interest income.

Do we need to diversify our investment portfolio?

Step 9: Diversify Your Portfolio

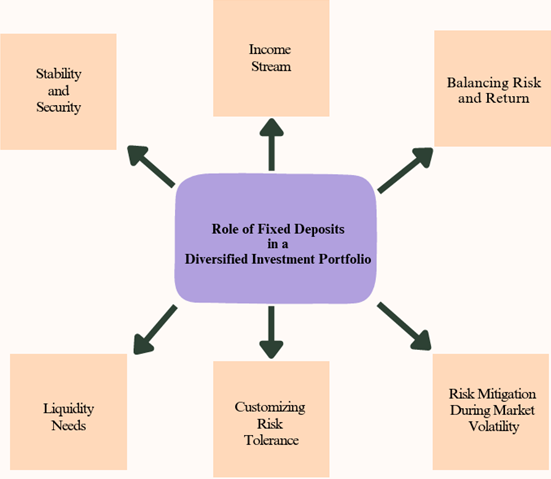

Diversification is a key principle of sound financial planning, and including fixed deposits in your investment portfolio plays a crucial role in achieving a balanced and diversified approach. Let’s discuss the role of fixed deposits in a diversified investment portfolio:

- Stability and Security: Fixed deposits are known for their stability and security. They offer a fixed and predictable return, making them a reliable anchor in your portfolio. In times of market volatility or economic uncertainty, the stability of fixed deposits provides a safety net for your overall financial well-being.

Investing in Fixed Deposits

- Income Stream: Fixed deposits, especially non-cumulative ones with regular interest payouts, can serve as a steady income stream. This regular income can be particularly beneficial for meeting recurring expenses or fulfilling short-term financial goals.

- Balancing Risk and Return: Diversification involves spreading your investments across different asset classes with varying risk-return profiles. While equities and other investments may offer higher potential returns, fixed deposits contribute to the overall balance by providing stability and reducing the overall risk of your portfolio.

- Liquidity Needs: Fixed deposits, especially those with flexible withdrawal options, add liquidity to your portfolio. In situations where you need quick access to funds, having a portion of your investments in fixed deposits can be advantageous.

- Risk Mitigation During Market Volatility: During periods of market volatility, the stability of fixed deposits can help mitigate overall portfolio risk. The fixed and predetermined returns provide a counterbalance to the potential fluctuations in the value of other investments.

- Customizing Risk Tolerance: Diversification allows you to customize your portfolio based on your risk tolerance and financial goals. By including fixed deposits, you can strike a balance that aligns with your comfort level regarding risk and return.

What is the importance of timely review and adjustment?

Step 10: Review and Adjust

Importance of Periodic Review of Fixed Deposit Investments

Financial landscapes change over time, influenced by economic conditions, interest rate movements, and personal financial goals. Periodic reviews allow you to assess the performance of your fixed-deposit investments and make informed decisions based on current circumstances.

Regularly monitoring interest rate movements helps you stay informed about potential changes in returns on your fixed deposits. If interest rates have increased, it might be an opportune time to consider reinvesting or renewing your deposits for higher returns.

Periodic reviews help you evaluate whether your fixed-deposit investments can be optimized to meet these changing requirements. You may decide to withdraw a portion or adjust the tenures for better flexibility.

Regularly reviewing your fixed-deposit investments allows you to stay informed about any alterations in tax implications. Adjustments to your investment strategy can be made to optimize tax efficiency.

By incorporating periodic reviews into your financial routine, you empower yourself to make informed decisions and ensure that your fixed deposit investments remain a valuable and effective component of your overall financial strategy. Adjustments made based on careful consideration can lead to a more resilient and adaptive investment portfolio

Conclusion

Investing in fixed deposits in India presents a reliable and straightforward avenue for investors seeking stability and assured returns. Fixed deposits, offered by banks and non-banking financial corporations, involve lending a predetermined sum at a fixed interest rate for a specified period. The simplicity of this investment makes it widely accessible. Choosing the right bank is crucial, considering factors such as reputation, interest rates, and customer service.

Determining the investment amount involves aligning financial goals, risk tolerance, and maintaining an emergency fund. The diverse types of fixed deposits, including regular, senior citizen, tax-saving, and more, cater to various needs. Understanding interest rates, managing maturities wisely, and being aware of tax implications contribute to the effectiveness of fixed deposits in a diversified portfolio. Regular reviews allow investors to adapt to changing economic conditions, ensuring that fixed deposits remain a stable and valuable component of their overall financial strategy.