Discover the Benefits, Types, and Strategies to Grow Your Wealth with Mutual Funds

Understanding Mutual Funds – Types, Benefits, and How to Choose?

Introduction

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets. It is managed by a professional fund manager or a team of managers who make investment decisions on behalf of the investors. Mutual funds have gained popularity among a wide range of investors, from affluents to the general mass, over the past couple of decades.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Basics of Mutual Funds

Structure

Mutual funds are typically structured as open-ended investment companies that issue an unlimited number of shares to investors. Investors can buy or sell shares at the fund’s net asset value (NAV), which is calculated at the end of each trading day. Some mutual fund schemes may also be close ended, which means they have a fixed number of shares and a specified maturity period.

Diversification

Mutual funds offer diversification by investing in a variety of securities. They spread investments across different asset classes, industries, and geographies to reduce risk and potentially enhance returns. This diversification helps in minimizing the impact of any individual security’s performance on the overall portfolio.

Professional Management

Mutual funds are managed by professional fund managers who have expertise in analyzing investment opportunities, making buy/sell decisions, and monitoring the portfolio. Fund managers select securities and adjust the portfolio to align with the fund’s investment objectives. Their expertise and knowledge play a crucial role in managing the fund effectively.

Investment Objectives

Each mutual fund has specific investment objectives that determine the types of securities the fund can invest in. For example, some funds focus on growth by investing in stocks of companies with high potential for capital appreciation. Other funds may focus on income by investing in bonds or dividend-paying stocks. It’s important for investors to understand a fund’s investment objectives and ensure they align with their own investment goals.

Risk and Return

Mutual funds carry varying levels of risk, depending on their investment strategies and asset allocation. Generally, funds with higher potential returns tend to have higher risk. Investors should carefully assess their risk tolerance and investment goals before choosing a mutual fund. It’s crucial to understand that all investments come with a certain level of risk, and past performance is not indicative of future results.

Fees and Expenses

Asset management companies managing mutual funds charge fees and expenses to cover operational costs, management fees, and other expenses. These fees can include sales loads (charges when buying or selling shares), annual management fees (typically a percentage of assets under management), and other administrative expenses. It’s important for investors to understand the fee structure and compare costs when selecting a mutual fund, as fees can significantly impact investment returns over time.

Performance and Returns

Mutual funds’ performance is measured by their returns, which can fluctuate over time. Funds report their performance in terms of total returns, which include both capital gains (or losses) and dividends or interest income generated by the fund’s holdings. Investors should review a fund’s historical performance and compare it to appropriate benchmarks to assess its track record.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Distribution of Earnings

Mutual funds may distribute earnings to investors in the form of dividends or capital gains. Dividends are typically paid by income-focused funds, while capital gains may result from the sale of securities at a profit. Investors can choose to reinvest distributions or receive them in cash, depending on their preferences.

Accessibility

Mutual funds are widely accessible to individual investors through various channels, such as banks, brokerage firms, independent financial advisors (IFAs), or directly from fund companies. The minimum investment requirements can vary depending on the fund. Some funds have lower minimum investment thresholds, making them accessible to a broader range of investors.

Regulatory Oversight

Mutual funds are subject to regulation by securities regulators, such as the Securities and Exchange Board of India (SEBI). Regulatory oversight aims to protect investors and ensure that fund managers operate within certain guidelines. It’s important for investors to invest in funds that are regulated and comply with the necessary regulations to safeguard their interests.

It’s important to conduct thorough research and consider your investment goals, risk tolerance, and time horizons before investing in mutual funds. Reading the fund’s prospectus, which contains essential information about the fund’s investment strategy, risks, and fees, is crucial for making informed investment decisions. Consulting with a financial advisor can also provide valuable guidance tailored to your specific financial situation.

Mutual Funds: Types

Types of Mutual Funds

In India, mutual funds are available in various types to cater to different investment needs and objectives. Here are some common types of mutual funds:

Equity Funds:

These funds primarily invest in stocks/shares of companies and aim for long-term capital appreciation. They can be further categorized as large-cap funds, mid-cap funds, small-cap funds, multi-cap funds, sector-specific funds, and thematic funds.

Debt Funds:

Debt funds invest in fixed-income securities such as government bonds, corporate bonds, and treasury bills. They focus on generating regular income and are considered relatively less risky than equity funds. Debt funds can include liquid funds, short-term funds, long-term funds, gilt funds, corporate bond funds, and dynamic bond funds.

Balanced/Hybrid Funds:

These funds invest in a mix of equities and fixed-income instruments, aiming to provide both capital appreciation and income generation. Balanced funds have a predetermined asset allocation, with variations like aggressive hybrid funds, conservative hybrid funds, and balanced advantage funds.

Index Funds:

Index funds aim to replicate the performance of a specific stock market index, such as the Nifty 50 or the Sensex. They invest in the same securities and in the same proportion as the index they track. Index funds are passively managed and have lower expense ratios compared to actively managed funds.

Tax-saving Funds (ELSS):

Equity Linked Savings Schemes (ELSS) are tax-saving mutual funds that offer tax benefits under Section 80C of the Income Tax Act. ELSS funds primarily invest in equities and have a lock-in period of three years. They have the potential for long-term capital appreciation along with tax benefits.

Money Market Funds:

Money market funds invest in short-term, low-risk instruments such as Treasury Bills, Commercial Papers, and Certificates of Deposit. They aim to provide liquidity and preserve capital.

Fund of Funds (FoFs):

Fund of Funds invest in other mutual funds, providing diversification by investing in a mix of mutual funds across different asset classes, including equity funds, debt funds, and international funds.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Benefits of Mutual Funds

Investing in mutual funds in India offers several benefits for investors:

Professional Management:

Mutual funds are managed by experienced and qualified fund managers who make informed investment decisions on behalf of investors. Their expertise can potentially lead to better investment outcomes compared to individual investors.

Diversification:

Mutual funds offer diversification by investing in a wide range of securities across different asset classes, sectors, and geographies. Diversification helps reduce the risk of concentration in a single security and spreads the investment across multiple assets.

Accessibility and Affordability:

Mutual funds are easily accessible to individual investors with low minimum investment requirements. They provide the convenience of systematic investment plans (SIPs), allowing investors to invest small amounts regularly.

Liquidity:

Mutual funds in India are open-ended, allowing investors to buy or sell units at the prevailing Net Asset Value (NAV) on any business day. This provides liquidity and flexibility to enter or exit investments as per the investor’s needs.

Regulatory Oversight and Investor Protection:

Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency, fair practices, and disclosure of relevant information. Regulatory oversight protects the interests of investors and promotes investor confidence.

Tax Efficiency:

Certain mutual funds in India, such as Equity Linked Savings Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act. Investments in ELSS funds are eligible for deductions up to a specified limit, providing potential tax savings. Additionally, mutual funds allow investors to benefit from indexation for long-term capital gains tax on debt funds, which can help reduce the tax liability.

Flexibility and Variety:

Mutual funds in India offer a wide variety of investment options to suit different investor preferences and goals. Investors can choose from equity funds, debt funds, balanced funds, sector-specific funds, index funds, and more. This allows investors to align their investments with their risk appetite, investment horizon, and financial goals.

Transparency and Information:

Mutual funds provide investors with regular updates on their investments. Fund houses publish factsheets, monthly/quarterly reports, and annual reports that contain information on the fund’s holdings, performance, expenses, and investment strategy. This transparency enables investors to make informed decisions based on reliable information.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

How to choose a Mutual Fund Scheme for investment?

Now let us understand how to choose a mutual fund scheme for investing. It requires careful consideration of several factors and is often considered as a puzzle. We will be solving this puzzle through the following steps.

Set Investment Goals

First you need to set your investment goals. Clearly define your investment goals, such as wealth creation, retirement planning, saving for a specific purpose, or generating regular income. Your investment goals will determine the type of mutual fund and investment strategy that aligns with your objectives.

Assess Risk Tolerance

Evaluate your risk tolerance, which refers to your comfort level with fluctuations in the value of your investments. Consider factors such as your age, financial responsibilities, investment timeline, and previous investment experience. Investors with a higher risk tolerance may opt for equity funds, while those with a lower risk tolerance may prefer debt funds.

Determine Investment Horizon

Determine the time period for which you are willing to stay invested in the mutual fund. Investment horizons can vary from short-term (less than 3 years) to medium-term (3-5 years) or long-term (5+ years). Longer investment horizons are generally associated with higher-risk investments, such as equity funds.

Research Fund Categories

Familiarize yourself with different types of mutual funds, such as equity funds, debt funds, hybrid funds, index funds, and sector-specific funds. Understand their investment objectives, asset allocation, and risk-return profiles. Each fund category serves different investment purposes, so choose the category that aligns with your goals and risk profile.

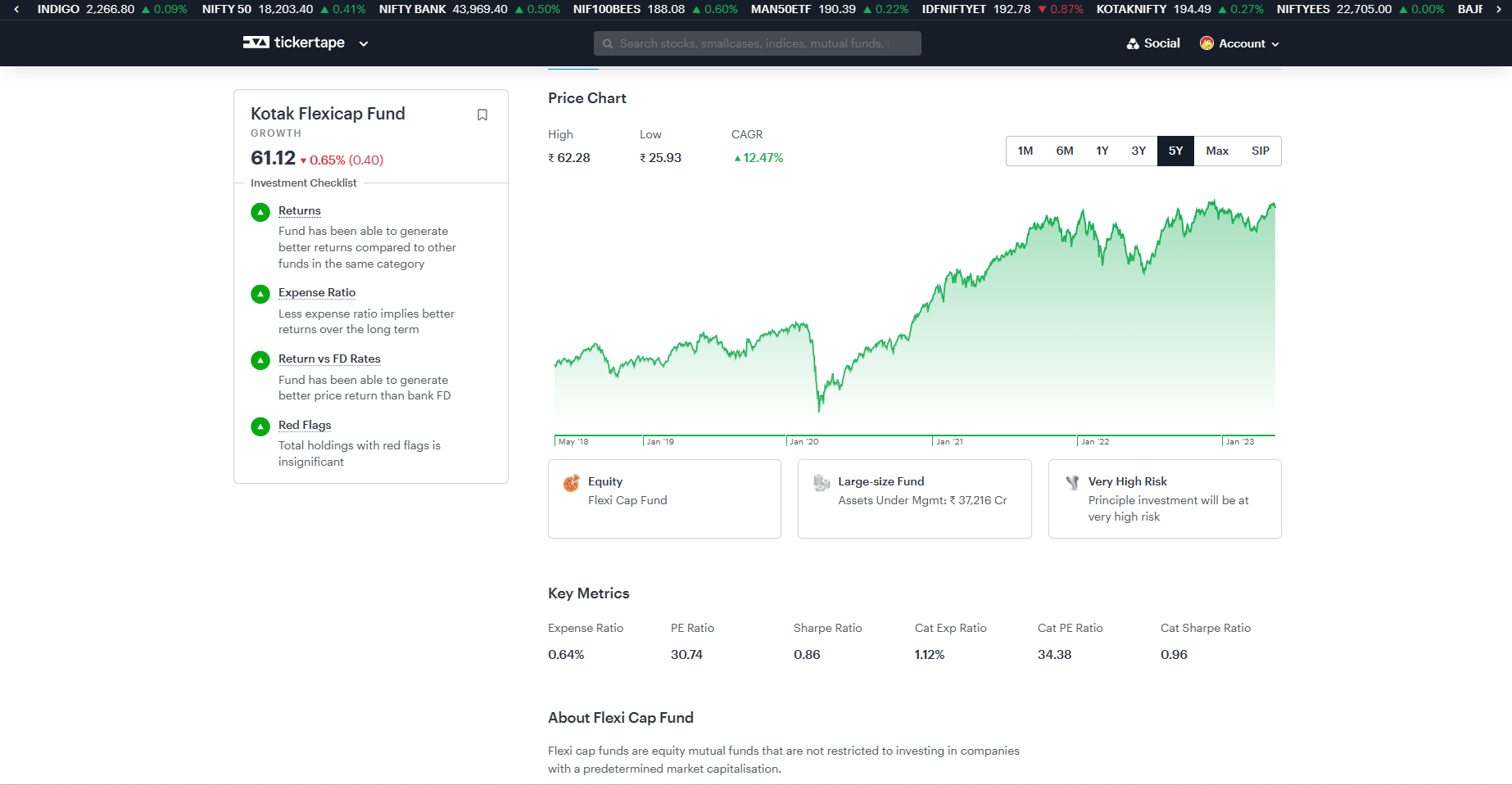

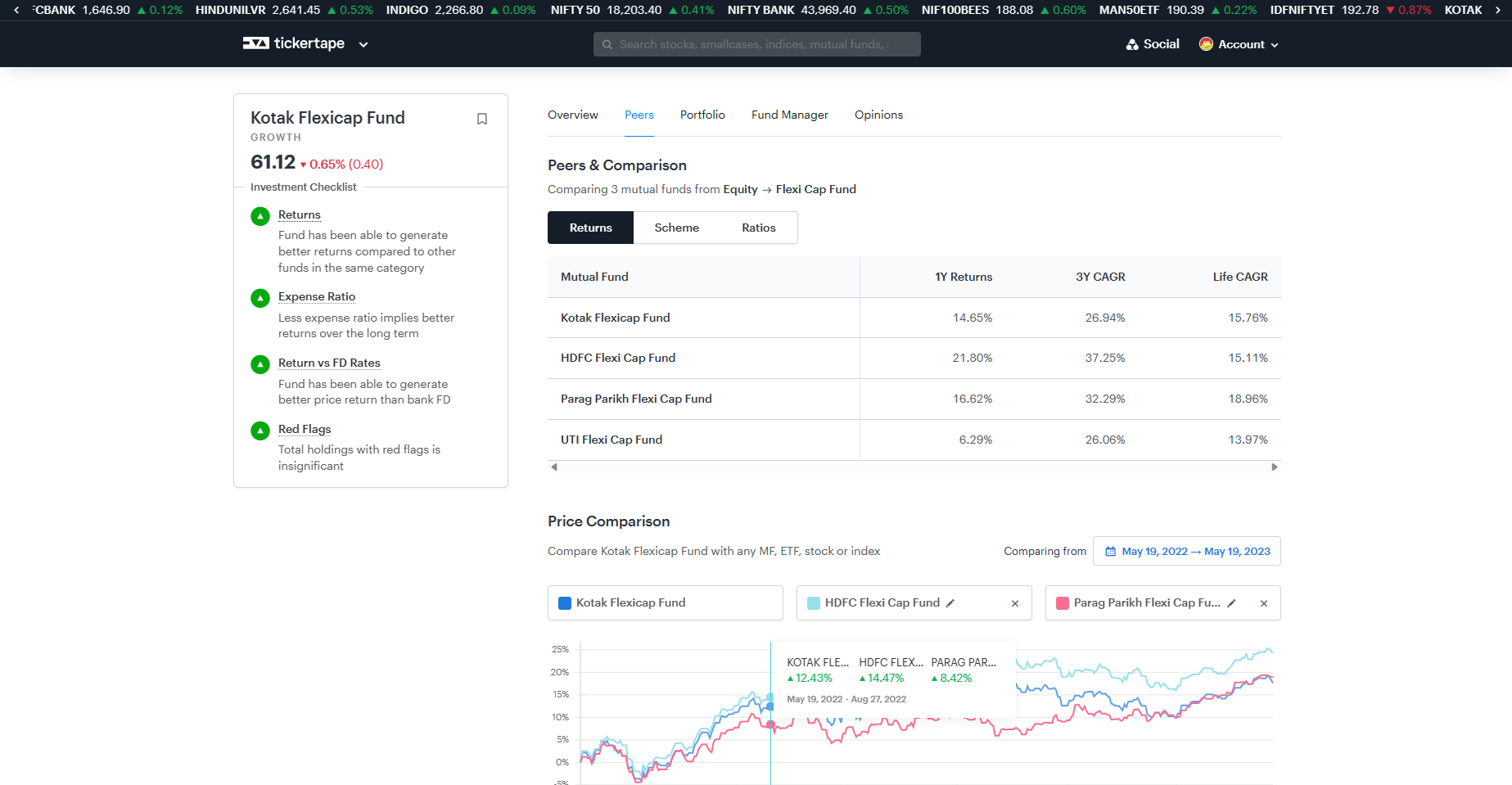

Analyse Performance

Review the historical performance of mutual funds within your preferred category. Consider factors such as returns over different time periods (1 year, 3 years, 5 years, and since inception), consistency of performance, and how the fund has performed in different market cycles. Compare the fund’s performance with its benchmark index and peer group to assess its relative performance.

Fund Manager’s Track Record

Evaluate the track record and expertise of the fund manager. Look for consistency in delivering good investment performance and their ability to align the fund’s strategy with its stated objectives. A skilled and experienced fund manager can play a crucial role in achieving favourable investment outcomes.

Fund House Reputation

Consider the reputation and credibility of the mutual fund house. Look for fund houses with a strong track record, established presence in the industry, robust investment processes, and adherence to regulatory guidelines. A well-managed fund house can provide stability and reliability in managing your investments.

Expense Ratio

Compare the expense ratios of different mutual funds. The expense ratio is the annual fee charged by the mutual fund company to cover expenses such as fund management fees, administrative costs, and other operating expenses. Lower expense ratios can have a positive impact on your investment returns over the long term.

Fund Size and Liquidity

Assess the size of the mutual fund. While size alone is not an indicator of performance, larger funds may offer advantages such as better liquidity, efficient management, and access to a broader range of investment opportunities. Additionally, check the fund’s liquidity to ensure that you can easily buy or sell units when needed.

Read the Fund’s Offer Document

Carefully read the mutual fund’s offer document, which includes the scheme’s investment objective, asset allocation, risk factors, expense structure, and other relevant information. Pay attention to any potential risks, fees, and charges associated with the fund.

Seek Professional Advice if Needed.

If you feel overwhelmed or unsure about selecting mutual fund schemes, consider seeking advice from a qualified financial advisor who can assess your financial situation, goals, and risk tolerance to provide personalized guidance.

With the advancement of FinTech, today we have numerous tools to available mostly free of cost or at a nominal premium to execute and monitor mutual fund investments. There are tools available to check the portfolio overlap between two schemes. These tools need to be used in the process of fund selection and monitoring.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Let’s take examples of how to select funds in a Flexi Cap category.

Let’s say you have decided to invest in Kotak Flexi Cap as your investment horizon and risk tolerance levels are aligned with this fund. Now before you make your final decision, you need to look at some of the parameters related to the scheme.

First take a look at how the fund is performing compared to its peers.

Then you take a look at the person who will be managing the fund.

Finally, you look at whether the fund manager is qualified enough to be trusted with your investment and how is he performing compared to his peers and what kind of portfolio mix is he offering in the scheme.

Historical Phases of Mutual Funds in India

Phase I: 1964-1987

The Mutual Fund (MF) industry in India started in 1963 with the formation of UTI (Unit Trust of India) in 1963 by an Act of Parliament.

UTI functioned under the regulatory and administrative control of the Reserve Bank of India (RBI) until 1978 when it was de-linked from the RBI, and the Industrial Development Bank of India (IDBI) took over regulatory control.

In 1964, UTI launched its first scheme called US’64 (Unit Scheme 1964).

By the end of 1988, UTI had INR 6,700 Crores of Assets Under Management (AUM).

Phase II: 1987-1993

In 1987, public sector mutual funds entered the market.

SBI MF (SBI Mutual Fund) was the first non-UTI mutual fund established in June 1987, followed by other public sector banks.

By the end of 1993, the industry AUM grew to INR 47,000 Crores.

Phase III: 1993-2003

The establishment of SEBI (Securities and Exchange Board of India) in April 1992 brought greater importance to the Indian Securities market and regulated the mutual fund industry.

By 1996, a new era of mutual funds began in India with comprehensive regulations.

The number of funds grew, giving investors a range of options to choose from.

By the end of 2003, 33 mutual funds were managing a total asset of INR 1,21,805 Crores.

Phase IV: 2003-2014

This phase started with the bifurcation of UTI.

After a quick sprint of the equity market between 2003 and 2008, the Global Financial Crisis (GFC) hit the world economy.

Many investors who entered during the peak of the market in late 2007 lost money and faith in mutual funds, resulting in a decline in popularity.

The abolition of Entry load by SEBI and the after-effects of the GFC, along with the taper tantrum in 2012, further impacted the Indian mutual fund industry, leading to sluggish growth until 2013.

Phase V: Since May 2014

Since May 2014, the mutual fund industry in India witnessed steady inflows due to steady governance and inflows in the capital market.

This resulted in an increase in AUM and investor folios.

The industry crossed milestones such as INR 10 Lakh Crore on 31st May 2014, INR 20 Lakh Crore in August 2017, and INR 30 Lakh Crore in November 2020.

As of 30th April 2023, the AUM reached INR 41.62 Lakh Crore, more than 5 times the AUM on 30th April 2013.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

Mutual funds in India offer a range of investment options to suit different investor needs and objectives. Whether you are seeking capital appreciation, regular income, tax savings, or diversification, there is likely a mutual fund that can align with your goals. With professional management, diversification, accessibility, liquidity, regulatory oversight, tax efficiency, flexibility, and transparency, mutual funds provide numerous benefits to investors.

However, it’s crucial to remember that investing in mutual funds carries risks, and it’s important to carefully assess your risk tolerance and conduct thorough research before making investment decisions. Consider factors such as investment goals, risk tolerance, time horizon, fund performance, expense ratios, and the expertise of the fund manager.

By evaluating these factors and seeking professional advice when needed, you can make informed decisions and build a well-rounded investment portfolio. Regular monitoring of your investments and adjusting them as per your changing circumstances is also essential. Remember, investing in mutual funds is a long-term commitment, and patience and discipline are key to achieving your financial goals.

FAQ on Mutual Funds

Q: What are the 4 types of mutual funds?

A: The four types of mutual funds commonly found in India are:

Equity Funds: These funds primarily invest in stocks/shares of companies.

Debt Funds: Debt funds invest in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

Balanced/Hybrid Funds: These funds invest in a mix of equities and fixed-income instruments.

Money Market Funds: Money market funds invest in short-term, low-risk instruments like Treasury Bills and Commercial Papers.

Q: Can I invest 1000 Rs in a mutual fund?

A: Yes, you can invest as little as Rs. 1,000 in some mutual funds. Certain funds have minimum investment requirements, and it’s important to check the specific fund’s minimum investment criteria.

Q: What are the top 3 mutual funds?

A: The top mutual funds can vary based on various factors such as investment goals, risk appetite, and time horizon. It’s essential to consider your personal investment objectives before identifying the top mutual funds. It’s recommended to research and consult with a financial advisor to determine the best funds for your specific needs.

Q: What is the full form of NAV?

A: NAV stands for Net Asset Value. It represents the per-unit value of a mutual fund scheme’s assets minus its liabilities. NAV is calculated at the end of each business day and is used to determine the purchase and redemption price of mutual fund units.

Q: What is SIP in mutual funds?

A: SIP stands for Systematic Investment Plan. It is an investment method in which an individual regularly invests a fixed amount of money at predetermined intervals (such as monthly or quarterly) into a mutual fund scheme. SIPs offer the advantage of rupee-cost averaging and disciplined investing, allowing investors to benefit from the power of compounding over the long term.

Q: How to make 1 crore in 5 years?

A: Making 1 crore in 5 years through mutual fund investments would require a substantial rate of return and a significant investment amount. However, it’s important to note that such high return expectations come with increased risk. It is advisable to consult with a financial advisor who can assess your financial situation and provide personalized guidance on suitable investment strategies to help you achieve your goal.

Q: Which SIP is best for 1 year?

A: Selecting the best SIP for a one-year investment horizon depends on various factors such as risk tolerance, investment goals, and market conditions. Generally, short-term debt funds or liquid funds are suitable for a one-year investment period as they aim to provide stability and liquidity. It is advisable to research different mutual funds, consider their historical performance, expense ratios, and consult with a financial advisor to identify the best SIP option for your specific needs.

Q: What is SIP 5000 per month for 20 years?

A: SIP of 5000 per month for 20 years refers to investing 5000 rupees every month in a mutual fund scheme for a period of 20 years. The power of compounding can potentially generate significant wealth over the long term. However, the actual returns will depend on the performance of the chosen mutual fund and market conditions. It’s advisable to select mutual funds that align with your investment goals, risk profile, and seek professional advice if needed.

Q: Which is the safest mutual fund?

A: Mutual funds carry varying degrees of risk depending on the type of funds they invest in. Generally, debt funds, especially those investing in high-quality government securities or highly rated corporate bonds, are considered relatively safer than equity funds. However, it’s important to note that all investments carry some level of risk, and it’s advisable to diversify your investments across different asset classes to manage risk effectively. Conduct thorough research, consider your risk tolerance, and consult with a financial advisor to determine the safest mutual funds suitable for your investment objectives.

Q: Which type of MF gives the highest return?

A: Equity funds, particularly those focusing on small-cap or mid-cap stocks, have the potential to provide higher returns over the long term. However, equity investments come with higher market risk. It’s important to note that past performance is not indicative of future returns, and selecting mutual funds should be based on a combination of factors such as risk tolerance, investment horizon, and financial goals. A balanced approach to investing, diversification, and professional guidance can help in achieving the desired investment returns.

Q: Which bank mutual fund is best?

A: The selection of the best bank mutual fund depends on various factors such as fund performance, investment philosophy, fund manager expertise, and expense ratios. It’s important to conduct thorough research and compare different mutual funds offered by various banks. Consider factors such as historical performance, consistency, investment strategy, and aligning the fund’s objectives with your investment goals. Additionally, consulting with a financial advisor can provide valuable insights and help you make an informed decision based on your individual circumstances.