Introduction:

Are you looking for ways to grow your wealth with minimal risk? One option that may interest you is investing in the debt market. While the stock market tends to get more attention, navigating the Indian debt market offers plenty of opportunities for savvy investors. However, this complex landscape can present a few challenges without a solid understanding of government bonds, corporate bonds, and debentures.

In this article, we will take a comprehensive look at the Indian debt market and explore how you can make informed investment decisions. We will start by breaking down each type of investment vehicle and discussing their benefits and risks. From there, we will provide tips on evaluating investments based on yield and risk before closing with advice on when to sell and exit the market.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding Bonds and Debentures

In the world of finance, bonds and debentures are the two most common types of fixed-income securities. Both bonds and debentures involve lending money to a borrower for a fixed period with the promise of receiving interest payments at regular intervals. Bonds are issued by governments or corporations, while debentures are unsecured loans issued by corporations.

Bonds are generally considered to be less risky than stocks as they provide a steady income stream with predictable returns. Debentures, on the other hand, carry more risk as they are unsecured loans and do not offer collateral to protect investors if the issuer defaults on its payments.

Despite their differences, both bonds and debentures serve as important investment options in today’s financial market. Understanding how these securities work is crucial in making informed investment decisions that can help you achieve your financial goals.

Types of Government Bonds in India

The Indian government issues several types of bonds that are available to investors. These include:

Treasury bills (T-bills): Short-term debt instruments with maturities ranging from 91 days to one year. They are issued at a discount to their face value and redeemed at par on maturity.

Government bonds: Long-term debt instruments with maturities ranging from 5 years to 40 years. These bonds pay a fixed rate of interest every year, and the principal is repaid on maturity.

Inflation-indexed bonds: These bonds are designed to protect investors against inflation. The principal amount is adjusted for inflation every six months, and interest payments are made twice a year based on the adjusted principal.

Sovereign Gold Bonds: Issued by the Reserve Bank of India, these bonds allow investors to invest in gold without physically owning it. The investment is denominated in grams of gold, and the bond’s price tracks the price of gold. This investment comes with a tax advantage if held till its maturity, when the entire capital gain gets exempted from tax.

State Development Loans: These are long-term debt instruments issued by the state governments to borrow for one year or more.

Investing in government bonds can be a safe option for conservative investors who might find it difficult navigating the Indian debt market and want stable returns without taking on too much risk. Government-backed securities have low credit risk since they are backed by the full faith and credit of the Indian government. Moreover, they offer higher returns than bank deposits but with lower risks than stock market investments.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Benefits of Investing in Government Bonds

Investing in government bonds can offer several benefits to investors.

Firstly, they are considered one of the safest investments as they are issued and backed by the government itself. This means that investors are unlikely to face defaults or credit risks when investing their money into government bonds.

Another significant advantage of investing in government bonds is that they offer fixed returns on investment. The predictability of returns can be incredibly beneficial for individuals who seek a stable source of income and want to minimize the uncertainty that comes with other types of investments.

Government bonds also provide excellent liquidity compared to other types of debt instruments, which means it is easy for investors to purchase or sell them as needed. In addition, these bonds usually have a longer maturity period, which makes them an ideal investment option for people looking for long-term financial planning.

If you’re looking for a low-risk investment with predictable returns and significant tax benefits, then considering investing in Indian Government Bonds might be an excellent choice. The Reserve Bank of India offers a direct opportunity for retail investors to buy Government securities through its dedicated portal RBI Retail Direct. This initiative opened up an opportunity for informed retail investors to transact directly with government, thus bypassing the hassles of intermediation.

However, it is important to note the word “informed” in the previous sentence, as bond investment is a more sophisticated investment tool compared to equity. An understanding of interest rate cycle and macroeconomic data is extremely important to make the right choice. While it may be offering a fixed income and return of principal if held till maturity, but with volatility in interest rate, the bond pricing will go through interim volatility as well.

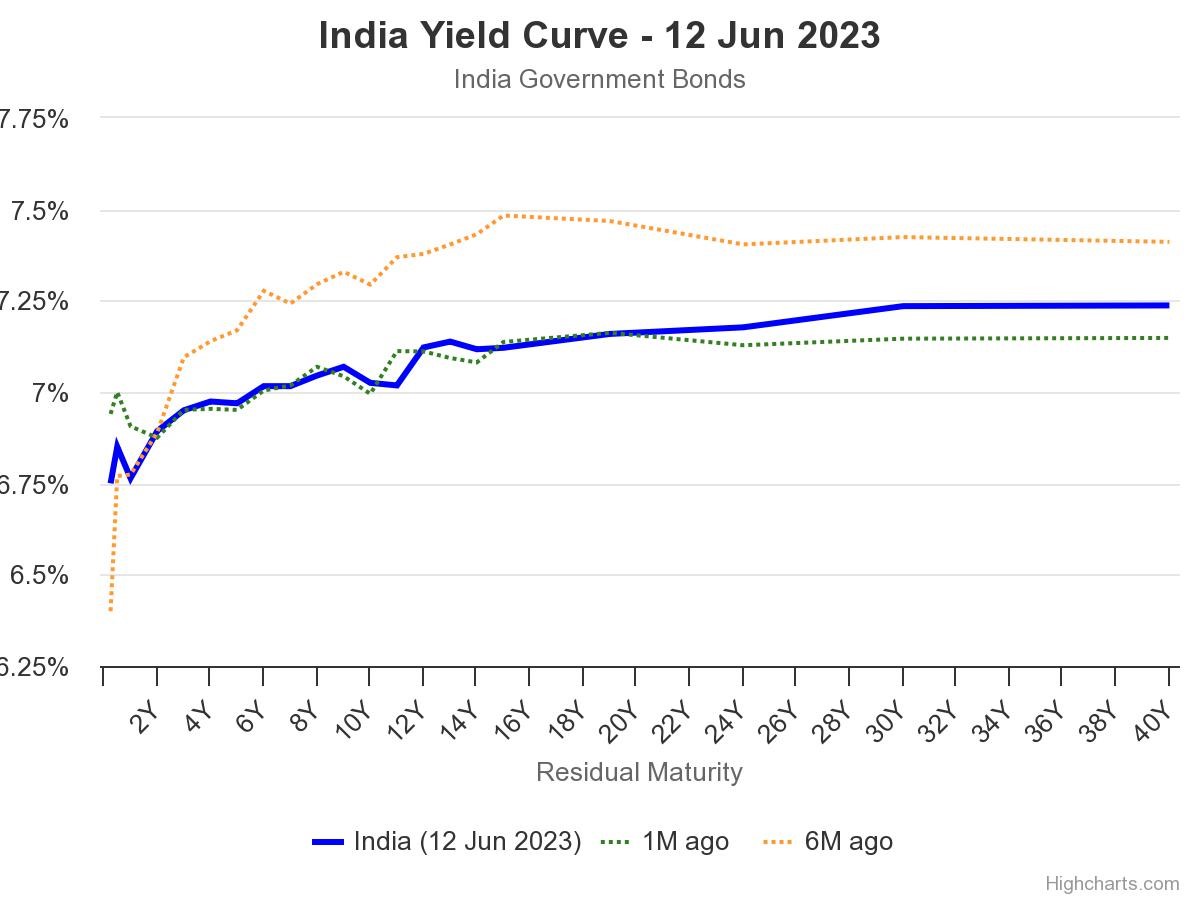

It is imperative to follow the yield curve while making the investment decisions.

Corporate Bonds: An Alternative Option

Corporate bonds are fixed-income securities that companies issue to raise capital for various purposes, such as expanding their business or funding new projects. These bonds offer an alternative investment option to investors who seek higher yields than what government bonds provide. A good understanding of corporate bonds might be the key to successfully navigating the Indian debt market. Corporate bonds are classified into two categories: secured and unsecured.

Secured corporate bonds have a claim on specific assets of the issuer in case of default, providing added protection to investors. In contrast, unsecured corporate bonds have no such collateral and rely solely on the creditworthiness of the issuer. Investing in corporate bonds requires thorough research about the issuing company’s performance and credit rating, but it presents an opportunity for higher returns compared to government-backed securities.

Example: Let’s say ITC is planning to expand its operations by launching a new product line and needs funds to finance this project. They have decided to raise capital by issuing corporate bonds with attractive yields that would entice investors looking for higher returns on their investments. As an investor, you can choose to invest in ITC Ltd’s secured or unsecured bond offerings after evaluating their financial health and creditworthiness. The reports from the credit rating agencies can assist you in this process to a large extent.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Challenges and Opportunities:

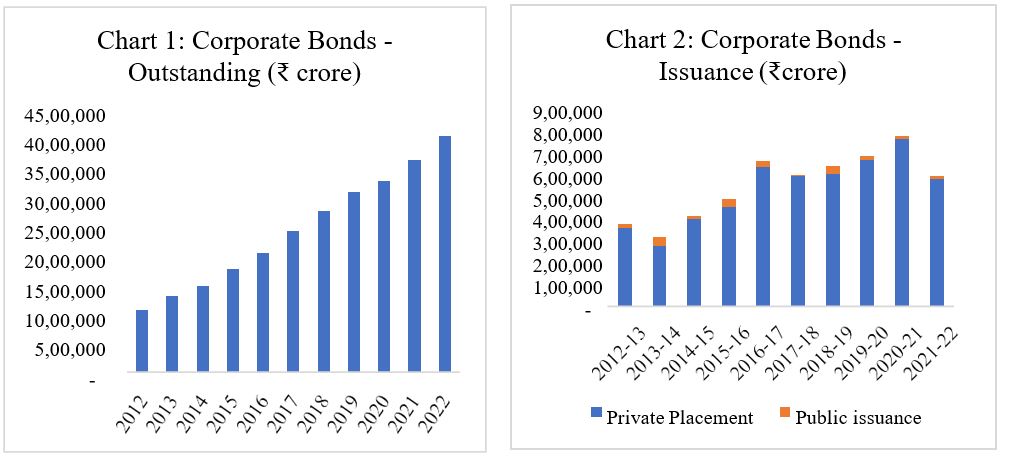

A lot of effort has been made to develop the corporate bond markets broadly over the last decade and a half. The reforms and developments were made starting from the advancements in the corporate bond microstructure to the evolution of a facilitative regulatory framework, complemented by effort to develop the derivative market and an understanding of risk and measures to enhance the secondary market liquidity.

In the past decade alone, it has grown four-fold from INR 10.5 trillion in 2012 to INR 41 trillion in 2022 at a 13% CAGR (Chart 1). The annual issuance during this period grew from INR 3.8 lakh Crore to INR 6.0 lakh Crore (Chart 2). The corporate bond market has come to an inflection point from where it is expected to grow exponentially.

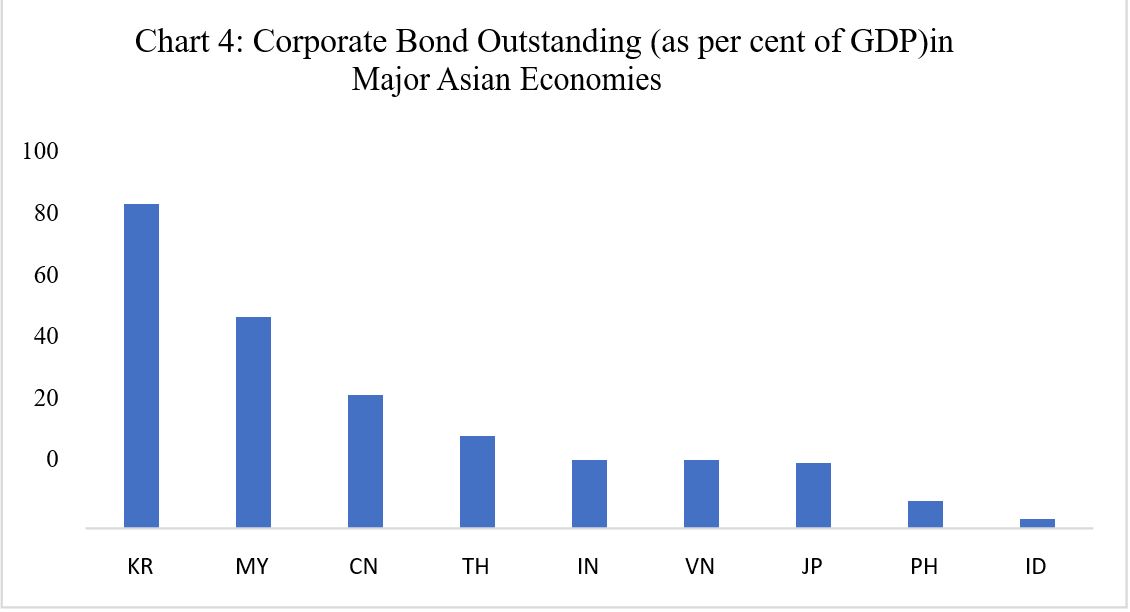

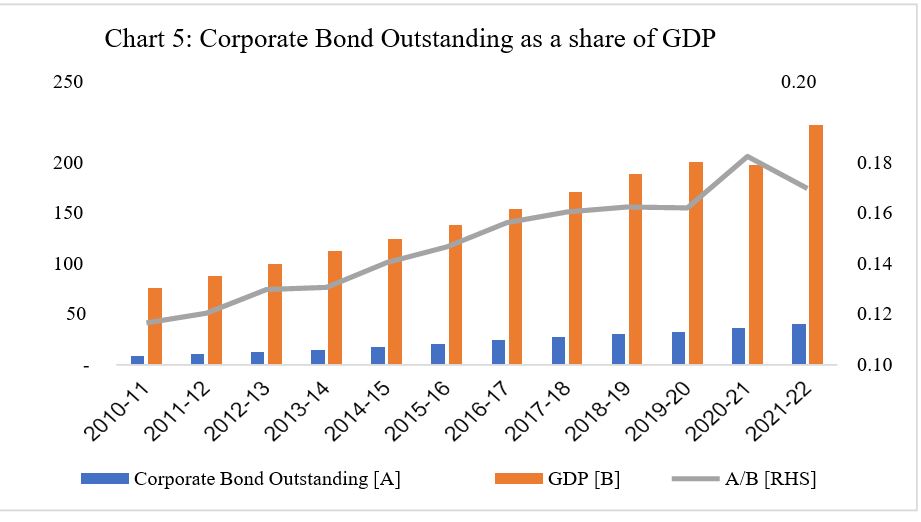

The size of the corporate bond market in India, scaled by GDP, remains small compared to other major Asian emerging markets such as Malaysia, Korea and China (Chart 4). But the market is growing steadily (Chart 5) and reasonably given the traditional bank dominance.

Source: Asian Development Bank and SEBI; Data as on March 2022

Source: RBI & SEBI

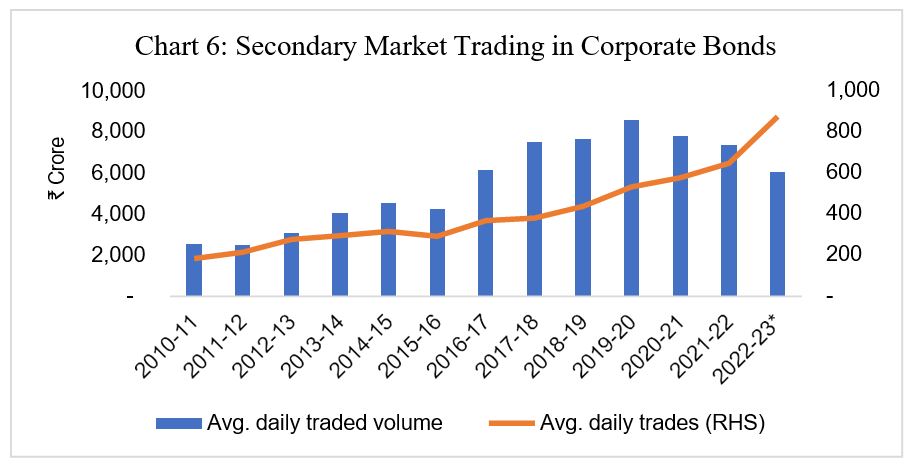

The other important metric to assess the development of a corporate bond market is the development of secondary bond markets. Over the years, a significant growth has been witnessed in the secondary market trading volumes (Chart 6). The total settled value of secondary market trades during FY 2010-11 was INR 4.50 lakh crore which rose to INR 14.37 lakh crore for FY 2021-22.

Source: SEBI

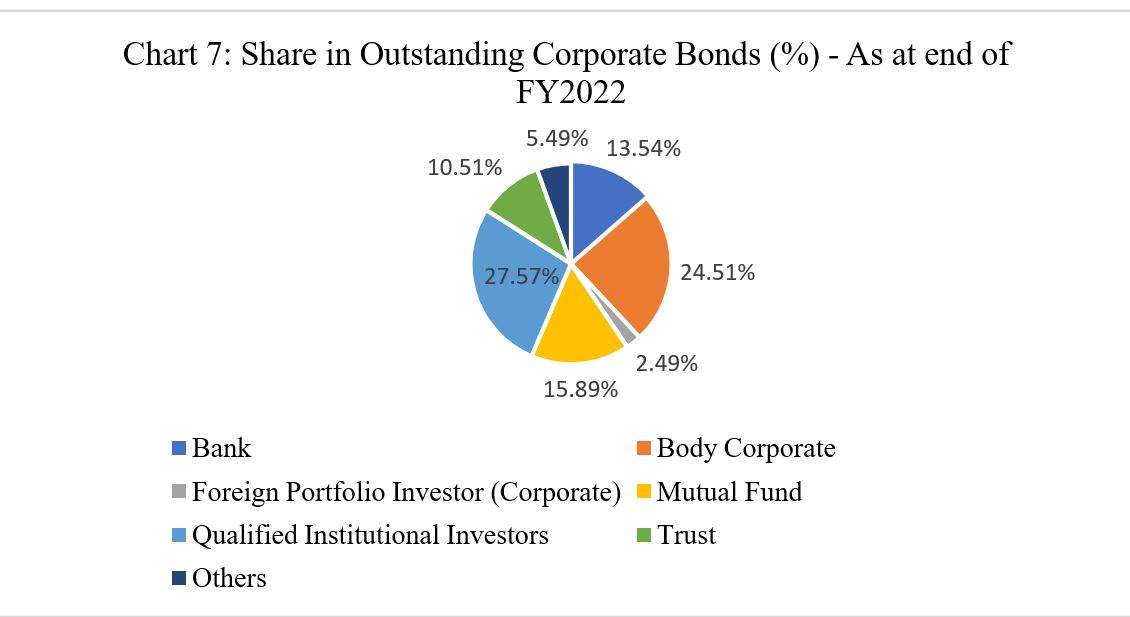

Let us now look at the investor base. The investor base for corporate bonds is largely dominated by domestic institutions, such as insurance companies, banks and mutual funds (Chart 7). Retail participation in corporate bonds remains low – this in fact is a global trend. What is somewhat unique in India is that investors in debt oriented mutual funds – which is the avenue through which globally the retail investor participates in debt markets – are also largely institutional. Foreign participation in corporate debt, has also not been favorable to secondary market activity.

Source: SEBI

Thus, it can be concluded that impressive progress has been made in the development of corporate bond markets – the market is large and growing; the issuer base is expanding; product diversity and sophistication are developing; secondary volumes are low but growing; and market infrastructure is the best in the world.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Debentures: A Comprehensive Guide

Debentures are another type of debt instrument that companies use to raise money. When a company issues debentures, it essentially borrows money from investors in exchange for periodic interest payments and the promise of repayment at a specified time in the future. Unlike bonds, debentures are not secured by any specific assets and are therefore considered unsecured debt. Navigating the Indian debt market can become that much easier with a grasp of how different types of debentures work.

There are two primary types of debentures: convertible and non-convertible.

Convertible debentures can be converted into equity shares at a later date, while non-convertible debentures cannot. Debenture holders typically receive a fixed rate of return, which can be either cumulative or non-cumulative. Cumulative debentures accrue interest if it is not paid out in the current year, while non-cumulative debentures do not.

Investing in debentures can provide an attractive source of regular income for investors looking for steady returns. However, investors should also carefully evaluate the creditworthiness of the issuer and understand the risks associated with investing in unsecured debt instruments.

Yield and Risk: How to Evaluate Investments

When it comes to evaluating investments in the Indian debt market, yield and risk are two crucial factors that investors must take into consideration. Yield refers to the returns generated by an investment, while risk is the probability of losing capital or getting lower returns.

To evaluate yield, investors must assess various metrics such as coupon rates, maturity periods, and credit ratings. High-yielding investments can be attractive but come with increased risk. On the other hand, low-yielding investments may offer stability but provide lower returns. When it comes to assessing risk, credit ratings play a key role in determining an investment’s safety and reliability. A higher credit rating indicates lower default risk while a lower rating indicates higher default risk.

Evaluating yield and risk is a balancing act that requires finding a suitable mix of both elements based on an individual’s financial goals, investment horizon, and risk tolerance. Investors should also consider diversifying their portfolio across different bonds and debentures to minimize risks associated with concentration.

When to Sell and Exit the Market

Selling your investments in the Indian debt market can be a tricky decision, but it’s essential to know when to exit the market and avoid potential losses. One factor to consider is the maturity date of your investment. If you hold a bond or debenture until its maturity date, you will receive your principal back along with an interest payment, which can be a good exit point.

Another factor to consider is the current market conditions which can be helpful in expertly navigating the Indian debt market. If interest rates are rising, it may be wise to sell your bonds or debentures before their maturity date and invest in new ones with higher yields. On the other hand, if interest rates are falling, it could be advantageous to keep your current investments until their maturity date so that you can enjoy higher yields.

It’s important not to panic when things get tough in the debt market; instead, take a step back, reassess your investments, and consult with financial experts if needed. A well-planned exit strategy can help you navigate through any volatility in the Indian debt market and ensure that you maximize profits while minimizing risks.

Tips for Successful Investing in the Indian Debt Market

Investing in debt securities can provide steady returns over time, but it’s essential to make informed decisions. Here are some tips to help you navigate the Indian debt market with confidence.

- First and foremost, do your research. Thoroughly understand the issuer’s creditworthiness, repayment capacity, and track record before investing. Make sure to examine the historical data on yields and ratings that will help you evaluate their risk levels.

- Secondly, diversify your portfolio. Consider investing in a mix of government bonds, corporate bonds, and debentures to spread out your risk. Having a well-diversified portfolio reduces the impact of any one investment going sour and can bring stability to your overall returns.

- Thirdly, be mindful of interest rate movements and inflation rates when making longer-term investments. Interest rates have a significant impact on bond prices; high inflation could lead to higher interest rates that could lower bond prices and reduce income streams.

- Last but not least is timing. Don’t try to time the market as it is almost impossible even for experts. Instead, take a long-term view while investing so that you can weather fluctuations in price or yield.

By following these simple yet crucial tips, investors can maximize their chances of success in navigating the Indian debt market while minimizing their risks.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion: Invest with Confidence in the Indian Debt Market

In conclusion, the Indian debt market provides investors with a variety of options to choose from, including government bonds, corporate bonds, and debentures. Each investment has its unique benefits and risks. Investing in government bonds provides security and guaranteed returns, while corporate bonds offer higher returns but also come with a higher risk. Debentures provide investors with a comprehensive guide to understanding the market’s intricate details. Evaluating yield and risk is essential in making an informed investment decision.

Thus, it is necessary to research the specific company or organization issuing the bonds or debentures before investing your money. Despite the risks involved in investing in debt markets, successful investors have found ways to navigate through these issues. Proper knowledge and tips such as diversifying investments across different sectors and fixed income instruments such as mutual funds can lead toward successful investments in this market. Investing in Indian debt markets can be profitable if done carefully with discipline and patience. These investments have moderate risks and return potential for those looking for a steady income.

Very informative…..