Introduction:

India’s real estate market has been on an upward trajectory for several years now. With a growing middle-class population, increased urbanization and infrastructure development, it is no surprise that investors are now eyeing the Indian real estate market. However, investing in this market requires a keen understanding of its dynamics and risks. In this article, we will explore the opportunities and challenges of investing in real estate in India, as well as identify the hottest investment destinations.

We will delve into financing options available to investors and discuss the regulatory framework governing this sector. Additionally, we will provide tips for identifying profitable real estate deals in India and share case studies of successful investment strategies. By the end of this article, you can expect to have a comprehensive understanding of what it takes to invest in Indian real estate successfully.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding the Indian Real Estate Market

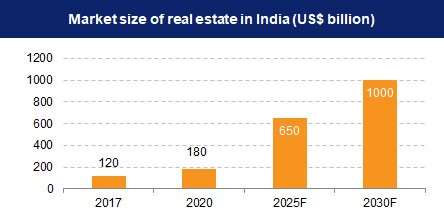

India is one of the fastest-growing economies in the world, and its real estate market has been witnessing a significant upswing in recent years. The Indian real estate sector can be segmented into residential, commercial, retail, and hospitality segments. According to a report by PwC India, the sector is expected to reach a market size of US$1 trillion by 2030.

The demand for real estate in India is fueled by several factors such as rapid urbanization, rising income levels, favorable government policies promoting affordable housing and smart cities, and growth of industries such as IT/ITES, manufacturing, healthcare and education. However, challenges like lack of transparency in land acquisition and regulatory approvals processes and high prices have also been observed. Understanding these trends can help investors make informed decisions while investing in Indian real estate.

Hottest Real Estate Investment Destinations in India

India is a vast and diverse country with several potential destinations for real estate investment. However, some places have emerged as the hottest real estate investment destinations in recent times. One such place is Bangalore, also known as the Silicon Valley of India. With a booming IT industry and several multinational companies setting up offices here, Bangalore has become a hub for real estate investment. The demand for commercial and residential properties is on the rise, making it an ideal destination for investors.

Mumbai, the financial capital of India, is another hot spot for real estate investment. With limited available land and an ever-growing population, Mumbai witnesses high demand and prices when it comes to property investments. The city’s infrastructure development projects further add to its attractiveness as an ideal destination for real estate investments.

Opportunities and Challenges of Investing in Real Estate in India

Investing in Indian real estate offers a plethora of opportunities and challenges, which must be weighed carefully before making any investment decisions. On the one hand, India’s growing population and rapidly expanding economy make it an attractive market for real estate investors looking for long-term growth potential. Additionally, the government has implemented various policies to encourage foreign investment and simplify regulations to further attract investors. On the other hand, there are various challenges that investors must navigate through such as lack of transparency in the market, legal complexities, title disputes, corruption and political instability.

Finding profitable investment opportunities can also be challenging. Investors need to understand local demographics, economic development plans, infrastructure projects like road networks or metro rail systems under construction near their properties. Regulatory compliance is also a significant challenge in India’s real estate market because there are multiple authorities such as municipal corporations or state governments who regulate different aspects of property transactions. Knowledge of local property laws is crucial when conducting due diligence before making an investment decision.

Real Estate Financing Options: A Comprehensive Guide

Investing in real estate in India requires significant capital, and not everyone has the funds to buy a property outright. Fortunately, there are several financing options available for individuals looking to invest in Indian real estate.

The most common financing option is taking out a mortgage loan from a bank or financial institution. These loans usually have lower interest rates compared to other types of loans and can be paid back over an extended period. Another popular option is investing through Real Estate Investment Trusts (REITs). REITs enable investors to pool their money together and invest in multiple properties, creating an attractive investment opportunity for those who cannot afford to purchase individual properties.

Other financing options include seeking funding through crowdfunding platforms or investing in rental income schemes where the investor purchases part of a rental property and receives a share of the rental income generated by that unit.

It is important to note that each financing option has its pros and cons, so it’s crucial to evaluate each one carefully before making your decision. It’s also essential to have a solid understanding of your financial situation and goals before selecting any particular financing option.

In conclusion, while real estate investment requires significant capital, there are various financing options available that can help make it more accessible for interested individuals. By researching different possibilities and selecting the right one based on your unique situation, you can make a profitable investment in Indian real estate.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Real Estate Regulatory Framework in India: What You Need to Know

As a real estate investor in India, it is important to understand the legal and regulatory framework governing property transactions. The Real Estate (Regulation and Development) Act, 2016 (RERA) is one of the most significant pieces of legislation that regulates the Indian real estate market. RERA aims to protect homebuyers and investors by ensuring transparency and accountability in real estate development projects.

RERA mandates that every state establishes a regulatory authority to oversee the functioning of the real estate sector and ensure compliance with standard operating procedures. It also requires developers to register their projects with this authority before advertising or selling them. Additionally, RERA mandates that developers maintain an escrow account with at least 70% of buyers’ funds for each project until completion, which ensures that funds are not misused.

While some developers may initially struggle to adjust to RERA’s new requirements, it is ultimately a positive development for the industry as a whole. By creating more transparency and accountability in real estate transactions, RERA makes investing in Indian real estate less risky for buyers and investors alike.

Key Factors to Consider Before Investing in Real Estate in India

Investing in real estate requires a significant amount of capital, so it is crucial to consider various factors before making a decision. These factors will determine the success or failure of your investment strategy.

- The first factor to consider is location. In India, real estate prices vary significantly depending on the location. It is crucial to research and identify areas that have high potential for growth and development.

- Second, you should consider the property’s size and type. You must have a clear understanding of your target market to determine the type of property that will yield maximum returns.

- Thirdly, you should evaluate your financial capability and choose an investment strategy that aligns with your budget. You can choose between buying land or investing in pre-constructed properties. Additionally, you must consider the legal framework surrounding real estate investments in India.

- Lastly, it’s vital to conduct thorough due diligence on property developers or sellers before investing in any project. This includes checking for their reputation, past projects’ performance and scrutinizing all legal documents relating to the property transfer process.

How to Identify Profitable Real Estate Deals in India?

Identifying a profitable real estate deal in India can be a daunting task, especially for inexperienced investors. However, with the right knowledge and skills, it is possible to make a successful investment that generates an impressive return on investment. Here are some tips on how to identify profitable real estate deals in India:

- Firstly, research the market thoroughly. Look at recent sales data, trends and forecasts for your desired location. Analyze factors such as the local economy, infrastructure development plans and demographic changes that may impact property values in the future.

- Secondly, consider various financing options and choose one that suits your needs best. Evaluate different lenders and their terms of lending before making a decision.

- Thirdly, engage professional help. Find trustworthy brokers or agents who have deep knowledge of the local property market and can give you valuable insights into lucrative deals that meet your investment goals.

- Last but not least, conduct thorough due diligence before investing. Inspect properties carefully for potential issues such as legal disputes or structural damage that could affect their value in the long term.

By following these tips and staying committed to your investment goals, you can identify profitable real estate deals in India that will provide excellent returns on investment.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Best Practices for Real Estate Investment Success in India

Investing in real estate in India requires a long-term commitment that requires careful planning and execution. To maximize your returns and avoid costly mistakes, it’s essential to follow some best practices for real estate investment success in India.

- Conduct thorough market research and analysis to identify the most promising locations and properties. Consider factors such as demographic trends, economic growth, infrastructure development, and government policies.

- Work with reputable developers or brokers who have a proven track record of delivering quality projects on time and within budget.

- Diversify your real estate portfolio by investing in different asset classes such as residential, commercial, retail or hospitality properties. This helps to minimize risk and maximize returns in the long run.

- Be prepared to negotiate hard for the best possible price and terms of purchase or lease agreement.

- Maintain good relationships with tenants or buyers by providing excellent customer service and timely maintenance services. This increases tenant retention rates and enhances property value over time.

- Stay updated on the latest market trends, regulations and tax implications affecting real estate investments in India.

By following these best practices for real estate investment success in India, you can make informed decisions that yield profitable returns while minimizing risks associated with this dynamic sector.

Case Studies: Real-Life Examples of Profitable Real Estate Investment Strategies

Real estate investment is all about finding the right property at the right price and then taking advantage of its appreciation over time. Case studies can provide valuable insights into what works and what doesn’t in real estate investment. To help investors understand how to identify profitable real estate deals in India, we have compiled a list of some successful case studies:

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Case Study 1:

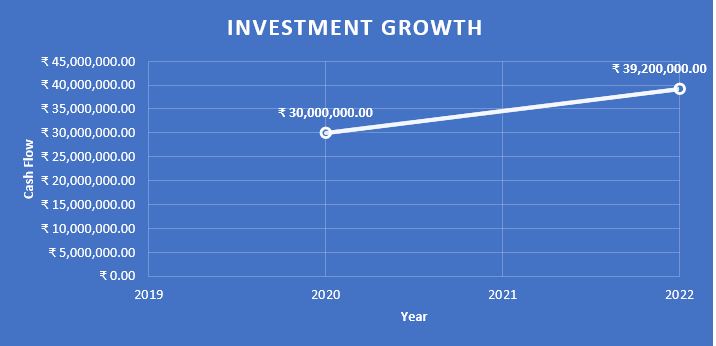

Mr. Gupta invested INR 3 crore in an upcoming residential project located in Bangalore’s outskirts in 2020. The project was launched by a reputable builder and promised luxury amenities such as a swimming pool, clubhouse, gymnasium, etc. Within two years, the project was completed and Mr. Gupta sold his flat for INR 4 crore, earning a pre-tax profit of INR 92 lakhs after deducting brokerage fee of 2%. This is almost 30% return on investment over a period of 2 years.

Case Study 2:

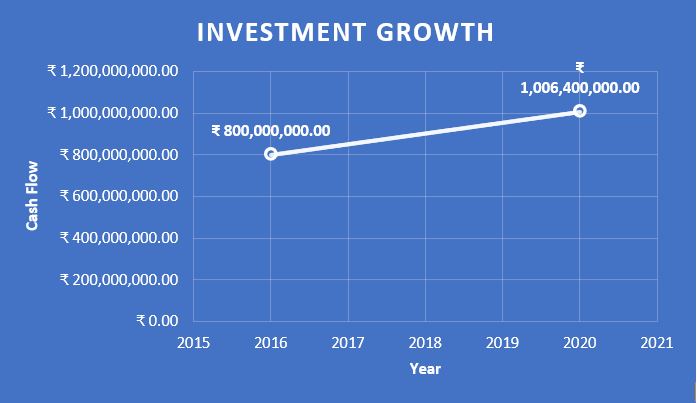

Ms. Mehta invested INR 80 Crore in a commercial property located on Mumbai’s prime business district in 2016. The property was leased to a multinational company for office purposes with an annual rental income of INR 64 lakhs. Over the next four years, the rental income increased every year due to inflation adjustments and market demand for office space. In late-2020 when Ms.Mehta sold her property for INR100 crore, apart from the regular income she enjoyed over the previous 4 years, she earned a pre-tax profit of INR 18 Crore after deducting brokerage fee of 2%. With a relatively higher investment, she could only make a CAGR of 6% which is significantly lower compared to what Mr. Gupta made in Case 1. This is primarily because when she sold the property, most of the companies were operating with their employees at home and hence the demand for commercial properties came down significantly.

Conclusion: The Future of Real Estate Investment in India

From the two case studies discussed above, it is quite evident that investing in real estate in India can be a highly profitable venture, provided that investors take the time to understand the market, identify trends and opportunities, and manage risks properly. At the end it is a game of supply and demand. Whether you will be making a profit as an investors completely depends upon the time you invest and the diversification you do while investing in this sector. Say, if Ms. Mehta would have diversified her investment of INR 80 Crore into multiple properties and both residential and commercial segment, the return would have been a lot different than that.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

With the regulatory framework becoming more robust and financing options expanding, it is an exciting time for real estate investment in India. By following best practices and learning from successful case studies, investors can achieve long-term returns on their investment and contribute to the growth of India’s vibrant economy. As always, due diligence is key when investing in any market, but with careful planning and research, real estate investment in India can be a rewarding experience for those willing to put in the effort.