Introduction:

Taxation can be a burden on hard-earned money, eating away at the returns from our investments. However, for intelligent investors seeking a way to minimize this burden and maximize their wealth, tax-free bonds in India present a lucrative opportunity. In this comprehensive guide on investing in tax-free bonds in India, we will break down the benefits and risks associated with these instruments, exploring their benefits, risks, and best practices to help you make informed investment decisions. When it comes to investing, it’s essential to be well-informed about different avenues that can potentially reduce your tax liabilities.

Tax-free bonds provide an avenue where you can earn interest income without having to pay any taxes on it. This unique feature makes them highly attractive for individuals in higher tax brackets who are looking to optimize their investment returns while minimizing their tax burden. We will also delve into best practices that can help you make wise investment choices and maximize your returns. So sit back, relax, and get ready to embark on a journey towards financial freedom through tax-free bond investments!

➤ Enquire now for CWM Program ➤ Download CWM Brochure

The Power of Tax-Free Bonds:

An Opportunity for Smart Investors

Tax-free bonds can be a game-changer for savvy investors, providing an exceptional opportunity to grow wealth while minimizing tax burdens. These bonds offer a unique advantage that sets them apart from other investment options available in the market. The primary allure lies in their tax-exempt status, which means that the interest earned from these bonds is entirely free from income tax. This distinctive feature allows investors to keep more of their hard-earned money and channel it towards achieving their financial goals.

Imagine the satisfaction of maximizing your investment returns without having to worry about paying hefty taxes on your earnings. Tax-free bonds not only provide a secure and reliable avenue for generating income, but they also serve as an efficient tool for preserving wealth over the long term. By intelligently leveraging this investment instrument, astute investors can protect their capital against inflationary pressures and build a solid financial foundation that will withstand the test of time.

Setting the Stage:

The Benefits of Investing in Tax-Free Bonds

Tax-free bonds, a popular investment avenue in India, offer a plethora of benefits that have enticed smart investors over the years. These financial instruments are issued by government-backed organizations and provide individuals with an opportunity to earn interest income that is exempt from tax. One of the key advantages of tax-free bonds is their ability to help you grow your wealth while ensuring steady income without the burden of taxes eating into your returns.

By making investments in tax-free bonds, not only do you enjoy attractive interest rates, but you also gain peace of mind knowing that the income generated from these investments is entirely tax-free. This unique feature allows investors to optimize their earnings by avoiding unnecessary tax obligations. Additionally, tax-free bonds provide stability to one’s investment portfolio as they are backed by reputable government entities and carry low credit risk.

Saving Taxes Made Easy:

Understanding the Basics of Tax-Free Bonds

When it comes to saving taxes, tax-free bonds are a golden opportunity for investors in India. These bonds, issued by government-backed entities and public-sector enterprises, offer the enticing advantage of providing tax-free returns to investors. But what exactly are tax-free bonds and how do they work?

Tax-free bonds are debt instruments that come with a unique advantage – the interest income earned from these bonds is exempt from income tax. This means that the returns you receive from investments in tax-free bonds will not be reduced by hefty taxes, allowing you to keep more of your hard-earned money. In addition, these bonds typically have longer tenures, offering investors a stable source of income over an extended period.

Generally, there are two types of tax-free bonds available. While tax-free bonds provide interest that is exempt from taxes, tax-saving bonds offer tax exemption on the initial investment. The former type offers higher interest payments as well.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

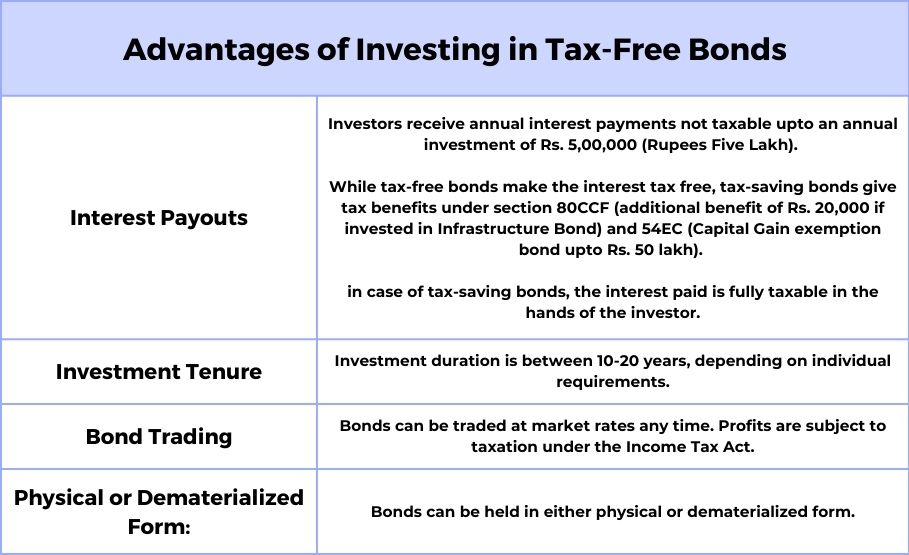

Investing in tax-free bonds provides the following advantages:

Interest payouts:

Investors receive annual interest payments that are not taxable upto an annual investment of Rs. 5,00,000 (Rupees Five Lakh). It is important to note here that While tax-free bonds make the interest tax free, tax saving bonds give you tax benefits for the investment amount under section 80CCF (additional benefit of Rs. 20,000 if invested in Infrastructure Bond) and 54EC (Capital Gain exemption bond upto Rs. 50 lakh). Remember, in case of tax-saving bonds, the interest that is paid is fully taxable in the hands of the investor.

Investment tenure:

The duration of the investment ranges from 10 to 20 years, depending on individual requirements.

Bond trading:

Bonds can be traded at any time based on prevailing market rates. However, profits from trading are subject to taxation under the Income Tax Act.

Physical or dematerialized form:

Bonds can be held in either physical or dematerialized form.

Apart from tax-free interest, tax-free bonds offer additional benefits:

Regular income:

Investing in these bonds ensures a guaranteed annual income that is tax-free, in addition to the principal amount returned upon maturity.

Safety:

Since tax-free bonds are issued by public entities or the government, the risk of default is relatively low.

Ease of trading:

Tax-free bonds are listed on the stock exchange, enabling convenient trading at market prices. The appreciation in bond prices can result in significant profits.

Higher profits for higher tax brackets:

Individuals in higher tax brackets, such as those in the 30% or above bracket, can earn greater returns from tax-free bonds. Additionally, there is no upper limit on the investment amount, allowing for higher returns and increased tax benefits.

Tax-free bonds are ideally suited for individuals with a low-risk tolerance or a preference for secure investments. Since these bonds are issued by government or financially sound companies, the associated risk is relatively lower. They are also suitable for individuals with long-term investment horizons. Before you invest in tax-free bonds, it is important to consider your financial requirements and need for liquidity.

Growing Your Wealth:

How Tax-Free Bonds Can Boost Your Investment Portfolio

Investing in tax-free bonds can be a smart move to enhance your investment portfolio and accelerate the growth of your wealth. These bonds, which come with attractive tax benefits, offer a unique opportunity for investors to generate stable income while minimizing their tax liabilities. By incorporating tax-free bonds into your investment strategy, you open up doors to financial prosperity and long-term security.

What sets tax-free bonds apart from other investment options is their exemption from income tax. This means that the interest earned on these bonds is entirely tax-free, allowing you to maximize your returns. Furthermore, these bonds typically have fixed interest rates, providing a predictable and steady stream of income over the bond’s tenure.

Navigating the Risks:

Potential Pitfalls to Consider

Tax-free bonds can offer numerous benefits, but it’s important to be aware of the potential pitfalls that come with any investment. One of the primary risks associated with tax-free bonds is interest rate risk. As these bonds are long-term investments, fluctuations in interest rates can have a significant impact on their market value. When interest rates rise, the value of existing bonds tends to decline, affecting your potential returns.

Another risk to consider is credit risk. While tax-free bonds are generally considered safe investments since they are issued by government entities, there is still a possibility of default. It’s crucial to thoroughly research and assess the creditworthiness of the issuing authority before investing in their bonds. Additionally, liquidity risk should not be overlooked. Selling tax-free bonds before maturity may present challenges as they may have lower trading volumes compared to other securities.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Assessing the Risk Factors:

Understanding the Potential Downsides of Investing in Tax-Free Bonds

While tax-free bonds offer numerous advantages to investors, it is crucial to assess the potential downsides and risks associated with these investments. One significant risk factor is interest rate fluctuations. As tax-free bonds typically have a fixed interest rate, changes in market rates can impact their attractiveness. If market rates rise significantly, new bonds may offer higher yields, making existing tax-free bonds less appealing.

Another risk to consider is liquidity. Tax-free bonds generally have a longer maturity period compared to other investment options. This means that investors may not be able to access their funds for an extended period until the bond matures. It is essential to evaluate your financial goals and determine if you can afford illiquid investments before committing to tax-free bonds.

Managing Your Expectations:

Realistic Returns and Market Volatility

When it comes to making investments in tax-free bonds, it is essential to manage your expectations and have a clear understanding of the potential returns and market volatility. While tax-free bonds offer attractive benefits, it is crucial not to fall prey to unrealistic expectations. Remember that investing is a long-term game, and patience is the key to success.

Realistic returns from tax-free bonds can vary depending on several factors, such as prevailing interest rates, credit ratings of the issuing entity, and the duration of the bond. Generally, tax-free bonds offer competitive interest rates compared to other fixed-income instruments available in the market. However, it is important to keep in mind that these returns are often lower than the historical performance of riskier assets like equities.

Market volatility can also impact tax-free bond prices. During periods of economic uncertainty or changing interest rate scenarios, bond prices may fluctuate. However, as an astute investor, you should focus on the long-term benefits of holding tax-free bonds rather than short-term market fluctuations. Remember that these investments offer stability and consistent income over time.

To navigate market volatility successfully, consider maintaining a diversified portfolio with a mix of different asset classes. This approach helps mitigate risks and ensures that your investment portfolio remains resilient even during unpredictable market conditions.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Best Practices:

Maximizing Your Investment Potential

When it comes to investing in tax-free bonds, following a set of best practices can significantly enhance your investment potential.

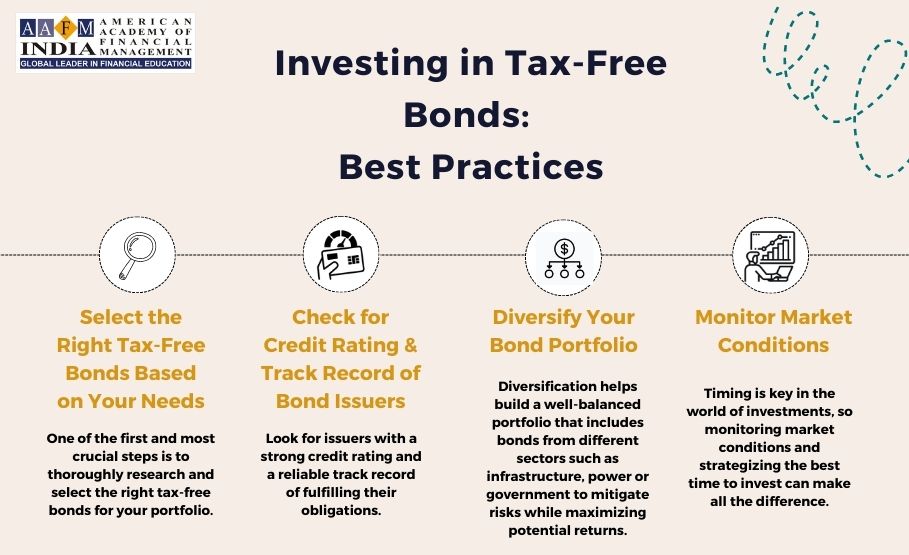

Select the Right Tax-Free Bonds Based on Your Needs

One of the first and most crucial steps is to thoroughly research and select the right tax-free bonds for your portfolio.

Check for Credit Rating & Track Record of Bond Issuers

Look for issuers with a strong credit rating and a reliable track record of fulfilling their obligations.

Diversify Your Bond Portfolio

Diversification is essential in any investment strategy, and tax-free bonds are no exception. Building a well-balanced portfolio that includes bonds from different sectors such as infrastructure, power, or government can help mitigate risks while maximizing potential returns.

Monitor Market Conditions

It’s important to note that timing is key in the world of investments, so monitoring market conditions and strategizing the best time to invest can make all the difference.

Finding success with tax-free bond investments isn’t solely about numbers; it’s also about learning from others’ experiences. Seek out inspiring stories from individuals whose financial futures were transformed by tax-free bonds. Additionally, gather insights and tips from successful investors who have navigated this terrain before you. Their expertise can provide valuable guidance on making informed decisions and avoiding common pitfalls.

Doing Your Homework:

Researching and Selecting the Right Tax-Free Bonds

When it comes to tax-free bonds, thorough research and careful selection are indispensable. To make informed decisions and maximize your investment potential, you must delve into the world of tax-free bonds with a curious mind and meticulous attention to detail.

Begin by understanding the issuer of the bond. Research their financial stability, track record, and credit rating. A well-established entity with a strong credit rating is more likely to honour its obligations. Furthermore, analyze the terms and conditions of each bond, such as its coupon rate, maturity period, call option features, and any potential tax implications. Comparing different options will help you identify bonds that align with your investment goals while considering your risk tolerance.

Diversify and Thrive:

Building a Well-Balanced Portfolio for Optimal Results

In the world of investing, diversification is often touted as a crucial strategy for minimizing risk and maximizing returns. This principle holds true when it comes to investing in tax-free bonds in India as well. Building a well-balanced portfolio that includes tax-free bonds alongside other investment instruments can help you achieve optimal results.

When constructing your portfolio, it’s wise to consider your risk tolerance, investment goals, and time horizon. Diversifying across different asset classes such as equities, fixed deposits, mutual funds, and tax-free bonds can spread out your risk exposure while providing potential for higher returns. By diversifying intelligently, you can create a safety net that cushions the impact of market fluctuations while capitalizing on the stability and tax advantages offered by tax-free bonds.

List of Tax-Free Bonds in India

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Timing is Key:

Strategizing the Best Time to Invest in Tax-Free Bonds

Timing plays a crucial role in maximizing your returns from tax-free bonds. The bond market is subject to various factors that can influence the yield and price of tax-free bonds. Therefore, strategizing the best time to enter the market can significantly impact your investment outcome.

One key aspect to consider is interest rate movements. As tax-free bonds are fixed-income securities, changes in interest rates can directly affect their attractiveness. Typically, when interest rates are high, bond prices tend to decline due to the inverse relationship between yields and prices. Conversely, when interest rates are low, bond prices rise as investors flock towards safer investments like tax-free bonds.

The economic landscape also plays a vital role in determining the ideal time for investment. Keeping an eye on economic indicators such as GDP growth, inflation rate, and government policies helps identify favourable conditions for tax-free bond investments. During periods of economic stability and growth, demand for tax-free bonds tends to be higher due to increased investor confidence.

Moreover, monitoring market trends and analysing historical data can provide valuable insights into potential patterns or seasonal variations that could influence bond prices. For example, there may be periods were demand for tax-free bonds spikes due to certain events like upcoming infrastructure projects or changes in government regulations.

While timing is certainly important when investing in tax-free bonds, it’s essential not to rely solely on short-term fluctuations. Taking a long-term perspective is equally crucial as it allows you to benefit from compounding returns over time and ride out temporary market volatility effectively.

Success Stories:

Real-Life Experiences and Tips

Within the realm of tax-free bond investing, numerous success stories have emerged, inspiring both novice and seasoned investors to explore this lucrative opportunity. One such tale revolves around Mr. Sharma, a diligent investor who, after carefully researching tax-free bonds and diversifying his portfolio, witnessed substantial growth in his wealth. By strategically timing his investments and aligning them with his long-term financial goals, Mr. Sharma not only enjoyed tax-free returns but also found himself on a path to financial freedom.

Another noteworthy account comes from Ms. Kapoor, who decided to invest her savings in tax-free bonds as a means of securing a stable income stream during her retirement years. With astute planning and prudent asset allocation, she was able to generate consistent tax-exempt passive income. The peace of mind that came with knowing her financial future was secure allowed her to pursue her passions and enjoy retirement to the fullest.

Inspiring Stories:

How Tax-Free Bonds Transformed Financial Futures

Within the realm of tax-free bonds lies a tapestry of inspiring stories that illuminate the transformative power of smart investment choices. Countless individuals from diverse backgrounds have experienced a remarkable change in their financial fortunes, all thanks to their astute decisions to invest in tax-free bonds. These stories serve as an embodiment of hope, showcasing how ordinary people can achieve extraordinary success.

One such story revolves around Mr. Sharma, a retired schoolteacher who had diligently saved throughout his career but struggled to find avenues for his hard-earned money to grow securely. However, upon discovering tax-free bonds, Mr. Sharma’s financial landscape transformed dramatically. Through careful research and expert guidance, he invested in a series of tax-free bond issuances, ensuring stable income and substantial savings on taxes for years to come. This newfound financial stability allowed him not only to fulfil his dreams of traveling the world but also support causes close to his heart by contributing generously towards education scholarships.

Expert Insights and Tips:

Advice from Successful Tax-Free Bond Investors

In the world of tax-free bond investments, wisdom can be found in the experiences of those who have achieved success. Seasoned investors know that patience and a long-term perspective are crucial for reaping the rewards of investing in tax-free bonds. One such investor, Mr. Sharma, shares his insights: “Diversification is key. By investing in a variety of tax-free bonds across different sectors, you can spread your risk and increase your chances of earning consistent returns.”

Another expert in this realm, Ms. Khan, emphasizes the importance of staying informed about market trends: “Keep an eye on interest rate movements and economic factors that impact bond yields. This knowledge will empower you to make informed investment decisions and take advantage of favourable market conditions.” She also advises starting early: “The power of compounding is tremendous when it comes to tax-free bonds. The sooner you start investing, the more time your investments have to grow.”

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

Making investments in tax-free bonds in India can be a wise and beneficial choice for savvy investors. The numerous advantages, such as tax savings, fixed returns, and safety make them an attractive option for those seeking stable growth and income. While it is important to be aware of the associated risks and market volatility, with proper research, diversification, and strategic timing, investors can maximize their returns. By embracing the power of tax-free bonds and taking proactive steps to build a well-balanced portfolio, individuals can set themselves up for a financially secure future. So why wait? Seize this opportunity to transform your financial outlook and embark on a path towards greater prosperity today.

Embracing the Power of Tax-Free Bonds: Take Action and Transform Your Financial Future

Now that you have delved into the intricate world of tax-free bonds, it’s time to harness their power and take control of your financial future. Embracing tax-free bonds is not just about saving taxes; it’s about embarking on a journey towards financial freedom and security. By investing in tax-free bonds, you are choosing a path that can lead to substantial wealth accumulation and a stress-free retirement.

Imagine a future where your investments generate consistent tax-free income, providing you with peace of mind and allowing you to pursue your dreams without financial constraints. Tax-free bonds offer an exceptional opportunity to achieve this reality. By carefully selecting the right bonds, diversifying your portfolio, and timing your investments strategically, you can make significant strides towards building long-term wealth. So don’t hesitate – take action today and transform your financial future with the power of tax-free bonds.

Good and very informative

Thanks

Bond Market is less explored than the equity market, However, the article explains lots of factors of investing in bonds, and it’s very informative. If it would have covered yield calculation it would of great help

Thank you for taking the time to read our article on the bond market. We truly appreciate your interest and are glad to hear that you found it informative. Your feedback is valuable to us, and we take note of your suggestion to include yield calculation in future articles.