A Step-by-Step Approach to Help You Navigate the Indian Stock Market with Confidence

A Guide to Investing in the Indian Stock Market: Tips for Beginners

Investing in the stock market can be a tricky proposition, especially for those who are beginning their journey in investing. However, it can be a good way to grow wealth over the long term. Here are some of the guidelines to help beginners invest wisely in Indian Stock Market.

Before investing in stocks in India, it’s important to have a basic understanding of how it works.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding the Basics of the Indian Stock Market

Your journey starts by gathering knowledge about various types of businesses, how each of those businesses earn their revenue and whether there is any seasonality in the revenue stream. Based on the understanding of certain businesses, you then move on to search for companies which are operating in that business space and which of those companies are listed on a stock exchange like BSE or NSE.

At this stage, you have ideally listed down a number of companies whose shares are available and can be bought. Now how do you buy those shares?

Choosing the Right Stockbroker and Setting Up Your DEMAT Account

This is when you need to find a stockbroker or depository participant who will provide a DEMAT account, which is essential to buy and hold the shares. Ideally, a stockbroker who has a good reputation in the market, and is generally trustworthy should be chosen for the job, however, with technology a lot of FinTech companies have been operating very successfully in this space and are also providing cutting-edge technology for the users, thus making the investment journey very smooth.

Planning Your Investments: Objectives and Time Horizon

Planning:

Now that the DEMAT account is ready, do not jump in to buy shares of those companies you have listed down. Instead, use the platform to proceed with advanced research with the companies listed. While doing this research, it is important to find answers to the following questions. Ask yourself,

- For how long will you do fine if you do not get access to the money, you are about to invest?

- How will you react if you find the value of your invested money depleting substantially?

- What is your objective to invest in stock market? Are you looking for wealth creation over a long period of time or quick profit within a shorter tenure?

These answers will provide guidance about the kind of company you should be choosing to invest in.

If getting access to the invested money is a major concern for you, then you should be choosing companies whose shares are traded in the stock exchange in substantial volume on a daily basis. Here it is important to mention that investment in shares of a company, no matter how reputed the company is, does not guarantee any return or principal protection. So, even if the share is trading regularly and readily in the exchange there is a possibility of you making a loss of principal in parts or in full. So, while investing in stocks in India, you should be prepared to hold on to your investment for a longer tenure, preferably 3 to 5 years.

Now during this tenure of 3 to 5 years, you might find the valuation of your investment going down from time to time. If that is a matter of discomfort for you, then you probably should avoid this investment with volatility in return and stick to assets which offer a fixed or guaranteed return.

However, if you are looking for a quick profit over a short tenure then you need to have a trader’s mentality and you will invariably expose yourself to a high degree of volatility.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Analysing Companies: Financial Parameters and Indicators

Analysis:

If you are still reading this, then I am assuming you are comfortable with the volatility that comes along with this investment. Now we will look into certain factors which will help you to control the volatility.

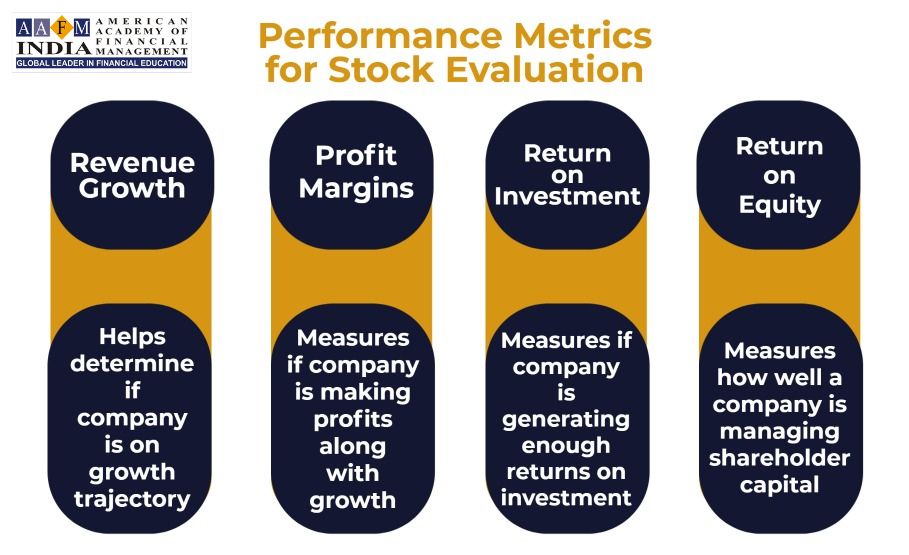

Let’s start with financials of the company you have listed and intend to invest in. A thorough analysis of all the financial statements gives you a fair understanding of the company’s financial health and also gives a forecast of where the company is heading in the near to medium term. Following are some of the parameters that you should be looking at while reaching a conclusion.

- Revenue Growth – Whether the company is on a growth trajectory.

- Profit Margins – Whether the company is making a profit while it is growing.

- Return on Investment (ROI) – Whether the business is generating a return on the investment made.

- Return on Equity (ROE) – Whether the shareholders are being benefitted from such return.

From your initial list of companies, check how many are showing positive results based on these parameters. These are the companies which you will be considering while moving on to the next phase of your analysis where you need to check whether the stock is at the right price to buy. The following ratios will act as indicative parameters of this.

- P/E Ratio: Price to Earnings Ratio – This indicates at what multiple the stock is trading compared to its earning per share. If the multiples are lower then it is considered to be a good price for you to buy the share.

- P/B Ratio: Price to Book Value – This indicates at what multiple the stock is trading compared to the value of the company. Again, if the multiples are lower then it is considered to be a good price to buy.

Once you have reached this point, you need to read the technical charts of the stock which indicate the market sentiment. It is important to align your investment with the market sentiment as that plays a significant role in price movement of any stock in shorter tenure. Although it would phase out over time, if you can use the technical charts then you might be able to get a little discount while buying the share.

Also, if you are investing in stocks in India with an objective of quick profit, then you will have to rely on these technical charts more than the other parameters discussed earlier, as short-term price movement in stock market is driven largely by market sentiments. Having said that, it is difficult to read such a chart at the beginner’s level and hence you should not rely much on this during your initial days of investment.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Executing Your Trades: Buying and Selling Stocks

Execution: By now you will be able to decide on the stock that you want to invest in. This is when you go to the DEMAT platform and execute your trade and complete your transaction. The stock gets credited to your DEMAT account within the next day (T+1) and then you keep monitoring its price movement to develop your further understanding of the stock’s characteristics and the company’s performance.

The Importance of Diversification in Managing Risk

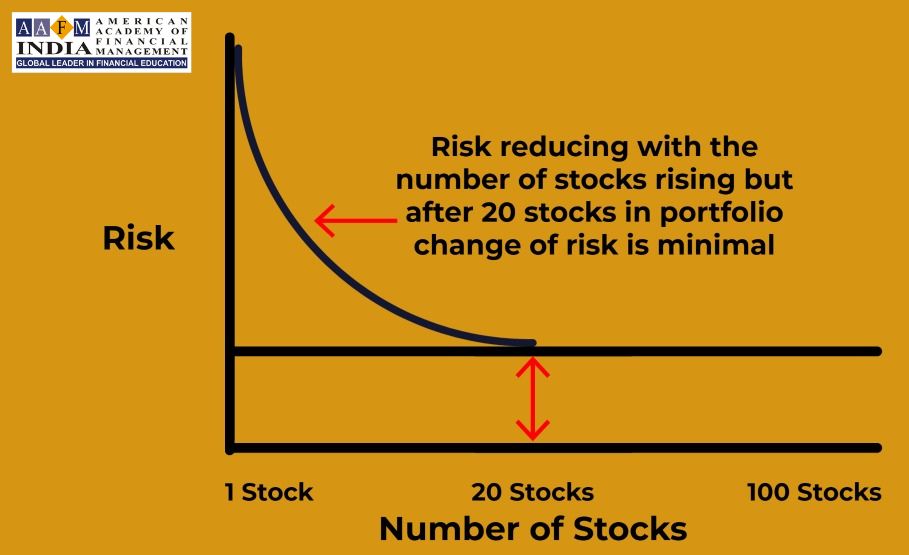

Diversification: As an investor, you should remember that investment in stock market is more about risk management than betting on risky propositions. The time-tested method of risk management is diversification. Diversification is a risk management strategy that involves spreading investments across different industries, sectors and companies. The primary goal of diversification is to reduce the overall risk of an investment portfolio by minimizing the impact of any individual investment’s poor performance.

How does it reduce the risk?

Sector and industry diversification: Investing across various sectors and industries helps to mitigate the risk associated with any particular sector’s performance. Economic conditions, regulatory changes, or industry-specific factors can impact sectors differently. By holding investments in multiple sectors, as an investor you can reduce the risk of significant losses if a specific industry or sector experiences difficulties. Let’s take a look at IT sector, which played a significant role during the pandemic.

Chart: 1Y Performance of NiftyIT

The figure shows how volatile this sector has been over the past one year. Now if you would have invested in this sector then the performance of your investment would have gone through the same volatility as the chart shows.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Chart: 1Y Performance of Nifty50

On the other hand, if you would have invested across all industries, the volatility would have been significantly lower in comparison.

Diversification can also mitigate the risk associated with individual companies. Holding a diverse range of stocks helps to minimize the impact of poor performance or unexpected events affecting a single company. Even if some companies face difficulties, the overall portfolio can remain relatively stable if other investments perform well. Let’s take a look at one of the established IT companies.

Chart: 1Y Performance of Wipro

The volatility is more significant, and you can potentially lose a significant amount of your principal or you may remain stuck with it for a long time.

Once the investment is done, as an investor, you need to keep track of investment and regularly review the portfolio to make sure it is aligned with investment goals. Here patience is the key. It is a long-term game, and as an investor you should stick to the investment strategy.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Tools and Resources for Developing Market Intelligence

Today we have a lot of tools at our disposal to track the market and our investment. Most of them are available in the form of mobile applications which you can use at your convenience. Most of the tools are provided by the stockbroker along with your DEMAT account which is essential for investing in stocks in India. A decent stockbroking firm will be having a robust software which will provide you with the required analytics to track your investment, generate reports on your investment and also develop market intelligence in the process. Apart from that there are open sources available today, where you can have access to an unbiased and complete flow of information, which you can interpret as per your level of expertise.

Apart from investing in shares of companies through your DEMAT, there are other available avenues to invest in Indian stock market. Mutual Funds, Portfolio Management Services are some of the popular and time-tested investment vehicles which invest your money into the stock market. These vehicles come with the benefit of diversification, that we discussed. Along with that, it brings expertise and sophisticated market intelligence on the table, something which is extremely difficult if not impossible for a beginner to develop. Over the years these managed portfolio approaches towards investment gained traction.

Now, let us deep dive into the tools which you can use to start developing this expertise and market intelligence which these investment managers offer in Mutual Funds and PMS.

Tradingview.com: This tool provides you with all the technical charts and indicators which need to be interpreted. Like this, there are many open sources which can provide real-time data and analytics.

Screener.in: This is an open source which provides all the company-specific fundaments and other information which can be used to build an understanding of the characteristics of a stock.

At this point, it is important to note that no tool can be used in isolation while investing in the stock market. It is the interpretation that you develop based on the information flow from all the tools. Hence, while choosing a stock for a longer tenure, you may need to check the fundamental paraments along with the technical charts, this should then be analysed with the macro-economic factors such as the GDP growth rate, near to medium-term forecast of interest rate trajectory and the status of overall economic activity in the country.

There are numerous open sources such as Economic Times; Financial Times; Moneycontrol.com and other such websites, which provide you market-related information along with real-time news feeds about the macroeconomic factors and economic status of the country as a whole. At a beginner’s level, you should avoid going for any paid subscription on these open sources, as the information available with a free subscription is more than what you will be requiring.

Key Takeaways for Successful Stock Market Investing

Drawing the strings of all these discussions we have had so far, the six key things which I would want you to take away from this discussion:

- Don’t Try to Time the Market: You must accept the fact that market is smarter than its best participant. So, it is pointless to try and outsmart the market and incur losses in return. Historical data proves this fact.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Table: Outcome of investing in a basket of 500 stocks listed in NSE over the last 25 years.

Table: Outcome of investing in a basket of 500 stocks listed in NSE over the last 25 years.

The table clearly shows the stability of return as you stay invested for a longer tenure.

- Investment is a Habit: Invest in a systematic way to make the best use of this asset class. Investing in stocks in India on a regular basis helps you to benefit due to the market volatility. Once you have created a portfolio of stocks, you keep investing in those stocks until you have reached your target, or the fundamentals of those companies have changed significantly in a negative way.

- Do Not be Swayed by Sentiments: You should avoid greed and fear while investing in stock market. You must set a target for yourself based on your interpretation of information. Once the target is achieved, you must book profit and close the position irrespective of what the market sentiments are. Similarly, if you have a very strong conviction on a particular stock, then buy or hold on to your position irrespective of the depletion in value of your investment and all the negative news that you might be getting about the company.

- Stay Humble: This holds especially good when you are making a high profit. If you are making out of the turn profits, it could be due to some of the factors you anticipated in advance which unexpectedly worked in your favour to an unusually high degree. So, take your winnings out and save them for the rainy days.

- Monitor and Rebalance: Keep an eye on your investments and periodically review your portfolio. Rebalance your holdings if necessary to maintain your desired asset allocation. Avoid making impulsive investment decisions based on fear or greed. Emotional investing can lead to poor choices and negative outcomes. Stick to your investment strategy and stay disciplined.

- Seek Professional Help: If you’re unsure or uncomfortable with making investment decisions, consider consulting a financial advisor. They can provide personalized guidance based on your financial situation and goals. You can also take the help of Robo Advisory, which is an upcoming offering of FinTech. Although it’s debatable whether Robo Advisory is capable of bettering your returns, nonetheless it is a good starting point for a beginner. You may also choose to invest through ETFs to get a feel of the stock market.

Remember, investing in stocks involves risks, including the potential loss of principal. Be sure to do your due diligence, stay informed, and make informed decisions based on your financial circumstances and risk tolerance.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

FAQ’s

Q1: How can a beginner start investing in stocks in India?

A1: To start investing in stocks in India, beginners should follow these steps:

Educate Yourself: Gain a basic understanding of the stock market, including terminology, investment strategies, and risk management.

Research: Study different companies, their financials, and industry trends. Look for companies with strong fundamentals and a good track record.

Open a Demat Account: Choose a reputable stockbroker and open a Demat (Dematerialized) account to hold your shares electronically.

Set Financial Goals: Determine your investment objectives, time horizon, and risk tolerance. This will help you select suitable stocks for your portfolio.

Start Small: Begin with a small investment amount to gain experience and confidence. Consider investing in mutual funds or index funds for diversification.

Monitor and Review: Keep track of your investments regularly, stay updated on market news, and review your portfolio’s performance periodically.

Q2: Which stock market is best for beginners in India?

A2: For beginners in India, the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) are the two major stock exchanges to consider. Both provide a wide range of investment options and have a robust regulatory framework. It is advisable to start with the NSE or BSE, as they offer better liquidity, transparency, and a larger number of listed companies.

Q3: How to invest in stocks: a complete guide for beginners?

A3: Investing in stocks as a beginner involves the following steps:

Research and Education: Understand the basics of the stock market, including types of stocks, risk management, and investment strategies.

Setting Goals: Determine your financial goals, investment objectives, and risk tolerance.

Choose a Stockbroker: Select a reputable stockbroker and open a Demat account to buy and sell shares.

Fundamental Analysis: Research and analyse companies to identify those with strong financials, competitive advantages, and growth potential.

Technical Analysis: Learn to interpret stock charts and patterns to make informed buying and selling decisions.

Building a Diversified Portfolio: Spread your investments across different sectors and industries to minimize risk.

Regular Monitoring: Stay updated on market news, track your investments, and review your portfolio’s performance periodically.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Q4: What are 5 tips for beginner investors?

A4: Here are five tips for beginner investors:

Start with a Plan: Define your investment goals, risk tolerance, and time horizon. Having a clear plan will help you make better investment decisions.

Diversify Your Portfolio: Spread your investments across different asset classes, sectors, and companies to reduce risk.

Invest in what you Understand: Stick to industries or companies you know about. Avoid investing in complex instruments without proper understanding.

Do Your Research: Thoroughly analyse companies, review their financials, and consider their long-term prospects before making investment decisions.

Stay Disciplined and Patient: Investing is a long-term game. Avoid making impulsive decisions based on short-term market fluctuations and stay committed to your investment strategy.

Q5: How to earn 1 lakh per day from the share market?

A5: Earning 1 lakh per day from the share market is not guaranteed and is highly dependent on various factors, including market conditions, trading strategies, and risk tolerance. It requires significant knowledge, experience, and often involves high-risk trading methods. It is important to note that consistent and sustainable returns are more realistic goals for long-term investing in stocks in India.

Q6: Which stocks to sell first?

A6: The decision of which stocks to sell first depends on your investment strategy, financial goals, and the performance of individual stocks. However, a general approach to consider is:

Evaluate Underperforming Stocks: Identify stocks that have consistently underperformed compared to their peers or the overall market. Assess if there are fundamental issues affecting the company’s prospects.

Reassess Investment Thesis: Review the original reasons for investing in a particular stock. If the reasons are no longer valid or if the stock’s outlook has significantly changed, it may be wise to consider selling.

Monitor Market Conditions: Keep an eye on market trends, economic indicators, and industry-specific factors that may impact the performance of your stocks. If there are signs of a downturn or a negative shift in a particular industry, it may be prudent to sell stocks associated with it.

Take Profits: If a stock has performed exceptionally well and reached your target price, consider selling a portion or all of your holdings to lock in profits. However, be cautious of potential capital gains taxes and the possibility of missing out on further gains.

Rebalance Your Portfolio: Regularly rebalance your portfolio by selling stocks that have become overvalued or overweighted and reallocating the proceeds into other stocks or asset classes that may offer better growth potential.

Consult with a Financial Advisor: If you are uncertain about which stocks to sell first, seek advice from a qualified financial advisor who can provide personalized guidance based on your financial situation and investment goals.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Q7: Which stock is safe to buy?

A7: There is no such thing as a completely “safe” stock as all investments carry some level of risk. However, there are certain characteristics to consider when looking for relatively safer stocks:

Established Companies: Look for well-established companies with a proven track record of stable earnings, strong market presence, and a history of consistent dividend payments.

Diversified Businesses: Consider companies that operate in different sectors or have a diverse range of products and services. This helps mitigate risks associated with relying on a single industry or product line.

Financial Stability: Evaluate the financial health of the company by analysing its balance sheet, cash flow, and debt levels. Companies with low debt, healthy cash reserves, and stable profitability are generally more resilient.

Dividend-Paying Stocks: Dividend-paying stocks can provide a level of stability, as they distribute a portion of their profits to shareholders. Look for companies with a history of regular dividend payments and sustainable dividend yields.

Blue-Chip Stocks: Blue-chip stocks are shares of large, well-established companies with a history of stable performance. These companies are often leaders in their respective industries and tend to be more reliable in turbulent market conditions.

It is crucial to conduct thorough research and consider your risk tolerance and investment objectives before investing in stocks in India.

Q8: How do I choose my first stock?

A8: When choosing your first stock, consider the following steps:

Research: Gain a basic understanding of the stock market and various industries. Read financial news, company reports, and analyst recommendations to identify potential investment opportunities.

Evaluate Financial Health: Assess a company’s financials, including its revenue growth, profitability, debt levels, and cash flow. Look for stable or improving financial metrics.

Competitive Advantage: Determine if the company has a competitive edge or unique selling proposition that differentiates it from its competitors. Consider factors such as brand value, market share, and intellectual property.

Industry Outlook: Analyse the industry in which the company operates. Look for industries with favorable growth prospects and positive market trends.

Management Team: Research the company’s management team and their experience in running the business.

Q9: Can I start investing in stocks with just Rs. 100?

A9: While it is technically possible to invest in stocks with a small amount like Rs. 100, it may not be practical due to transaction costs and brokerage fees. The fees associated with buying and selling stocks can eat into your investment, making it difficult to generate meaningful returns. It is generally advisable to have a sufficient investment amount to cover transaction costs and to consider starting with a larger sum to build a diversified portfolio effectively.

Q10: How much money do I need to start investing in Indian stock market?

A10: The amount of money needed to start investing in Indian stock market can vary depending on your investment goals and the price of individual stocks. While there is no fixed minimum requirement, it is generally recommended to have a substantial amount to cover transaction costs, create a diversified portfolio, and manage any potential market fluctuations effectively. Many investors start with at least a few thousand rupees, but it is advisable to consult with a financial advisor to determine the appropriate amount based on your specific circumstances.

Q11: What is the difference between a Demat account and a trading account?

A11: A Demat (Dematerialized) account is used to hold and store your shares in an electronic format. It is similar to a bank account where your shares are held instead of cash. On the other hand, a trading account is used to buy and sell stocks. When you place an order to buy or sell shares, it is executed through your trading account. Both accounts are linked and necessary for investing in the stock market.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Q12: How can I minimize the risks associated with stock market investing?

A12: While it is not possible to eliminate all risks, you can take certain steps to minimize risks associated with stock market investing:

Diversify Your Portfolio: Spread your investments across different sectors, industries, and companies. This helps reduce the impact of poor performance in any single stock or sector.

Research and Due Diligence: Thoroughly research and analyse companies before investing. Understand their financials, competitive position, and growth prospects. Make informed decisions based on solid research.

Invest for the Long Term: Stock market investing is generally suited for long-term goals. Avoid short-term speculation and focus on companies with strong fundamentals and growth potential over the long run for successfully investing in stocks in India.

Set Realistic Expectations: Be realistic about your return expectations and understand that the stock market can be volatile in the short term. Avoid making impulsive decisions based on short-term market movements.

Stay Informed: Keep up with market news, company updates, and economic trends. Stay informed about the companies you have invested in to make informed decisions.

It is important to note that investing in the stock market involves risks, and it is advisable to consult with a financial advisor before making investment decisions.

Q13: How often should I review my stock portfolio?

A13: The frequency of portfolio reviews can vary depending on your investment strategy and personal preferences. However, it is generally recommended to review your portfolio on a regular basis, such as quarterly or semi-annually. Regular portfolio reviews allow you to assess the performance of your investments, rebalance if necessary, and make any adjustments based on changing market conditions or your financial goals. Additionally, it is important to keep track of company news, earnings reports, and industry updates that may impact your portfolio holdings.