Introduction:

Are you a retail investor in India looking to make smart investment decisions? If so, then evaluating Initial Public Offerings (IPOs) could be a key strategy for you. However, understanding the complexities of IPOs and making informed choices amidst the ever-changing market can be challenging. That’s where this article comes in.

In this comprehensive guide, we will explore the intricate subject of evaluating IPOs in India and provide you with valuable insights on how to evaluate them effectively. We will explore the key factors that retail investors should consider before investing their hard-earned money in an IPO. By the end of this article, you’ll be armed with knowledge and tools to make well-informed investment decisions, giving you a competitive edge in the market.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding IPOs: A Beginner’s Guide

Embarking on an investment journey can be both exciting and daunting, especially when it comes to the world of Initial Public Offerings (IPOs). But fear not, for understanding IPOs is not as complex as it may seem. In its simplest form, an IPO marks a company’s transition from being privately owned to becoming a publicly traded entity. This means that the company offers shares of its ownership to the general public for the first time.

Imagine being present at the birth of a revolutionary idea or witnessing the inception of a potentially game-changing company. That’s precisely what an IPO offers – a chance to be part of something big right from its genesis. It provides retail investors with an exceptional opportunity to invest in emerging businesses before they take off on their growth trajectory. By understanding how IPOs work and knowing what factors to consider, you can position yourself advantageously in this exciting realm of investment.

The Rise of IPOs in India: Exploring the Trend

Over the past decade, India has witnessed a remarkable surge in initial public offerings (IPOs), marking a significant milestone in its economic growth. The country’s robust financial market and favorable regulatory environment have propelled IPOs to the forefront, offering both companies and investors unprecedented opportunities. On the other hand, it has also created new challenges for accurately evaluating IPOs in India as we shall see shortly.

One of the driving forces behind this trend is India’s thriving startup ecosystem. With an increasing number of innovative startups emerging across various sectors, IPOs provide a means for these companies to raise capital and fuel their expansion plans. This not only boosts entrepreneurship but also encourages job creation and fosters technological advancements.

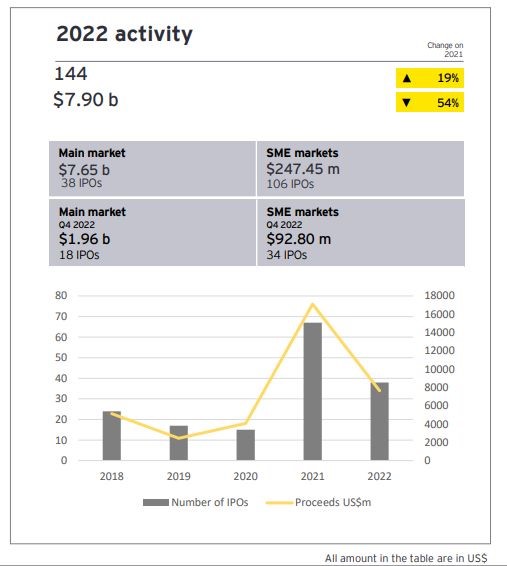

In 2022, the Indian stock exchanges, including BSE and NSE, ranked third globally in terms of the number of initial public offerings (IPOs). However, there were no cross-border deals during this period. In the main markets (BSE and NSE), there were a total of 18 IPOs in the fourth quarter of 2022, which included one InvIT.

This number was lower compared to the 24 IPOs in the fourth quarter of 2021, representing a decrease of 25%. However, it showed a significant increase of 350% compared to the four IPOs in the third quarter of 2022.

On the other hand, in the SME markets, there were a total of 34 IPOs in the fourth quarter of 2022. This number was higher than both the 23 IPOs in the fourth quarter of 2021 and the 33 IPOs in the third quarter of 2022.

This represented an increase of 48% and 3% respectively, compared to the corresponding quarters of the previous year.

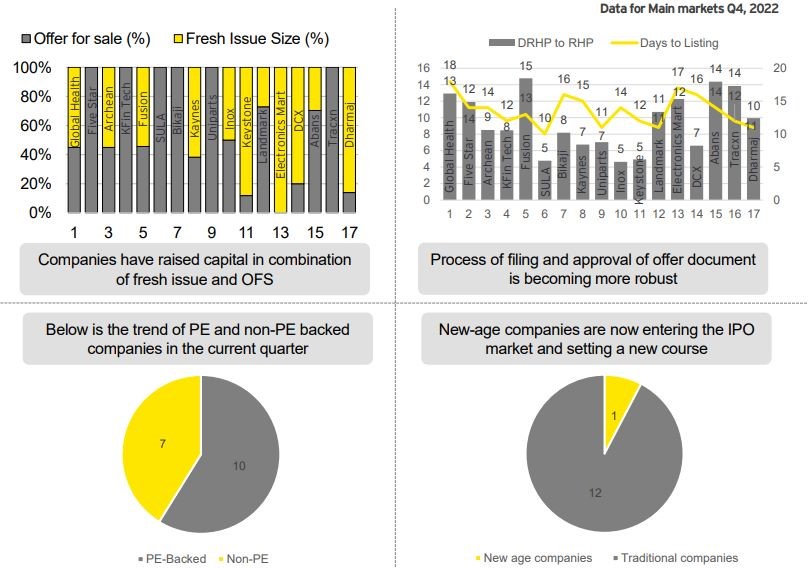

The fourth quarter of 2022 has been the most successful quarter in terms of the number of deals, surpassing the relatively subdued activity seen throughout the year. Furthermore, more than 10 companies have filed their Draft Red Herring Prospectus (DRHPs) in the fourth quarter of 2022, indicating a potentially more prosperous year ahead in 2023.

Based on the recent DRHP filings, the sectors that have shown the most activity are consumer products & retail, technology, and diversified industrial products.

A key development in this quarter is the introduction of significant regulatory changes by SEBI. These changes include the requirement of a committee of independent directors to recommend

- A justified price band based on quantitative factors,

- Disclosure of all key performance indicators with a three-year look back period and comparison with peers,

- The track record of information on share pricing from private equity/investors,

enabling confidential IPO filings with the regulator, and an increased responsibility of the audit committee, among others.

Figure: IPO activities in 2022

Figure: IPO trends in Q4 of 2022

Why Should Retail Investors Consider IPOs?

Retail investors, often regarded as the backbone of the stock market, may find IPOs an enticing investment opportunity. Participating in an initial public offering not only allows them to invest in promising companies at an early stage but also opens doors to potential financial gains. By evaluating IPOs in India and investing in them, retail investors can become a part of a company’s growth story right from the beginning, potentially reaping significant rewards as the company expands its operations and increases its market value.

Furthermore, IPOs offer retail investors the chance to diversify their investment portfolios by adding new stocks with growth potential. It is an opportunity to take part in exciting ventures that may otherwise be inaccessible or already established by institutional investors. By identifying companies with strong fundamentals and a compelling business strategy, retail investors can position themselves for long-term wealth creation while contributing to the growth of promising enterprises.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

8 Key Factors in Evaluating IPOs in India

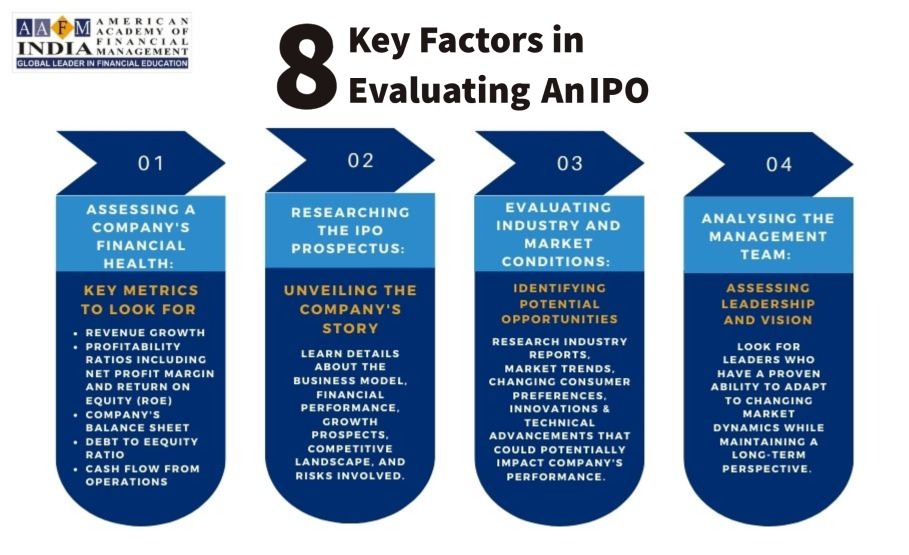

1. Assessing a Company’s Financial Health: Key Metrics to Look For

When evaluating an IPO, one of the most crucial aspects to consider is the company’s financial health. By examining key financial metrics, investors can gain valuable insights into the firm’s stability and growth potential.

Revenue Growth:

One essential metric to focus on is revenue growth. A company that consistently demonstrates strong revenue growth over time indicates a healthy and thriving business.

Profitability Ratios:

Additionally, analysing profitability ratios such as net profit margin and return on equity provides valuable information about how efficiently the company generates profits and utilizes its resources.

Analyzing Company’s Balance Sheet:

Besides revenue growth and profitability, it is also important to delve into a company’s balance sheet to assess its financial strength.

Other Key Metrics:

Investors should closely examine metrics such as debt-to-equity ratio, current ratio, and cash flow from operations. A low debt-to-equity ratio indicates a lower risk profile for the company, while a higher current ratio suggests better short-term liquidity.

Cash Flows:

Furthermore, studying cash flow from operations helps determine if the business generates sufficient cash to sustain its operations or if it relies heavily on external financing.

2. Researching the IPO Prospectus: Unveiling the Company’s Story

When considering an IPO, one of the most crucial steps for retail investors is delving into the company’s prospectus. This document serves as a window into the company’s story and provides valuable insights that can shape investment decisions. The prospectus typically contains a wealth of information, including details about:

- Business Model

- Financial Performance

- Growth Prospects

- Competitive Landscape and Risks

As you embark on your journey to unveil the company’s story, start by thoroughly examining its business model. Seek answers to questions such as: What products or services does it offer? How does it generate revenue? Does it possess a unique value proposition or a competitive advantage in its industry? Understanding these aspects will help you gauge whether the company has potential for long-term success.

3. Evaluating Industry and Market Conditions: Identifying Potential Opportunities

Examining the industry and market conditions is crucial in evaluating IPOs in India and understanding the potential opportunities presented by an IPO. A thriving industry can provide a fertile ground for growth and profitability, while a stagnant or declining market may pose challenges for even the most promising companies. As a retail investor, it is essential to delve deep into understanding the dynamics of the industry in which the IPO candidate operates.

Consider researching industry reports, market trends, and forecasts to gain insights into factors that can impact the company’s performance. Look for signs of innovation, technological advancements, or changing consumer preferences within the sector.

Identifying an industry that is poised for growth can offer you a remarkable chance to invest in a company that stands on the cusp of success. Remember, investing in an IPO should not only be about immediate gains but also about long-term prospects within an evolving landscape.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

4. Analyzing the Management Team: Assessing Leadership and Vision

When it comes to evaluating an IPO, one of the most crucial factors to consider is the management team behind the company. Effective leadership and a clear vision are vital for steering a company towards success.

- Retail investors should delve into the profiles of key executives and assess their track records, experience, and expertise.

- A strong management team instils confidence in investors as it demonstrates their ability to navigate challenges and capitalize on opportunities.

- Look for leaders who have a proven ability to adapt to changing market dynamics while maintaining a long-term perspective.

A visionary management team will not only possess excellent strategic planning skills but also foster innovation within the organization. Companies led by leaders with foresight are more likely to identify emerging trends and seize competitive advantages that can lead to substantial growth.

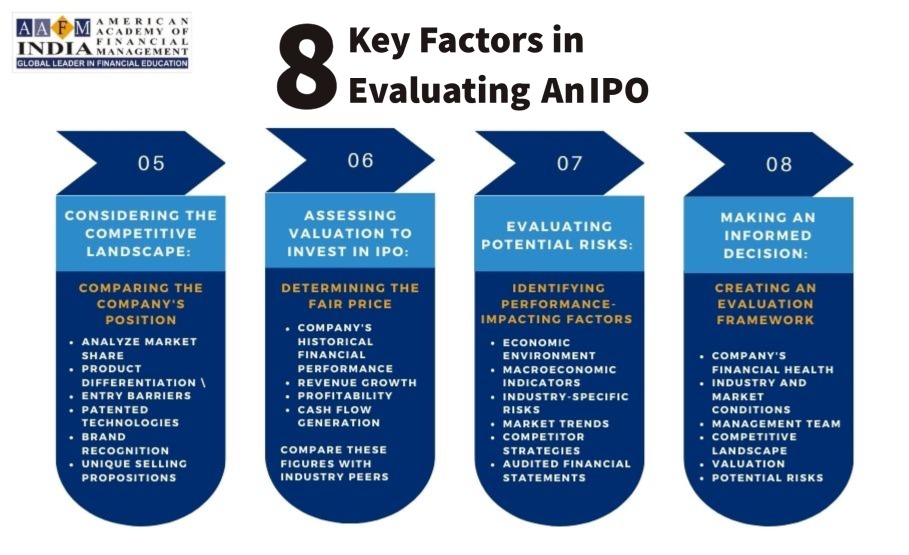

5. Considering the Competitive Landscape: Comparing the Company’s Position

When evaluating IPOs in India, one crucial aspect that retail investors must carefully examine is the competitive landscape in specific sector of the Indian industry in which the company operates. Understanding how a company positions itself in relation to its competitors is essential for making informed investment decisions.

- To assess the competitive landscape, investors should analyze various factors such as market share, product differentiation, and barriers to entry.

- A company with a strong competitive advantage, whether through patented technologies or established brand recognition, will have a higher likelihood of success in the marketplace.

- Retail investors should seek companies that have unique selling propositions and are capable of maintaining their competitive edge in an ever-evolving market.

By scrutinizing the competitive landscape, investors can gain insights into a company’s potential for long-term growth and profitability. Identifying companies that have a strong foothold in their respective industries can instil confidence in retail investors, knowing they are investing in entities well-positioned for success.

6. Assessing Valuation: Determining the Fair Price

When it comes to investing in an IPO, one crucial aspect that retail investors must carefully evaluate is the valuation of the company. Determining the fair price of an IPO is essential for making informed investment decisions and maximizing potential returns.

To assess valuation, investors need to delve deep into the financials and analyze various factors. Firstly, examining the company’s historical financial performance is imperative. By studying its revenue growth, profitability, and cash flow generation over time, one can gauge its overall financial stability.

Additionally, comparing these figures with industry peers provides a benchmark for evaluating whether the proposed IPO price aligns with market standards.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

7. Evaluating Potential Risks: Identifying Factors That Could Impact Performance

While evaluating IPOs in India, it is crucial for retail investors to carefully assess the potential risks associated with the company’s performance. By understanding and identifying these factors, investors can make informed decisions that mitigate potential losses and maximize their chances of success.

- One key risk to consider is the overall economic environment. Economic fluctuations, political instability, or changes in government policies can have a significant impact on a company’s performance.

- By monitoring macroeconomic indicators such as GDP growth rates, inflation levels, and interest rates, investors can gauge the potential risks that may affect the IPO.

- Furthermore, industry-specific risks should not be overlooked. Market competition, technological advancements, and regulatory changes within a particular sector are just a few examples of factors that could impact an IPO’s performance.

- Thoroughly researching market trends and analyzing competitors’ strategies will allow investors to evaluate these risks effectively.

- Auditing financial statements is another crucial aspect of risk evaluation. Inaccurate or misleading financial information can distort a company’s true financial health and pose significant risks for investors.

By reviewing audited financial statements and conducting due diligence on accounting practices, retail investors can gain greater confidence in their evaluation process.

8. Making an Informed Decision: Creating a Well-Rounded Evaluation Framework

When it comes to investing in IPOs, having a well-rounded evaluation framework is crucial for making informed decisions. This framework should take into account various factors, including financial health, industry conditions, management team, competitive landscape, valuation, and potential risks. By carefully analyzing these aspects, retail investors can gain a comprehensive understanding of the IPO’s potential and make investment choices that align with their goals.

Company’s Financial Health:

One key aspect of creating an evaluation framework is conducting thorough research on the company’s financial health. This involves assessing important metrics like revenue growth, profitability ratios, and debt levels. A financially healthy company with consistent growth and manageable debt is more likely to offer better returns in the long run.

Evaluating Industry and market Conditions:

Additionally, for successfully evaluating IPOs in India, an in-depth understanding of industry and market conditions is also vital for identifying potential opportunities. Understanding the market dynamics and trends within the sector in which the IPO operates allows investors to gauge whether there is sufficient demand for its products or services. This knowledge helps investors assess its growth potential and make predictions about future performance.

Management Team:

Furthermore, analyzing the management team provides insights into their expertise and vision for the company. A strong leadership team with experience in navigating challenges can drive sustainable growth. By researching their past track record and assessing their ability to execute business strategies effectively, investors can determine if they are capable of steering the company towards success.

Competitive Landscape:

An evaluation framework should also consider the competitive landscape by comparing the IPO company’s position within its industry. Understanding its competitors’ strengths and weaknesses helps investors gauge its market share potential and assess if it has a unique offering or competitive advantage.

Determining Fair Valuation Is Another Critical Factor In:

Determining the fair value of an IPO is of utmost significance in the world of finance. The fair value, or the intrinsic value, represents the estimated worth of a company’s shares when it goes public. This critical assessment is essential for both potential investors and the company itself.

For investors, understanding the fair value of an IPO helps in making informed investment decisions.

- By analyzing factors such as the company’s financials, market potential, growth prospects, and competitive landscape, investors can assess whether the offering price is reasonable.

- If the IPO is undervalued, investors can seize the opportunity to acquire shares at a favorable price, potentially reaping substantial returns over time.

- Conversely, an overvalued IPO might indicate unrealistic projections and could lead to poor investment outcomes.

- On the other hand, determining the fair value is equally important for the company issuing the IPO. It allows them to set an appropriate offering price that strikes a balance between attracting investors and maximizing funds raised.

- Pricing an IPO too low may result in missed opportunities to raise capital, while pricing it too high may deter potential investors or lead to stock market underperformance after the offering.

Overall, while evaluating IPOs in India, accurately determining the fair value of an IPO is crucial which serves as a key benchmark for investors and companies alike. It helps ensure transparency and fairness in financial markets, enabling investors to make informed decisions and companies to access the necessary capital for growth.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

After carefully evaluating the key factors to consider when investing in IPOs in India, it is evident that retail investors can greatly benefit from conducting thorough research and analysis. By assessing a company’s financial health, understanding its industry and market conditions, analyzing the management team, and considering valuation and potential risks, investors can make informed decisions that can potentially lead to profitable outcomes.

While investing in IPOs always carries a certain level of risk, it is important to approach it with optimism and a long-term perspective. By identifying promising companies with strong fundamentals and growth potential, retail investors have the opportunity to participate in the early stages of exciting ventures. With careful evaluation and prudent decision-making, IPO investments can prove to be rewarding experiences for those willing to dedicate the time and effort.