Discover the Key to Financial Success in Your 20s and 30s with These Essential Tips and Tricks

Are you a young adult just starting your career?

Or maybe you’re a financial advisor looking to serve the next generation of clients? Either way, this article is for you!

In today’s world, young adults face an ever-increasing range of financial complexities, from student loan debt to changing jobs and life transitions. And with traditional financial planning models often geared towards retirees with substantial assets, there’s a clear gap in financial planning services for young adults. But fear not, as a financial advisor, there are many opportunities to help the next generation build wealth and navigate the unique financial challenges they face. Let’s dive in and explore the complexities of financial planning for next-generation clients!

➤ Enquire now for CWM Program ➤ Download CWM Brochure

The Shocking Truth About Life Transitions and Young Adults’ Financial Planning Needs

Lately, financial advisors have been taking notice of younger clients from Generations X and Y, which is exciting! While these individuals may not have a huge chunk of money saved up just yet, they are making progress on saving quickly. In fact, Gen X’ers are earning more money than ever before, which is fantastic news. And get this – they’re also going to inherit a whopping $30 trillion from their parents and grandparents in the coming decades! So, while they may not be the wealthiest clients you’ve ever worked with, there’s a lot of potential for growth and building wealth for the future.

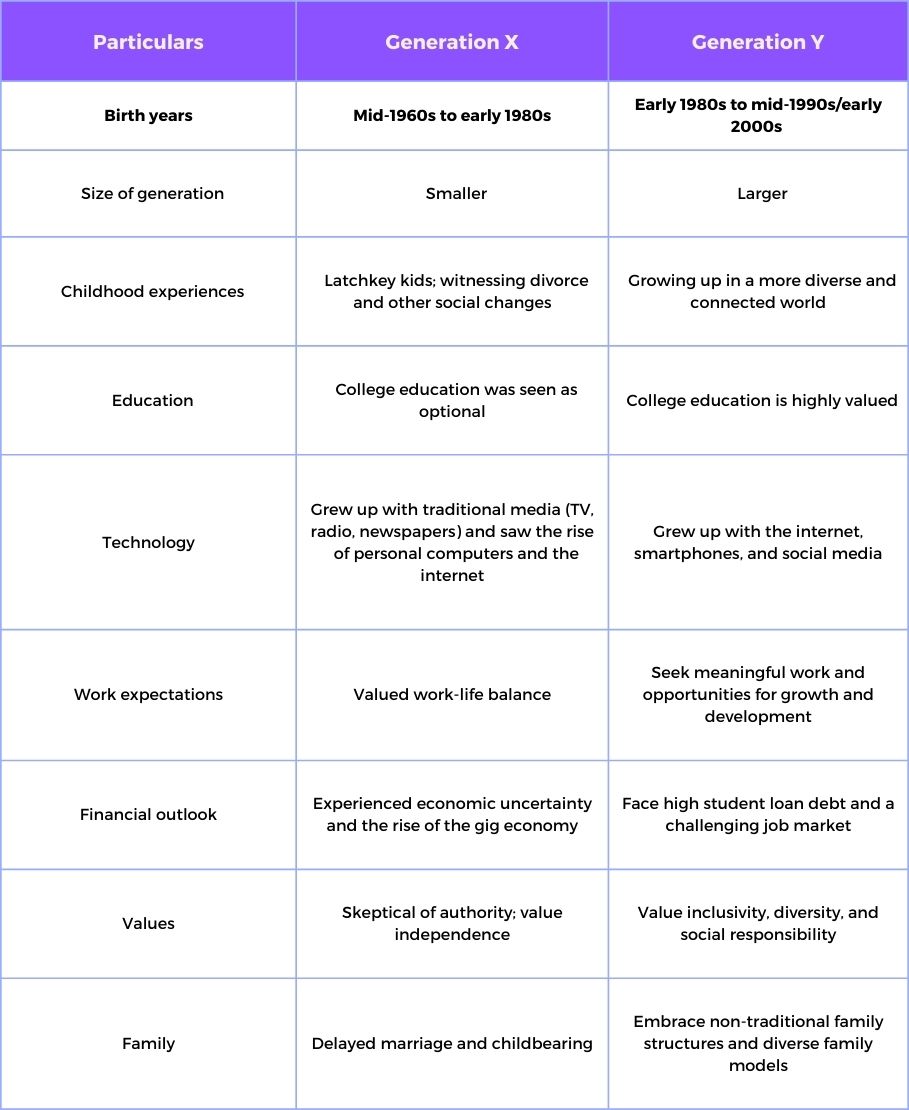

Who are Gen X and Gen Y?

Generation X (Gen X) and Generation Y (Gen Y), also known as Millennials, are two demographic cohorts that are defined by birth years.

GenX

Gen X refers to individuals born between the mid-1960s and the early 1980s, making them currently in their late 30s to early 50s. This generation experienced events such as the end of the Cold War, the rise of personal computers, and the advent of the internet.

Gen Y

Gen Y or Millennials generally refers to individuals born between the early 1980s and mid-1990s to early 2000s, making them currently in their mid-20s to mid-30s. This generation experienced events such as the September 11 attacks, the Great Recession, and the rise of social media.

Here’s a table highlighting some of the key differences between Generation X and Generation Y (Millennials):

THE CHALLENGE

The Challenge of Delivering Financial Advice to Next-Generation Clients

Challenges with Serving Younger Clients

Financial advisors used to have a tough time serving younger clients since they didn’t have many assets to their name. The cost of personalized financial advice often exceeded the value of their available assets, making it uneconomical for advisors to serve them. This is why many advisors primarily focused on serving high-net-worth clients who had more investable wealth.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Some of the key challenges include:

- Asset Limitations for Personalized Advice

- Preference for High-Net-Worth Clients

- Cost-Value Imbalance

Shift in Client Demographics

But things are changing as more and more young people are starting to save earlier. Moreover, there’s a lot of wealth that’s going to be inherited by Gen X’ers from their parents and grandparents over the next few decades. This is why financial advisors are now actively searching for ways to serve this market segment more efficiently and cost-effectively.

Key takeaways:

- Rise of Early Saving Habits

- Anticipated Wealth Transfer to Gen X

Evolution of Financial Advisory Models

As younger clients become a more significant part of the financial advisory market, fee-for-service models such as charging a percentage of income or monthly subscription fees for financial planning are emerging. These models have made it economically viable for advisors to deliver advice to clients with lower assets. However, the financial advisory industry is still struggling to determine what kind of advice to deliver to next-generation clients that justifies the advisory fees.

Key Takeaways:

- Fee-for-Service Paradigm

- Income Percentage Charges

- Subscription-Based Financial Planning

Adapting to Changing Markets

The reality for early accumulators is that how they invest doesn’t matter as much as how much they invest each year. This means that for younger clients, having a relatively “simple” asset-allocated portfolio and focusing on saving is often more effective than seeking a few extra basis points of alpha. In fact, the age-old advice of living within one’s means, spending less than what is earned, and saving the rest remains the most critical advice for young savers.

- Economical Solutions for Lower Asset Clients

- Identifying Appropriate Advice for Fees

Navigating the Path Forward

Despite the industry’s challenge of delivering advice that justifies the fees, the emergence of new models provides hope for financial advisors seeking to serve the next-generation clients.

- Struggles in Justifying Advisory Fees

- Hope through Emerging Models

- Future Prospects for Next-Generation Client Services

Simplified Financial Planning Tools for Next-Generation Clients in India

In India, several financial planning software tools have recognized the need to simplify their offerings to meet the needs of next-generation clients. These tools aim to bridge the gap between traditional financial advisory services and the unique requirements of younger individuals with lower net worth.

Here are a couple of financial planning tools designed for next-gen clients:

Kuvera App: Streamlined Investment Planning for the Younger Generation

Kuvera, an Indian investment platform, stands out as an example of catering to the needs of younger clients with relatively lower net worth. Their approach involves offering a simplified planning tool that focuses on foundational aspects of financial planning.

Unique Selling Point (USP):

This innovative tool lays emphasis on foundational planning and covers various aspects with an integrated approach.

Key Offerings:

- Goal Setting: Helping clients set clear financial goals for their future.

- Budgeting: Assisting clients in creating and adhering to realistic budgets.

- Basic Investment Strategies: Introducing fundamental investment concepts suitable for beginners.

Goalwise App: Low-Cost Robo-Advisory for Limited Assets

Another noteworthy platform in India, Goalwise, addresses the financial planning needs of clients with limited assets by providing a cost-effective and simplified robo-advisory service.

Unique Selling Point (USP):

As part of a unique approach, Goalwise offers goal-based investing solutions for clients to help achieve optimal results.

Key Offerings:

Tailored Goals: Allowing clients to define specific financial objectives.

Long-Term Planning: Focusing on strategies that align with clients’ long-term aspirations.

Portfolio Rebalancing: Ensuring investments stay aligned with clients’ goals over time.

Financial Planning Tools Cater to the Unique Needs of Next-Gen Clients

These apps and tools recognize the distinct financial requirements of next-generation clients who might be interested in financial planning but possess limited net worth and less complex financial situations compared to traditional clients.

Some of the key advantages offered by financial planning tools:

Addressing Limited Net Worth

Ensuring Accessibility: Offering planning tools that are economically viable for clients with lower assets.

Affordability: Providing cost-effective solutions that don’t strain younger clients’ budgets.

Simplicity and Effectiveness

Streamlined Offerings: Focusing on essential financial planning aspects without overwhelming complexity.

Building Strong Foundations: Assisting younger clients in establishing healthy financial habits early in life.

Empowering Future Financial Success

Through their simplified and cost-effective planning solutions, these tools play a crucial role by offering expert financial advice and equipping younger clients with valuable financial knowledge that can help them establish a strong foundation for their future financial success.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

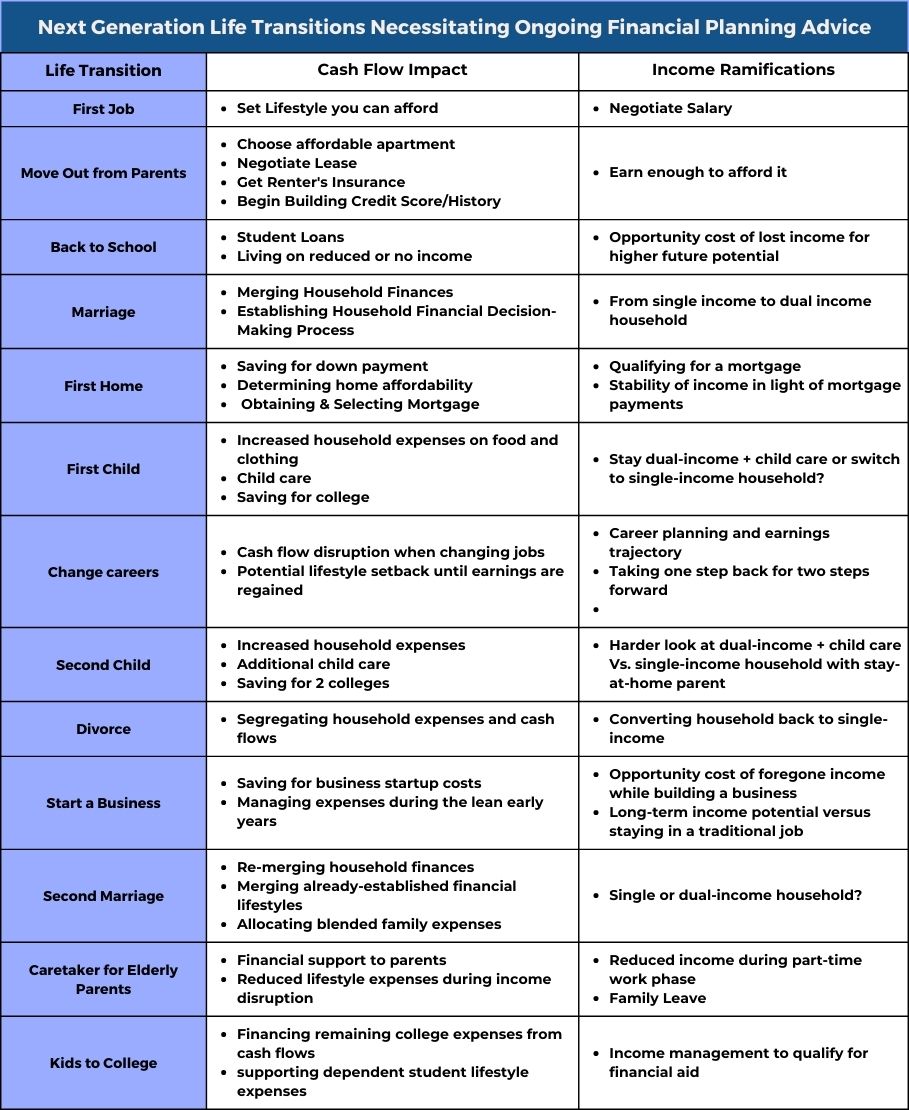

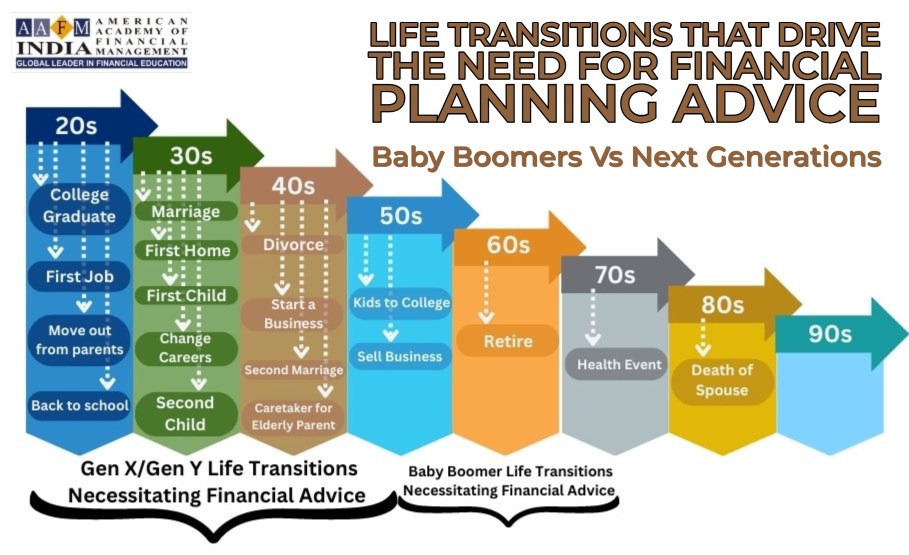

The Complexity of Financial Life Transitions in Middle Age

While it’s true that next-generation clients in their 20s, 30s, and 40s may not have accumulated significant wealth, their financial lives are far from simple. This is because these years are often marked by a series of financial life transitions that can cause significant strain on their finances.

Multitude of Financial Life Transitions

Here are some of the possible life transitions an individual might undergo. Each of these transitions can occur every few years, one after another.

- Leaving Home & Becoming Financially Independent

- Building A Career & Managing Employee Benefits

- Marriage and Shared Finances

- Homeownership and Family Planning

- Job Changes and Career Shifts

- Divorce and Financial Resettlement

- Changing Careers

- Entrepreneurship and Business Ventures

In contrast, for the typical retired client, the major financial transitions are retirement, dealing with a major health event, and the death of a spouse. While retirement is a complex transition, it is not as frequent as the multiple transitions that next-generation clients experience in their middle decades of working years.

Retirement Transition

- Complex Nature: Retirement involves multifaceted financial adjustments.

- Infrequency: Retirement as a less frequent life event compared to middle-age transitions.

- Other Significant Transitions in Retirement: Dealing with health events and the death of a spouse.

Frequency and Impact of Life Transitions

Unlike retired clients who often face fewer and more predictable financial transitions, next-generation clients encounter a series of significant life changes that can occur relatively frequently during their working years.

Rapid Succession: The occurrence of multiple transitions every few years.

Cumulative Impact: The cumulative effect of these transitions on financial stability.

Addressing Unique Financial Challenges

Therefore, while next-generation clients may not have significant assets to manage, their financial planning needs are not simple. Financial advisors must understand and address the unique financial challenges that arise during these various life transitions.

Client-Centric Approach:

Tailoring financial advice to accommodate various life stages.

Navigating Rapid Changes:

Assisting clients in adapting to frequent transitions.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

The Significance of Life Transitions in Financial Planning

Life transitions can create a lot of stress and complexity in one’s financial situation. These moments of change can serve as a catalyst for people to take a closer look at their finances and consider making behavioral changes. Seeking the help of a financial advisor during these times can provide guidance and support through the transition process. Therefore, recognizing and understanding the significance of life transitions is an essential aspect of effective financial planning.

Baby boomers are individuals born in the post-World War II baby boom between the mid-1940s and mid-1960s, a period marked by a significant increase in birth rates. The term “baby boomers” is typically used to refer to people born during this time, who are now in their late 60s to early 80s. Baby boomers are often seen as a significant demographic group, as their sheer size has had a profound impact on various aspects of society, including the economy, culture, and politics.

In essence, a life transition is the trigger that creates a need for financial advice and prompts clients to seek out a financial advisor. Based on this perspective, it could be argued that next-generation clients require ongoing financial planning advice even more than retirees. Unlike retirees who may only experience major life transitions that require the services of a financial advisor once in a decade, next-generation clients face life transitions affecting their financial planning needs every year or few.

How to Approach Financial Planning for Young People:

Understanding Income and Cash Flows

Different Focus in Financial Planning

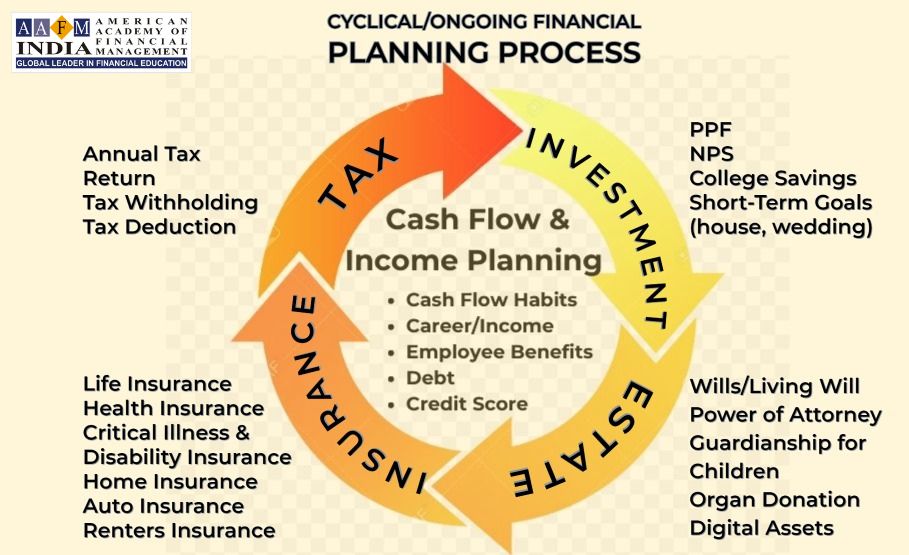

Notably, financial planning for next-generation clients differs from planning for traditional Baby Boomer clients not only in the pace and nature of life transitions but also in the focus of the financial planning process.

Importance of Income and Cash Flows

Baby Boomer planning typically concentrates on assets, which refers to their balance sheet. However, financial planning for next-generation clients is more about income and expenses, which is the “cash flow statement” of the household. In other words, most financial planning decisions for next-generation clients are not about how to allocate and grow their assets, but rather about how to allocate and grow their household’s income.

Impact of Life Transitions on Cash Flows

Next-generation clients face many significant life transitions that can have a significant impact on their income and cash flows.

- Negotiating Salary and Benefits for First Job

- Merging Finances After Marriage

- Qualifying for and Affording a First Home

- Managing Childcare Costs in Dual-Income Household

- Or Becoming A Single-Income Household With A Stay-At-Home Parent After Having Kids

These transitions don’t necessarily affect the household’s assets, but they can have a substantial impact on their cash flows.

Complex Financial Conversations

Have you noticed that almost every life transition in our 20s, 30s, and 40s has a big impact on our finances? Whether it’s negotiating our first salary, merging our finances with a partner, buying a home, or starting a family, each step has its own financial implications.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Key Concerns:

Merging Finances with a Partner

Financial Implications of Starting a Family

These transitions often require serious financial conversations. We need to discuss the household’s income and cash flows, as well as how to manage them effectively during this time of change.

Unfortunately, the steady pace of life transitions can make financial planning seem incredibly complex. It can be overwhelming to constantly navigate these shifts, especially when each one requires a new round of financial discussions and decisions.

For example, consider the conversation about merging finances with a partner. Do you keep separate accounts, or combine everything? Who makes the financial decisions? And if you decide to start a family, how will you handle the cost of childcare? These are not easy topics to discuss, but they’re essential for effective financial planning during these crucial years.

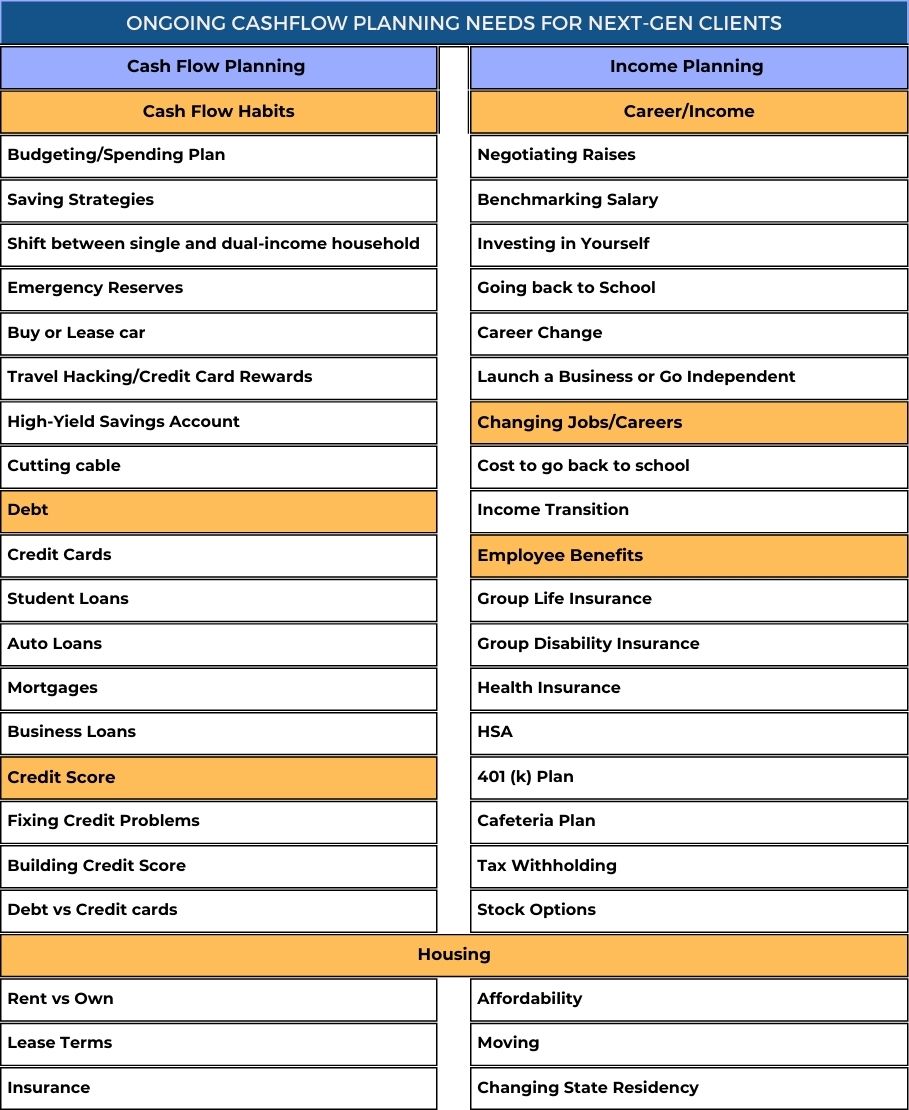

Ongoing Financial Planning Concerns

Along with the financial issues that come with life transitions, next-generation clients have many other ongoing financial planning concerns. These can include things like finding ways to save money, figuring out how to manage debt, and building a good credit score. Additionally, career planning is crucial for increasing earning potential, from salary negotiations to pursuing education or starting a business. Maximizing employee benefits can also be an opportunity to save money. When it comes to housing decisions, income is a major factor in what can be rented or purchased, which in turn affects cash flow. And it’s essential to consider how housing choices impact the ability to find a better job or manage a commute. These are all important financial planning topics that should not be overlooked.

Key Concerns:

Devising Personalized Savings Strategies

Devising Personalized Debt Management Strategies

Building a Healthy Credit Scores

Career Planning and Maximizing Earning Potential

Maximizing Employee Benefits

Impact of Housing Decisions on Career

The financial complexities faced by next-generation clients stem from the focus on income and cash flows, influenced by numerous life transitions and ongoing financial considerations. Effective financial planning is crucial to navigate these complexities and make informed decisions that set the stage for financial success in the long term.

Adapting Financial Planning to the Next Generation: A Cyclical Approach

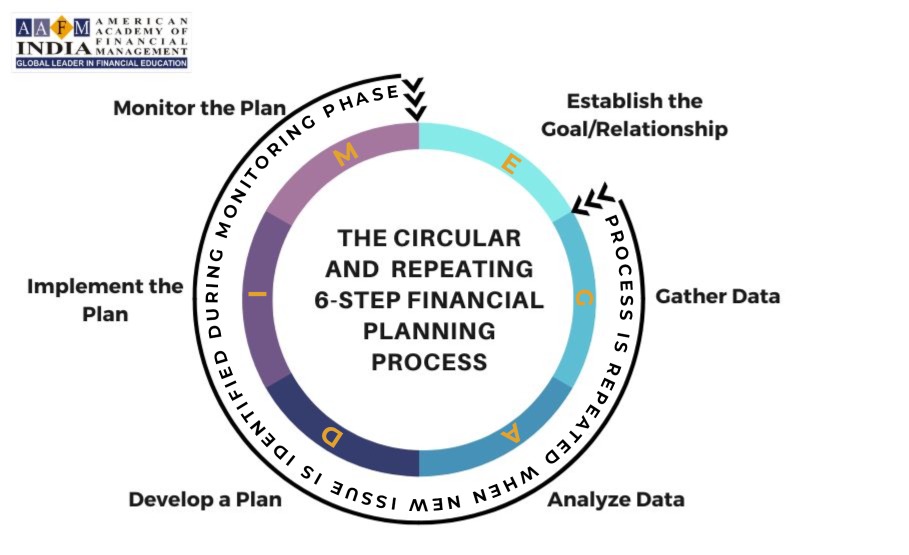

The financial planning process typically consists of six steps, which are soon to become seven. The final step involves the implementation of the financial advice and a monitoring phase where the advisor keeps an eye on the client’s situation. The monitoring phase is crucial as it helps the advisor identify situations where the financial planning process needs to be revisited.

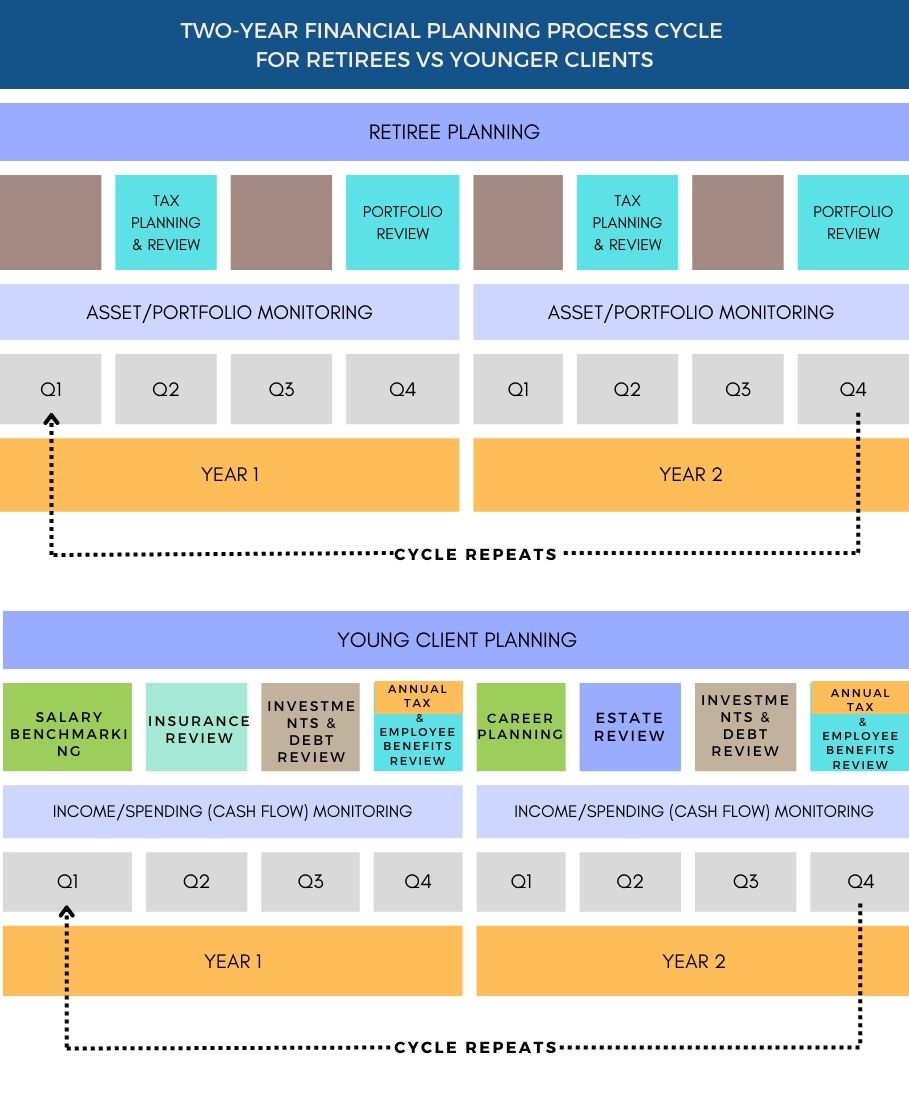

When financial advisors work with retirees or asset-based clients, the “monitoring” process mostly revolves around their assets. This is because ongoing investment management needs ongoing monitoring to ensure that the portfolio remains well-invested and aligned with its Investment Policy Statement. Since very few life transitions occur for these clients, except for retirement, a health event, or the death of a spouse, monitoring the assets becomes the primary focus for these clients.

When it comes to younger clients who are still in their working years, the financial planning needs are much broader compared to retirees or clients with more significant assets. This is because next-generation clients are still experiencing many life transitions, and all these transitions will have an impact on their financial plans. As a result, the financial advisor needs to regularly update their plan and consider all aspects of the client’s financial needs. These include insurance planning, tax planning, college planning, estate planning, cash flow and income planning, and how any changes in these areas affect the client’s retirement plans.

To put it another way, it’s interesting that ongoing life transitions for next-generation clients create even more opportunities for a cyclical advice relationship. Because these clients are experiencing so many changes, from insurance planning to tax planning to college planning and beyond, it’s important to regularly monitor and update their financial plans. In contrast, for older clients who have already gone through most of life’s big changes, the focus is usually on portfolio management since there isn’t much left to plan for.

As demonstrated in the chart above, financial planning for younger clients involves many topics that are regularly changing. Operating on a 2-year cycle is important for this demographic because there is a high likelihood that some life event or transition may occur that necessitates a change in one or more areas of the financial plan. During the cyclical planning process, these changes can be identified and addressed.

The anchor of the monitoring process for traditional retired clients is tied to investment portfolio monitoring, while for younger clients, it’s primarily focused on income and spending monitoring to address the impact of changes in household cash flows. By recognizing the differences between these monitoring focuses, financial advisors can ensure they are addressing the unique needs of their next-generation clients in an ongoing cyclical advice relationship.

The idea that young people with limited investment assets have simpler financial planning needs is a misconception. They have a different range and type of complex financial needs and more frequent life transitions that may trigger the need for financial advice. Despite having less wealth at stake (especially investment assets), there are still opportunities to charge for financial planning advice and create value to justify those fees. This is because the focus of planning shifts to the income and cash flows that build wealth instead.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

- Traditional financial planning approaches that are primarily focused on managing investments and asset-based clients are no longer sufficient for younger, next-generation clients.

- Younger clients face a higher number of life transitions and complex financial needs, which require an ongoing cyclical advice relationship.

- The traditional monitoring process for older clients with fewer life transitions centers around managing investment portfolios, while for younger clients, it revolves around income and cash flow management.

- Next-generation clients’ financial planning needs span beyond the traditional investment focus, including cash flow management, insurance, tax, estate and college planning.

- Financial advisors who adjust their approach to serve the financial planning needs of younger clients can create value and generate fees, even though there may be less aggregate wealth at stake.

- By embracing a more cyclical financial planning process and focusing on the broader range of financial planning needs, advisors can create a mutually beneficial, long-lasting relationship with younger clients.