Introduction

As the world becomes increasingly interconnected, it has become clear that businesses can no longer operate in isolation from the social and environmental challenges facing our planet. Impact investing has emerged as a powerful tool for aligning profit with social and environmental goals, and India is fast becoming a hub for impact investment opportunities.

In this article, we will explore the field of impact investing in India and how it is playing a crucial role in driving sustainable development. From historical overviews to current state of affairs, we will delve deep into the strategies, best practices, financial considerations, tools and opportunities for investing in India. Whether you are an investor looking to make a positive difference or simply curious about this emerging field, this article promises to offer insightful information on what you can expect from impact investing in India.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Aligning Profit with Social and Environmental Goals: The Power of Impact Investing

Impact investing, as a new investment approach, offers investors the opportunity to put their money into companies that not only generate financial returns but also create positive social and environmental outcomes. Unlike traditional investment models, which focus solely on profit maximization, impact investing offers a more holistic approach to investing that considers the wider impact of business activities on society and the planet.

The power of impact investing lies in its ability to align profit with social and environmental goals. By doing so, it creates a sustainable business model that benefits both investors and society at large. Impact investments can support everything from renewable energy projects to affordable housing initiatives, from sustainable agriculture to microfinance for small businesses.

This section will explore the advantages of aligning profit with social and environmental goals through impact investing. It will delve into case studies of successful impact investments in India and examine how these investments have created positive change while generating financial returns for investors.

Impact Investing in India: Historical Overview and Current State

India has a rich history of social entrepreneurship, with organizations like the Self-Employed Women’s Association (SEWA) and Barefoot College leading the way. However, it wasn’t until 2001 that the term “impact investing” was coined by The Monitor Group and Acumen Fund to describe investments made with the intention of creating positive social or environmental impact alongside financial returns.

The impact investing sector in India has experienced substantial growth in recent years, particularly in big ticket deals exceeding $10 million, which have more than doubled in the past half decade. Additionally, the number of transactions valued at over $20 million has increased by a factor of 2.3. Emerging markets represent a vital arena for addressing social and environmental challenges, housing the majority of the global population, as well as nine of the top ten cities with the highest susceptibility to the effects of climate change. Among these markets, India stands out as the most significant investment destination, with considerable investor confidence. Nonetheless, actual investment interest remains lower than necessary. Early-stage investments have focused largely on solutions with limited scalability, but impact investment opportunities in India are now expanding beyond financial inclusion, encompassing a range of sectors such as agriculture, technology for positive impact, healthcare, education, and livelihoods.

According to a report by McKinsey & Company, impact investments in India have increased from $1.6 billion in 2010 to $10.6 billion in 2020 to $6.8 billion in 2021. This growth is due to a combination of factors, including rising awareness among investors about social and environmental issues, supportive government policies, and an abundance of innovative social enterprises.

Unlocking the Potential of Impact Investing: Identifying Sustainable and Scalable Business Models in India

There are multiple factors driving the growth in investor confidence and impact investments in India, setting it apart from other emerging markets. One significant driver is India’s status as the world’s most populous country, surpassing China. As a democratic nation, India boasts a young and skilled talent pool, making it an attractive destination for impact-driven enterprises. The fast-paced adoption of internet penetration and 5G technology presents a unique opportunity for low-cost offerings to be created for the “next half billion” population, referring to India’s fast-growing bottom half economy.

Identifying sustainable and scalable business models is crucial for unlocking the full potential of impact investing in India. Impact investors are not only looking for businesses that deliver positive social and environmental outcomes, but also those that have the potential to grow and generate profits over the long term.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

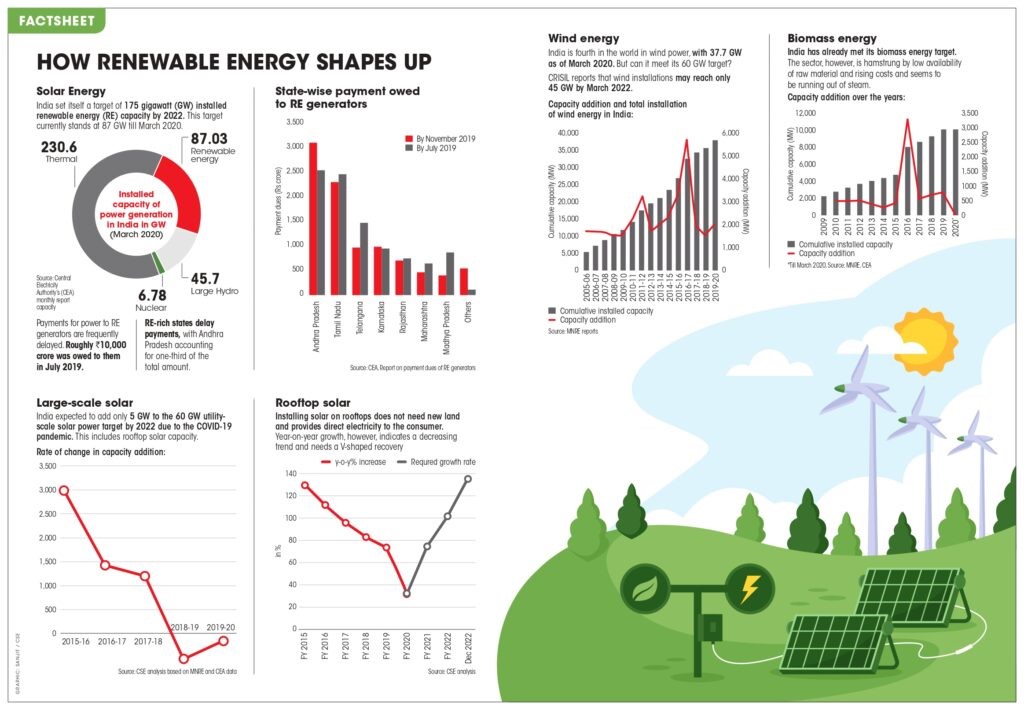

The digital penetration in India has allowed tech-enabled businesses to drive innovation and scale impact across various sectors, particularly in climate-tech and future of work. This is reflected in the increasing shift towards sustainable mobility and SME finance, which raised 16.7% and 11.2% of total equity impact capital in 2022, respectively. There are several other sectors that have shown promise for sustainable and scalable impact investments. One such sector is renewable energy, which has seen significant growth due to government incentives and favourable policies. Investments in solar, wind, hydro power projects can help mitigate climate change while generating reliable returns for investors.

Source: www.civilsdaily.com

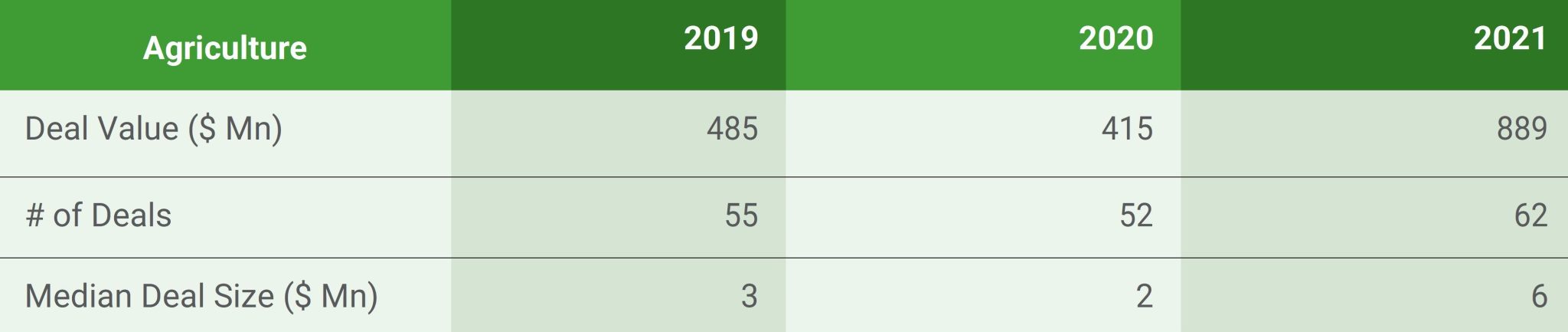

Agriculture is another promising sector for impact investments in India. The country’s vast agricultural resources can be leveraged to address food security challenges while creating new jobs and income opportunities for small farmers. By supporting sustainable farming practices and promoting market linkages, impact investors can help drive rural development while generating financial returns.

Table 1: Agriculture investment volume, deal flow and median deal size across 2019, 2020 and 2021

Table 2: Agriculture investment volume and deal flow across stages over 2019, 2020 and 2021

Source: IIC Report, 2021

The proliferation of impact-oriented business models aligns impact with robust returns, providing significant opportunities for social entrepreneurs to create impact at scale while generating returns for investors. Over the past decade, equity impact investments in India have generated an overall internal rate of return of around 30%, with a typical holding period of 5.2 years, as analysed by the Impact Investment Council (IIC). These investments have impacted more than 500 million lives across the country, highlighting the potential for impact investment to bring meaningful change and financial growth to India. The Indian impact investing ecosystem is gradually evolving, supported by stakeholders working to create a catalytic environment for such investments. The emergence of ecosystems, such as the IIC, focuses on increasing private capital flow into social impact through research and advocacy. Domestic impact fund managers are also incorporating better impact management practices to scale the impact of their portfolios. The maturing Indian ecosystem signals a bright future for impact investments in India, positioning the nation as a key player in the global impact investment landscape.

As impact investing gains momentum in India, it’s important to identify business models that have both social/environmental benefit AND the potential to be profitable over time. By focusing on these key sectors – renewable energy, agriculture – investors can unlock a universe of opportunities that create value not just for themselves but also society at large.

Building a Portfolio for Impact: Strategies and Tools for Investing in India

Building a portfolio for impact requires a comprehensive understanding of the social and environmental challenges facing India, as well as the economic factors that drive business growth. One key strategy is to focus on companies that have a clear mission to create positive social and environmental impact, while also generating strong financial returns. This way, investors can ensure that their capital is being used effectively to address pressing issues such as poverty, climate change and gender inequality.

Another important tool for building an impactful portfolio is due diligence. Investors should conduct thorough research on potential investments, including reviewing financial statements, analysing market trends and assessing the impact of the company’s products or services on society. It is also critical to engage with management teams to understand their long-term vision and commitment to sustainability.

In addition, diversification is key when building an impactful portfolio in India. This means investing in a range of sectors such as healthcare, education and renewable energy, as well as considering different types of investments such as debt or equity. By diversifying across sectors and asset classes, investors can minimize risk while maximizing their impact.

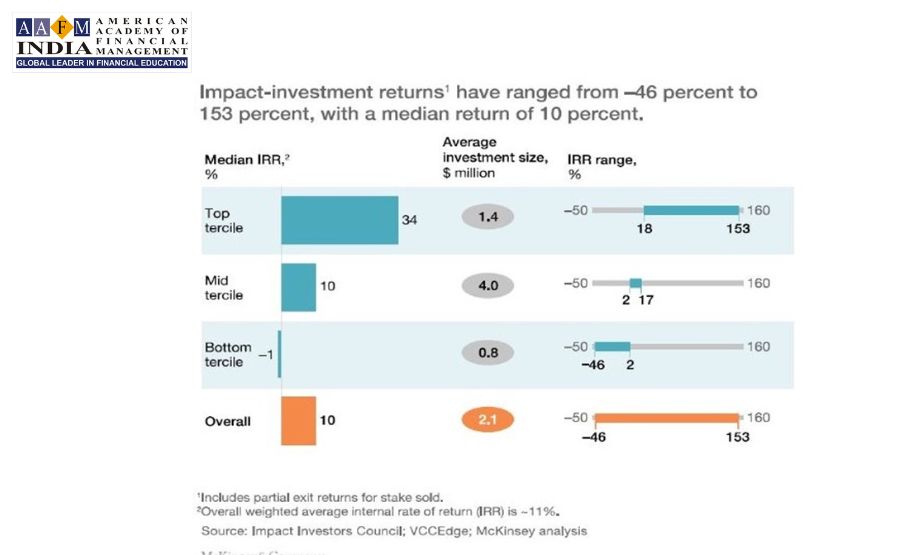

The misconceptions surrounding impact investing remain prevalent among investors who are struggling to break free from their preconceptions and biases. However, various analysis have revealed some counterintuitive findings. One of the main myths about impact investing is that it leads to lower returns. In India, investments geared towards making an impact have demonstrated their capacity to deploy capital sustainably while delivering the financial outcomes that investors expect. A review of 48 exits that occurred over the period between 2010 and 2015 demonstrated a median internal rate of return (IRR) of around 10%. Moreover, 58% of the deals either met or surpassed the earmarked market rate of approximately 7%. It is interesting to note that the top third of these deals delivered a median IRR of 34%, which underscores the possibility of achieving profitable exits through investments in social enterprises.

Source: McKinsey Reports.

Ultimately, building an impactful portfolio requires a combination of strategies and tools tailored to meet individual investor goals. With careful consideration of social and environmental factors alongside financial returns, investing in India can play an instrumental role in driving positive change while generating enduring financial value.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Mitigating Risk in Impact Investing: Best Practices and Financial Considerations

Impact investing involves a certain level of risk, as investments are made in emerging markets where political and economic instability can be high. Careful due diligence is necessary to ensure that investments align with social and environmental goals while remaining financially viable. One of the best practices for mitigating risk in impact investing is to diversify your portfolio across different sectors, geographies, and asset classes.

Another important consideration when mitigating risk in impact investing is to work with local partners who have a deep understanding of the social, cultural, and economic landscape of the region. This helps investors navigate complex regulatory environments and avoid potential legal or reputational risks. Furthermore, investors should monitor their investments closely and remain engaged with the companies they invest in to ensure that they are meeting their social and environmental commitments.

Despite the risks involved, impact investing can offer significant financial returns as well as positive social and environmental outcomes. By adopting best practices for mitigating risk, investors can build a diversified portfolio that aligns with their values while delivering financial returns over the long-term.

Measuring Impact: Evaluating the Social and Environmental Outcomes of Your Investments

Measuring the impact of impact investments is crucial for understanding whether your investments are making a difference. Impact investors need to understand how their investments have contributed to positive social and environmental outcomes, and what challenges they have faced along the way.

Evaluating social and environmental outcomes can be challenging due to the complexity of measuring intangible effects such as improved well-being, poverty reduction, or greenhouse gas emissions. However, there are several tools available that can help investors measure and report on their impact. For instance, the Global Impact Investing Network (GIIN) has developed a set of standardized metrics for evaluating social and environmental outcomes across different sectors. Investors can also use third-party ratings agencies to assess their portfolio’s impact performance against industry benchmarks.

By measuring impact, investors can learn from their experiences and adjust their strategies accordingly. They can also demonstrate accountability to stakeholders such as investors, beneficiaries, and governments who demand evidence of positive outcomes. In turn, this helps build credibility for the field of impact investing as a whole.

Embracing Collaboration: Partnering with Local Communities, NGOs, and Government Agencies

One of the key principles of impact investing is collaboration. This is particularly true in India, where partnerships with local communities, NGOs, and government agencies are essential for achieving positive social and environmental outcomes. By working together, investors can leverage their resources and expertise to support sustainable development initiatives that create lasting change.

Collaboration can take many forms in impact investing. For example, investors may partner with local communities to identify pressing social or environmental issues that require targeted investments. They may also collaborate with NGOs to build capacity within the organizations they support or work together on the ground to implement projects that address specific community needs. Additionally, partnerships with government agencies can provide valuable regulatory guidance and support for scaling successful impact investments.

Successful collaboration requires a willingness to listen and learn from others. Investors must be open to diverse perspectives and actively seek out partners who share their values and objectives for social and environmental impact. By embracing collaboration as a core principle of their investment strategy, impact investors in India can maximize their reach, effectiveness, and potential for creating positive change.

Taking Action: Getting Involved and Making a Difference through Impact Investing

Investing in impact ventures is not just about money. It’s also about getting involved and making a difference. Impact investment provides an opportunity to engage with social, economic, and environmental issues in your community and beyond. To truly make an impact, investors need to actively engage with the businesses they support, contribute their skills and expertise, and leverage their networks to create opportunities for growth.

One way to get involved is by attending events and networking with like-minded individuals who are interested in impact investing. Conferences, workshops, and meetups provide a platform for investors to learn from industry leaders, share insights and best practices, and collaborate on projects that align with their values.

Another way to make a difference is by volunteering your time or expertise to support social enterprises. Many impact businesses operate on limited budgets but have ambitious goals for social or environmental change. By providing pro-bono services or mentorship, you can help bridge the gap between these businesses’ aspirations and their capacity.

Finally, it’s essential to stay informed about the latest trends and developments in impact investment. As the field evolves rapidly across geographies and sectors, staying up-to-date on emerging opportunities can help investors identify new ways of driving positive change while aligning profit with purpose.

Advancing the Field of Impact Investing in India: Opportunities and Challenges for the Future

The field of impact investing in India has enormous potential to drive sustainable economic growth, create jobs, and improve social and environmental outcomes. As more investors recognize the financial returns and social benefits of impact investing, we can expect to see an increase in funding for innovative projects that address some of India’s most pressing challenges.

However, there are also several challenges that must be overcome in order to fully realize the potential of impact investing. One challenge is identifying high-quality investment opportunities that are capable of delivering both financial returns and measurable social or environmental benefits. Another challenge is finding ways to measure impact effectively so that investors can make informed decisions about where to allocate their capital.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Despite these challenges, there are many exciting opportunities for advancing the field of impact investing in India. For example, new technologies such as blockchain and artificial intelligence could be used to improve transparency and accountability in impact investing transactions. Additionally, collaborations between investors, NGOs, government agencies, and local communities could help expand access to capital for entrepreneurs and businesses working in areas such as renewable energy or agriculture.

In order to capitalize on these opportunities and address the challenges standing in our way, it will be critical for all stakeholders within the impact investment ecosystem – including investors, entrepreneurs, policymakers, NGOs, academics – to work together towards a shared vision of sustainable development through impactful investments.

Conclusion: Inspiring Change through Impact Investment in India

In conclusion, Impact Investing in India presents a unique opportunity for investors to align their financial objectives with social and environmental impact. With a growing pool of socially responsible businesses and entrepreneurs, paired with increasing government support and regulatory frameworks, the potential for impact investing in India is immense. By leveraging sustainable and scalable business models, partnering with local communities and stakeholders, measuring impact, and building portfolios that reflect the values of investors, we can create lasting change while generating long-term financial returns. Let us embrace this exciting frontier of finance that not only benefits our wallets but also our planet and people.