Guiding Clients Beyond Common Investment Pitfalls

Introduction

Understanding Behavioral Biases in Investment Decisions

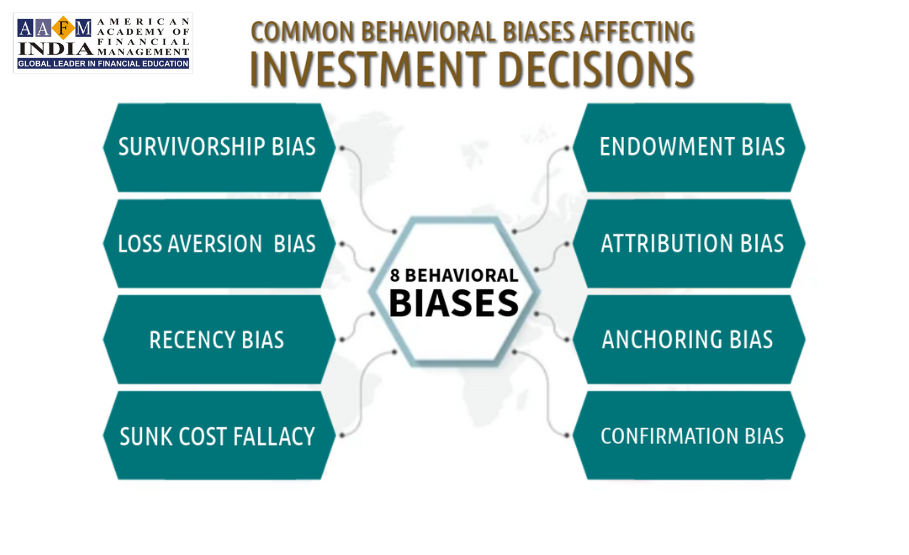

Behavioral biases are systematic patterns of deviation from norm or rationality in judgment, which can significantly impact investment decisions. As financial advisors or mutual fund distributors (MFDs), understanding these biases is crucial for guiding clients towards sound investment strategies.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

The Role of Financial Advisors in Mitigating Cognitive Biases

Financial advisors play a pivotal role in recognizing and mitigating cognitive biases, helping clients make more rational and informed decisions. This article explores eight key behavioral biases and provides strategies for advisors to address these biases effectively.

Key Behavioral Biases Affecting Investment Decisions

1. Survivorship Bias in Investment Advice

Definition of Survivorship Bias

Survivorship bias occurs when advisors focus only on successful investments, ignoring the numerous failures that didn’t make it to the analysis stage.

Examples and Impact on Investment Decisions

For instance, advisors might highlight only the successful small-cap stocks to clients, neglecting the numerous small-cap stocks that underperformed or failed. This can lead to unrealistic expectations about investment returns.

Strategies for Advisors to Mitigate Survivorship Bias

To counteract this bias, provide a balanced view by discussing both successful and unsuccessful investments. Use comprehensive performance data to present a realistic picture of potential risks and returns.

2. Loss Aversion Bias in Financial Planning

Understanding Loss Aversion

Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains, which can lead to overly conservative investment strategies.

Real-Life Examples of Loss Aversion

Clients may be reluctant to sell underperforming investments, preferring to hold onto them to avoid realizing a loss, even when better opportunities are available.

Techniques to Educate Clients and Overcome Loss Aversion

Educate clients about the importance of rebalancing portfolios and the potential long-term benefits of reallocating assets. Use historical data to show the impact of holding onto losing investments versus reallocation.

3. Recency Bias and Its Effect on Investment Strategies

What is Recency Bias?

Recency bias is the tendency to overemphasize recent events or short-term trends when making decisions.

How Recency Bias Influences Client Decisions

Clients might rush to invest in sectors or funds that have recently performed well, such as during a small-cap rally, ignoring long-term performance and fundamentals.

Long-Term Investment Strategies to Counteract Recency Bias

Encourage clients to focus on long-term investment goals and diversified portfolios. Provide historical performance data to illustrate the cyclical nature of markets.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

4. Sunk Cost Fallacy in Investment Decisions

Definition and Impact of the Sunk Cost Fallacy

The sunk cost fallacy involves continuing a behavior or investment due to previously invested resources, even when it’s no longer the optimal decision.

Client Examples and Common Pitfalls

Clients might hold onto underperforming stocks because they have already invested significant resources, rather than cutting losses and reallocating funds.

Advising Clients to Avoid the Sunk Cost Fallacy

Help clients understand the concept of sunk costs and the importance of forward-looking decisions. Use case studies to show the benefits of reallocating resources from underperforming assets.

5. Endowment Bias in Portfolio Management

Understanding Endowment Bias

Endowment bias is the tendency to overvalue something simply because one owns it.

The Impact on Client Investment Choices

Clients might become too attached to their existing investments and overestimate their value, leading to reluctance in diversifying portfolios.

Strategies to Address and Mitigate Endowment Bias

Promote regular portfolio reviews and objective assessments of investments. Use third-party evaluations to provide an unbiased perspective on the value of existing holdings.

6. Attribution Bias in Evaluating Investment Performance

What is Attribution Bias?

Attribution bias involves attributing successes to internal factors (skill, decision-making) and failures to external factors (market conditions).

How Attribution Bias Affects Client Perceptions

Clients might credit their success to personal skill while blaming market downturns for losses, without considering the overall market conditions.

Advising Clients with a Balanced Perspective on Performance

Discuss the role of market conditions and other external factors in investment performance. Encourage clients to maintain a balanced perspective on their investment outcomes.

7. Anchoring Bias in Investment Choices

Definition of Anchoring Bias

Anchoring bias occurs when advisors and clients base future decisions on the first piece of information or data they receive.

Examples of Anchoring in Investment Decisions

If clients anchor to their initial purchase price, they might perceive a drop in price as a buying opportunity without considering broader market conditions or changes in the company’s fundamentals.

Providing Comprehensive Analysis to Overcome Anchoring Bias

Provide comprehensive market analysis and context for investment decisions. Use comparative data to help clients see beyond initial anchors.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

8. Confirmation Bias in Investment Advice

Understanding Confirmation Bias

Confirmation bias is the tendency to seek out information or data that aligns with preexisting beliefs and ignore contradictory evidence.

The Role of Confirmation Bias in Client Decisions

Clients who are bullish on a particular sector may ignore warning signs and negative information, focusing only on data that supports their positive outlook.

Encouraging Critical Thinking and Diverse Perspectives

Encourage critical thinking and the consideration of diverse information sources. Facilitate discussions that explore multiple viewpoints and potential risks.

Conclusion

The Importance of Recognizing and Addressing Cognitive Biases

Addressing cognitive biases is essential for financial advisors and MFDs aiming to provide high-quality investment advice. By understanding these biases and implementing strategies to mitigate their effects, advisors can help clients make more rational, informed decisions.

Building Trust Through Informed and Balanced Investment Advice

This approach not only enhances client outcomes but also builds trust and reinforces the advisor’s role as a reliable and knowledgeable guide in the complex world of investments.

Continuous Learning and Adaptation in Financial Advisory Services

As experts in behavioral finance, we have a responsibility to educate ourselves and our clients about these biases. Continuous learning and adaptation are key to maintaining the highest standards of financial advisory services.