Introduction:

Are you tired of relying solely on your regular income and looking for ways to build a passive income stream? Look no further – dividend investing in India might just be the answer you’ve been searching for. In this article, we will delve into the world of dividend investing and explore how blue-chip stocks can pave the way to a steady flow of passive income.

Dividend investing offers a unique opportunity for investors to generate wealth by owning shares in well-established companies that distribute a portion of their profits as dividends. And what better place to embark on this financial journey than India, a country known for its robust stock market and growing economy?

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding Dividend Investing:

A Path to Passive Income

Dividend investing, the art of strategically selecting stocks that consistently pay out dividends, offers investors a unique pathway to passive income. Unlike traditional forms of investing that solely rely on capital appreciation, dividend investing allows individuals to generate a steady stream of income from their investments, regardless of market fluctuations. It is a method that not only provides financial stability but also empowers investors to break free from the shackles of active trading and embrace a more tranquil approach to wealth creation.

At its core, dividend investing is grounded in the idea that companies sharing their profits directly with shareholders offer an attractive investment opportunity. By investing in blue-chip stocks – shares of established companies with a history of stability and reliable dividend payments – investors can gain access to regular income while simultaneously enjoying the potential for long-term capital growth. Dividends act as a beacon of stability amidst the unpredictability of financial markets, providing investors with a sense of security and confidence in their investment strategy.

The Power of Blue-Chip Stocks:

Why They Are Ideal for Dividend Investing in India

Blue-chip stocks, often referred to as the stalwarts of the market, hold a unique allure for dividend investors in India. These are companies with a proven track record of stability and growth, typically leaders in their respective industries. Investing in blue-chip stocks offers a range of advantages that make them an ideal choice for those seeking to build passive income through dividends.

Firstly, blue-chip stocks tend to have a long history of consistently paying dividends, making them reliable sources of income. These companies are known for their ability to generate substantial profits year after year, allowing them to distribute a portion of their earnings as dividends. Investors can rest assured that their investments will generate steady returns over time.

Moreover, blue-chip stocks often offer a higher level of dividend stability compared to other types of investments. These companies have established themselves as leaders in their industries and have built strong competitive advantages, which translate into consistent cash flows and stable dividend payments. This stability provides investors with a sense of security and confidence in the reliability of their passive income streams.

In addition to stability, blue-chip stocks also offer the potential for capital appreciation. Many renowned blue-chip companies have demonstrated impressive growth over the years, resulting in increased stock prices. By investing in these companies at an early stage or during periods of undervaluation, investors not only benefit from regular dividend income but also stand a chance to profit from the appreciation in share prices.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Getting Started with Dividend Investing:

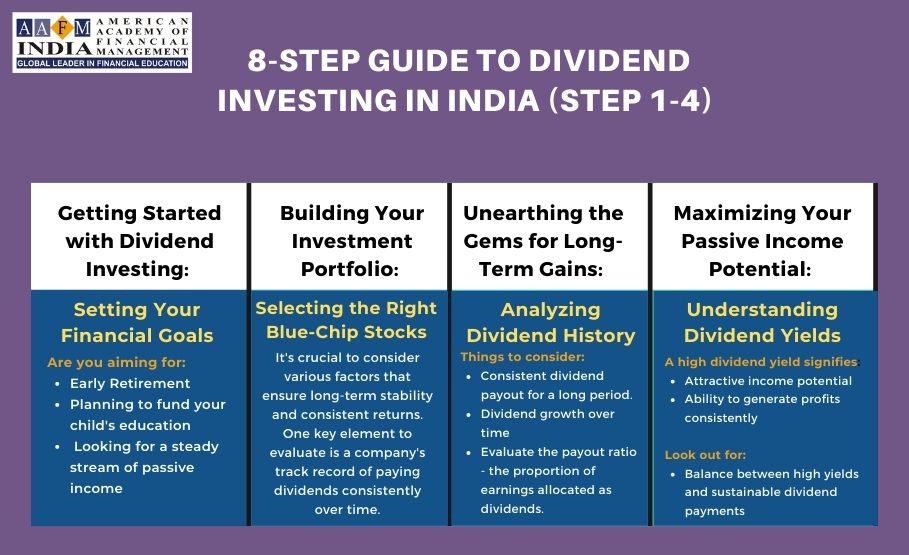

Setting Your Financial Goals

Embarking on the journey of dividend investing in India requires a clear vision and well-defined financial goals. Before making any investment decisions, take a moment to reflect on what you hope to achieve through this venture. Are you aiming for early retirement, funding your child’s education, or simply looking for a steady stream of passive income to enhance your lifestyle?

Setting specific and realistic financial goals is crucial in guiding your dividend investing strategy. Determine the amount of passive income you aim to generate annually and the timeframe within which you hope to achieve it. Consider factors such as your risk tolerance, current financial obligations, and desired standard of living. By establishing clear objectives from the outset, you will be better equipped to make informed investment choices and stay motivated in the face of market fluctuations.

Building Your Investment Portfolio:

Selecting the Right Blue-Chip Stocks

Building a well-diversified investment portfolio is the cornerstone of successful dividend investing. When it comes to selecting the right blue-chip stocks, it’s crucial to consider various factors that ensure long-term stability and consistent returns. One key element to evaluate is a company’s track record of paying dividends consistently over time. Look for companies that have a history of uninterrupted dividend payments even during market downturns, as this reflects financial strength and resilience.

In addition to dividend history, it is essential to assess the fundamental financial health of blue-chip stocks. Conduct thorough research into a company’s earning potential, debt levels, and cash flow generation. Look for sustainable competitive advantages such as strong brand recognition, wide economic moats, and innovative product pipelines. A company with solid fundamentals is more likely to weather economic uncertainties and continue generating reliable dividends.

Unearthing the Gems for Long-Term Gains:

Analyzing Dividend History

Delving into a company’s dividend history is like embarking on a treasure hunt, where each dividend payment represents a gleaming gemstone on the path to long-term financial gains. By carefully analyzing the consistency, growth, and sustainability of dividends over time, astute investors can uncover hidden opportunities that promise a steady stream of passive income through dividend investing in India.

When examining dividend history, it is crucial to consider several key factors. Firstly, focus on companies that have consistently paid dividends for an extended period. This demonstrates their commitment to shareholders and signifies financial stability. Secondly, assess the trend in dividend growth over time. A company that consistently increases its dividend payout indicates not only profitability but also management’s confidence in its future prospects. Lastly, evaluate the payout ratio – the proportion of earnings allocated as dividends – ensuring it remains sustainable and leaves room for future growth.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Maximizing Your Passive Income Potential:

Understanding Dividend Yields

Dividend yields play a crucial role in determining the potential returns you can generate from your investment in blue-chip stocks. It is the measure of the annual dividend payout as a percentage of the stock’s current market price. By understanding and analyzing dividend yields, you can unlock the key to maximizing your passive income potential.

When considering dividend investing, it is essential to seek stocks with higher dividend yields. A high yield not only signifies attractive income potential but also reflects a company’s ability to generate consistent profits and distribute them among shareholders. However, it is important to strike a balance between high yields and sustainable dividend payments, as excessively high yields might indicate an unhealthy financial situation or an unsustainable payout ratio.

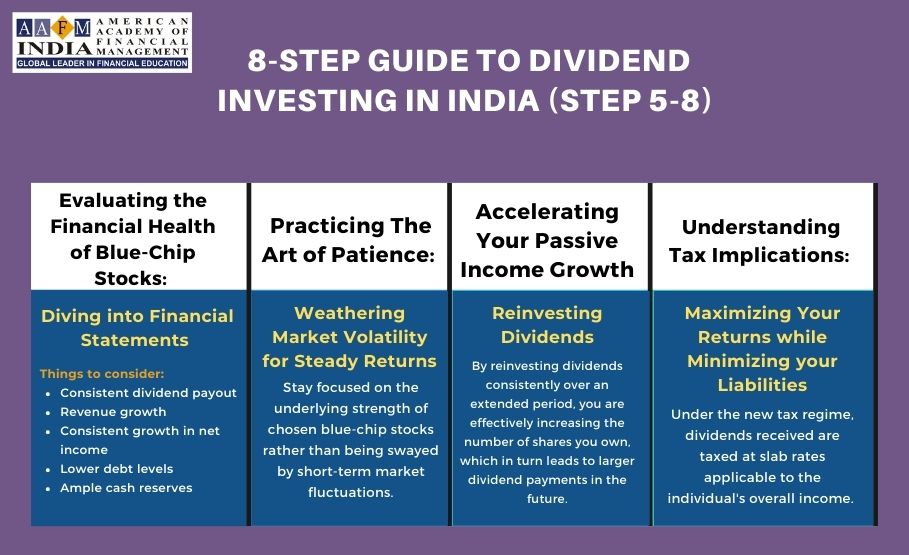

Evaluating the Financial Health of Blue-Chip Stocks:

Diving into Financial Statements

When it comes to dividend investing in India, understanding the financial health of a company is paramount. By diving into the depths of financial statements, investors can gain valuable insights into a blue-chip stock’s ability to generate consistent dividends. One key component to examine is the company’s revenue growth over time. Consistent growth indicates a healthy and thriving business, which implies higher chances of sustained dividend payments.

Another crucial aspect to consider is profitability. Analysing a company’s net income can reveal its ability to generate profits efficiently and consistently. A positive and growing net income indicates that the company has the capacity to continue paying dividends in the long run. It is also vital to assess a company’s debt levels and liquidity position by evaluating its balance sheet. A healthy balance sheet with manageable debt levels and ample cash reserves provides stability and minimizes risks for dividend investors.

The Art of Patience:

Weathering Market Volatility for Steady Returns

Patience is a virtue, and when it comes to dividend investing, it is an essential quality to possess. The stock market can be a rollercoaster ride of emotions, with sudden ups and downs that may tempt investors to make impulsive decisions. However, those who successfully navigate the volatility with a calm and patient mindset are rewarded with steady returns over the long run.

During periods of market turbulence, it is crucial to remember that blue-chip stocks are renowned for their stability and resilience. These companies have stood the test of time, weathered countless economic downturns while consistently delivering dividends to their shareholders. By maintaining a long-term perspective, investors can stay focused on the underlying strength of their chosen blue-chip stocks rather than being swayed by short-term market fluctuations.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Accelerating Your Passive Income Growth:

Reinvesting Dividends

One of the most powerful strategies for dividend investing in India is reinvesting dividends back into your portfolio. By doing so, you can unleash the compounding power of your investments and accelerate your passive income growth to new heights. When you choose to reinvest dividends, you are essentially putting your money to work for you, allowing it to generate even more returns over time.

Imagine this: You receive a handsome dividend payment from a reputable blue-chip stock in your portfolio. Instead of cashing out and enjoying the immediate gratification, you opt to reinvest that dividend back into purchasing additional shares of the same stock or other promising blue-chip stocks. By reinvesting dividends consistently over an extended period, you are effectively increasing the number of shares you own, which in turn leads to larger dividend payments in the future.

Maximizing Your Returns while Minimizing your Liabilities:

Understanding Tax Implications:

When it comes to dividend investing, understanding the tax implications is crucial for maximizing your returns and minimizing your liabilities. The Indian tax system treats dividends differently based on whether they are received from domestic companies or foreign companies. For dividends received from domestic companies, they are subject to a Dividend Distribution Tax (DDT) imposed by the company distributing the dividend.

However, there’s good news for individual investors! The Finance Act of 2020 introduced a new tax regime that allows individuals to choose between the existing tax regime and a new optional tax regime with lower income tax rates but without several exemptions and deductions. Under this new regime, dividends received are taxed at slab rates applicable to the individual’s overall income, ensuring that you can make the most of your hard-earned passive income while still adhering to legal requirements.

Success Stories and Lessons Learned:

Real-Life Examples of Dividend Investing Triumphs

One remarkable success story in the world of dividend investing in India is that of Mrs. Mehta, a diligent investor who meticulously built her portfolio over the years. She strategically invested in well-established blue-chip stocks that had a consistent track record of paying dividends. With her patient approach, Mrs. Mehta saw her passive income grow steadily year after year.

Another inspiring example is Mr. Kapoor, who believed in the power of reinvesting dividends to accelerate his wealth creation journey. He wisely chose companies with a history of increasing their dividend payouts over time, allowing him to benefit from compounding returns. Through disciplined reinvestment and careful selection of blue-chip stocks, Mr. Kapoor experienced exponential growth in his passive income, achieving financial independence earlier than he had ever imagined.

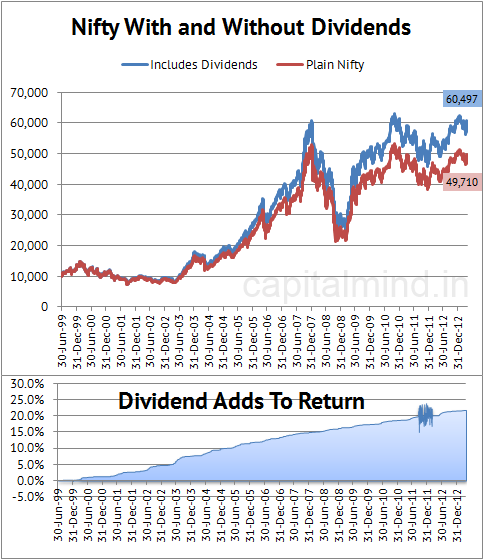

Figure: How dividend added to the overall return

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

Dividend investing through blue-chip stocks holds immense potential for individuals seeking to build passive income in India. By carefully selecting established companies with a consistent track record of dividend payouts, investors can create a reliable income stream and potentially achieve long-term financial stability. Furthermore, the power of compounding and reinvesting dividends can accelerate wealth accumulation over time. While it requires patience and diligent research, dividend investing offers a tried-and-true strategy that can weather market volatility and provide steady returns for those who commit to its principles. Embracing this approach not only opens doors to financial independence but also instills a sense of empowerment as investors take control of their financial future. So, embark on the journey of dividend investing in India with confidence, knowing that blue-chip stocks have the potential to pave the way toward a prosperous future.