Planning your child’s education can be very confusing, but it doesn’t have to be. This article is your straightforward guide to making smart decisions for your child’s education planning. We cut through the confusion to give you clear, practical advice on saving for your child’s education. If you want to secure your child’s future without getting lost in the details, this guide has you covered. Start reading now to get answers to your biggest questions and take the first step towards a bright educational path for your child.

A 10-Step Roadmap for Indian Parents

In the ever-evolving landscape of education, preparing for your child’s academic journey has become more critical than ever. For Indian parents, the pursuit of quality education is not just a goal; it’s a lifelong commitment. Recognizing the significance of education in shaping a child’s future, it becomes imperative for parents to embark on a well-thought-out plan that not only secures their child’s educational aspirations but also provides financial stability for the family.

India, with its diverse educational opportunities and growing costs, demands a strategic approach to planning for a child’s education. This roadmap aims to guide parents through a comprehensive 10-step plan, equipping them with the knowledge and tools needed to navigate the intricate realm of educational planning. From understanding the financial landscape to exploring funding options like education loans and scholarships, this roadmap is designed to empower parents to make informed decisions for their child’s educational journey.

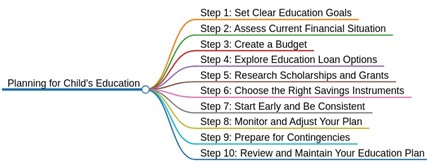

Planning for Child’s Education in India

What are the key components involved in education planning?

Step 1: Set Clear Education Goals

Setting clear goals is like plotting a course on a map; it helps you know where you’re headed. For parents, understanding and defining your child’s education goals is the first step in crafting a solid plan. Here’s how you can do it:

- Understand Your Child’s Aspirations: Start by talking to your child about their dreams and aspirations. What kind of education do they envision? Knowing their interests and ambitions will guide your planning.

- Research Future Education Costs: Investigate the current and expected future costs of the specific education path your child is interested in. Consider tuition fees, accommodation, and other related expenses.

- Factor in Inflation: Keep in mind that education costs tend to rise over time due to inflation. Factor in an estimated inflation rate to get a more accurate picture of future expenses.

- Set realistic financial targets: Based on your findings, set realistic financial targets. How much money will you need to meet these educational goals? This step helps in creating a savings target.

- Consider multiple scenarios: Anticipate different scenarios, like if your child decides to study abroad or pursue a specialized course. Having flexibility in your plan prepares you for various possibilities.

By the end of this step, you’ll have a clear understanding of what your child’s education might cost and a financial target to work towards. This sets the foundation for the next steps in our roadmap. Remember, clarity in goals is the key to a successful educational plan.

How much should I save or invest?

Step 2: Assess Current Financial Situation

Understanding where you stand financially is crucial before embarking on an education plan. Let’s break down how you can assess your current financial situation:

- Create a Budget: Begin by making a detailed budget that includes all your income sources and expenses. This helps identify how much money you can realistically allocate towards your child’s education fund.

- Evaluate Savings and Investments: Take stock of your existing savings and investments. This includes savings accounts, fixed deposits, or any investment portfolios you may have. Knowing your current financial assets is vital.

- Account for Liabilities: Consider any outstanding debts or loans you currently have. Understanding your liabilities helps you create a realistic plan that won’t strain your finances.

- Emergency Fund Assessment: Assess the status of your emergency fund. An emergency fund is crucial for unexpected expenses and ensures that your education fund remains untouched during emergencies.

- Identify Surplus or Shortfall: After accounting for all the above factors, determine if there’s a surplus or a shortfall. A surplus indicates potential savings for education, while a shortfall may require adjustments in your financial plan.

- Review Insurance Coverage: Ensure that you have adequate insurance coverage, including health and life insurance. This safeguards your family’s financial well-being in case of unforeseen circumstances.

How much money should I aim to save on a monthly or yearly basis?

Step 3: Create a Budget

Now that you’ve assessed your financial situation, it’s time to create a budget specifically tailored towards saving for your child’s education. Here’s how you can do it:

- Identify the Education Savings Goal: Based on the education goals you defined in Step 1 and considering the estimated costs, determine the amount you need to save for your child’s education.

- Prioritize Education in Your Budget: Allocate a specific portion of your monthly income towards education savings. Treat it as a non-negotiable expense, just like rent or utility bills.

- Trim Unnecessary Expenses: Review your current expenses and identify areas where you can cut back without compromising your family’s well-being. Redirect these savings toward your education fund.

- Automate Savings: Set up automatic transfers from your primary account to your designated education savings account. Automating savings ensures consistency and removes the temptation to spend the money elsewhere.

- Explore Additional Income Sources: Consider exploring additional income sources, such as freelancing or part-time work, to boost your education savings. Every extra rupee counts towards achieving your goal.

- Monitor and Adjust Regularly: Regularly monitor your budget and track your progress toward your education savings goal. Adjust your budget as needed to stay on track and accommodate any changes in your financial situation.

- Emergency Fund Protection: While prioritizing education savings, ensure that you continue to contribute to your emergency fund. Having a buffer for unexpected expenses safeguards your education fund from being depleted.

What are the key features and considerations associated with exploring education loan options?

Step 4: Explore Education Loan Options

Education loans are essentially financing facilities offered by banks or non-banking financial institutions to assist students in gaining admission to esteemed domestic and international universities so they may pursue their academic goals. Parents and students alike can cover the cost of tuition and other associated fees associated with the admissions process by using an education loan.

Planning for Child’s Education in India

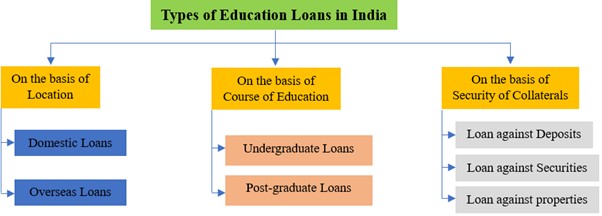

Types of Education Loan in India

There are various types of education loans based on course, location, and collateral, which are as follows:

Based on Location

- Domestic Loans: Students can apply for domestic education loans if they want admission to prestigious Indian educational institutes. Furthermore, before applying for a loan, you must be admitted to a college or institution that the lender recognizes.

- Overseas Loans: These loans are designed to help students realize their dream of studying abroad at a reputed foreign institution or university. Just like with domestic loans, you must have secured admission to an institute recognized by the lender to apply for an overseas education loan.

Based on Course

- Undergraduate Loan: These loans help students pay for their undergraduate degree programs. The course duration of an undergraduate degree might be three to five years, following which students have several work choices.

- Post-graduate Loan: Students who wish to continue their studies at Indian colleges will be given access to these education loans. Particularly for those who want to pursue postgraduate degrees, these loans are available. The students must have finished their undergraduate degree to be eligible for this loan.

Based on Collateral

- Loan against Deposits: An education loan can be availed against recurring deposits, fixed deposits, or gold deposits.

- Loan against Securities: The borrower can avail of education loans against debentures, bonds, or equity shares.

- Loan against Properties: Banks and NBFCs also provide education loans against immovable assets such as residential land, agricultural land, houses, flats, etc.

What about scholarships and financial aid?

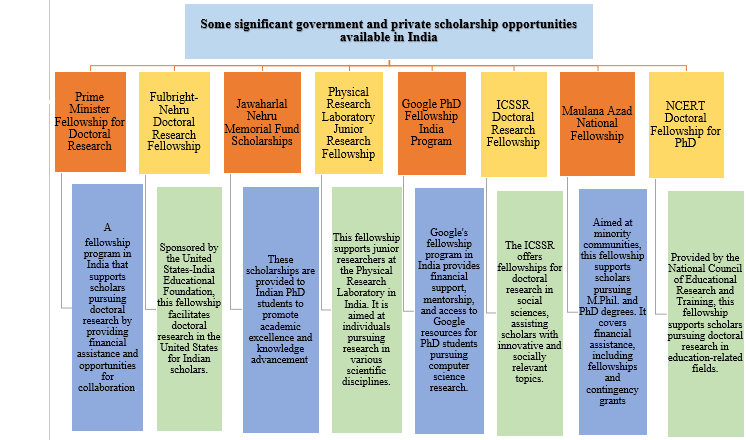

Step 5: Research Scholarships and Grants

Early scholarship searching is crucial for your child’s education, as many have application deadlines before the academic year begins. Explore scholarship websites, educational portals, and government scholarship programs to find opportunities. Investigate universities and colleges offering scholarships based on academic performance, extracurricular activities, or specific criteria. Research and apply for scholarships based on your child’s qualifications, academic achievements, and financial needs.

Planning for Child’s Education in India

What are the best investment options for saving for a child’s education in India (fixed deposits, mutual funds, etc.)?

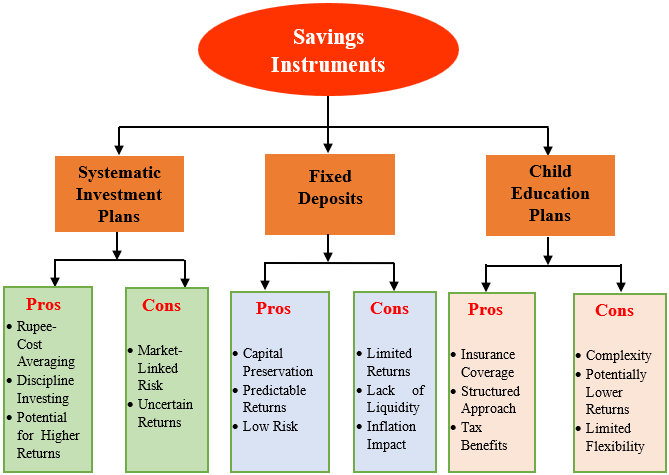

Step 6: Choose the Right Savings Instruments

Selecting the right savings instruments is a critical step in building a robust financial foundation for your child’s education. Let’s explore various investment options, including mutual funds, systematic investment plans (SIPs), fixed deposits, and child plans, highlighting the pros and cons for each:

Mutual Funds: -Systematic Investment Plans (SIPs)

Pros:

- Rupee-Cost Averaging: Mutual Funds (SIPs) allow investors to regularly invest a fixed amount, buying more units when prices are low and fewer units when prices are high. This averaging can reduce the impact of market volatility.

- Disciplined Investing: Mutual Funds (SIPs) promote financial discipline as investors commit to consistent contributions, regardless of market fluctuations.

- Potential for Higher Returns: Equity-based Mutual Funds (SIPs) have the potential for higher returns over the long term compared to traditional savings instruments.

Cons:

- Market-Linked Risk: Mutual Funds (SIPs) are subject to market risks, and the value of investments may fluctuate based on market conditions.

- Uncertain Returns: Returns are not guaranteed, and investors must be prepared for the inherent variability in equity markets.

Fixed Deposits

Pros:

- Capital Preservation: Fixed deposits provide a secure investment option, preserving the principal amount.

- Predictable Returns: FDs offer fixed interest rates, providing a predictable income stream.

- Low Risk: FDs are relatively low-risk investments, making them suitable for conservative investors.

Cons:

- Limited Returns: Returns on fixed deposits are generally lower compared to market-linked instruments.

- Lack of Liquidity: FDs often have a lock-in period, limiting access to funds in cases of urgent financial needs.

- Inflation Impact: Fixed deposit returns may not always outpace inflation, affecting real returns.

Planning for Child’s Education in India

Child Education Plans

Pros:

- Insurance Coverage: Many child plans offer life insurance coverage, ensuring financial protection for the child even in the absence of the parent.

- Structured Approach: These plans are specifically designed for education planning, providing a structured approach to achieving financial goals.

- Tax Benefits: Some child plans offer tax benefits under Section 80C of the Income Tax Act.

Cons:

- Complexity: Child plans can be complex, with a combination of insurance and investment components.

- Potentially Lower Returns: Returns may be lower compared to pure investment options, as a portion of the funds is allocated to insurance coverage.

- Limited Flexibility: Child plans may have limited flexibility in terms of withdrawals and adjustments based on changing financial circumstances.

How early in my child’s life should I start saving for their education?

Step 7: Start Early and Be Consistent

Initiating savings early and maintaining consistent contributions are key principles for maximizing the benefits of compounding and building a robust education fund. Let’s discuss why these aspects are crucial and how parents can implement them effectively:

Importance of Starting Early:

- Compounding Magic: Starting early investments allows your savings to benefit from the compounding effect, where the returns on your investments generate additional returns over time. The longer your money is invested, the greater the compounding effect.

- Increased Investment Horizon: An early start provides a longer investment horizon, allowing you to ride out market fluctuations and benefit from the potential growth of your investments.

- Reduced Financial Stress: Starting early alleviates the pressure of accumulating large sums of money in a short period. It allows for smaller, more manageable contributions over time.

Consistency in Contributions:

- Building Discipline: By making regular contributions, parents cultivate the habit of saving for their child’s education, ensuring steady progress toward the goal.

- Mitigating Market Volatility: Regular contributions help average out the impact of market volatility. When investing consistently, you buy more units during market lows and fewer units during market highs, potentially reducing the overall average cost.

- Achieving Long-Term Goals: Consistent contributions contribute significantly to achieving long-term financial goals. It ensures a steady accumulation of funds over time, reducing the need for large lump-sum investments later on.

What adjustments might I need to make to my overall financial plan to accommodate education savings?

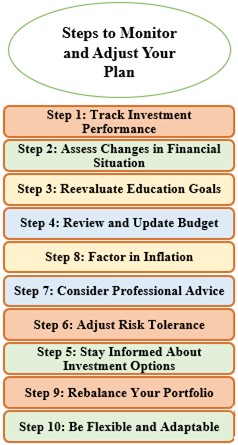

Step 8: Monitor and Adjust Your Plan

As you progress in your child’s education savings journey, it’s crucial to regularly monitor your plan and make adjustments as needed. Here’s a guide on how parents can effectively track their progress and make necessary changes:

Planning for Child’s Education

- Track Investment Performance: Monitor the performance of your chosen savings instruments. Keep a close eye on returns and compare them against your initial expectations. Tools like investment apps and online portals can simplify this process.

- Assess Changes in Financial Situations: Life is dynamic, and financial situations can change. Regularly assess changes in income, expenses, and overall financial health. Adjust your savings contributions accordingly.

- Reevaluate Education Goals: As your child progresses in their education journey, their goals and aspirations may evolve. Reevaluate these goals periodically and adjust your savings targets to align with their changing needs.

- Review and Update Budget: Your budget is a dynamic component of your plan. Regularly review and update your budget based on changing circumstances, ensuring that your savings goals remain realistic and achievable.

- Stay Informed About Investment Options: Keep yourself informed about new investment options and changes in the financial landscape. This knowledge can help you optimize your investment strategy and explore opportunities for better returns.

- Adjust Risk Tolerance: Your risk tolerance may change over time. Assess whether your current investment portfolio aligns with your risk appetite and adjust the mix of assets if needed.

- Consider Professional Advice: Seek advice from financial experts or advisors. A professional can provide insights into market trends, suggest adjustments, and ensure your financial plan remains on track.

- Factor in Inflation: Regularly inflation factor when reassessing your savings goals. Adjusting for inflation ensures that your savings maintain their purchasing power over time.

- Rebalance Your Portfolio: If you have a diversified investment portfolio, rebalance it periodically. This involves adjusting the allocation of assets to maintain the desired risk-return profile.

- Be Flexible and Adaptable: Financial plans are not set in stone. Be flexible and adaptable to changing circumstances. A well-adjusted plan is more likely to withstand unforeseen challenges.

What key aspects should be considered when preparing for unforeseen circumstances in the context of educational planning?

Step 9: Prepare for Contingencies

Life is unpredictable, and having a contingency plan is a crucial element in safeguarding your child’s education fund against unexpected events. So, let’s understand the importance of having a contingency plan: –

- Uncertainties of Life: Unexpected events are an inherent part of life, ranging from health emergencies to sudden changes in financial circumstances. A contingency plan acts as a safety net, providing financial protection during challenging times.

- Preserving Educational Goals: A well-thought-out contingency plan ensures that your child’s education goals remain intact, even in the face of unforeseen events that might impact your ability to contribute to the education fund.

- Peace of Mind: Knowing you have a contingency plan in place provides peace of mind. It allows you to face uncertainties with resilience, knowing that you’ve taken steps to protect your child’s educational aspirations.

Options for Contingencies:

- Emergency Fund: It is very important to establish and maintain an emergency fund separate from your education savings and this fund should cover living expenses for three to six months and act as a financial cushion during unexpected situations so that your education fund remains intact during hard times.

Insurance Coverage:

- Health Insurance: Comprehensive health insurance is crucial to cover medical expenses in case of illness or accidents. It prevents unexpected healthcare costs from depleting your savings.

- Life Insurance: Consider life insurance coverage to provide financial support to your family in the event of the policyholder’s death. This ensures that your child’s education fund remains intact even in the absence of the primary contributor.

- Loan Protection Insurance: If you have education loans, explore loan protection insurance. This coverage can help settle outstanding loan amounts in case of unforeseen circumstances, such as disability or death.

Preparing for contingencies is a proactive and responsible approach to securing your child’s education fund. By having a well-thought-out plan, including an emergency fund and appropriate insurance coverage, you enhance your financial resilience, ensuring that your child’s educational journey remains on track even in the face of unexpected challenges.

How does the ongoing process of reviewing and maintaining your education plan contribute to its effectiveness?

Step 10: Review and Maintain Your Education Plan

Regular reviews and commitment to adaptation are crucial for the long-term success of your child’s education plan. These reviews help assess progress, align the plan with changing circumstances, and identify optimization opportunities. Commitment to your child’s goals and flexibility are essential for a resilient journey. Be proactive in adapting the plan based on changes in your child’s aspirations, financial situations, or personal life goals.

Encouragement for Parents:

Dear parents, you hold the key to unlocking a bright and promising future for your child. Taking proactive steps today is like planting seeds of opportunity that will bloom into a world of possibilities for your children.

Imagine the joy of seeing your child confidently pursue their dreams, armed with the education and knowledge you’ve carefully nurtured. Your commitment to their educational future is not just a financial investment; it’s a profound expression of love and foresight. So, don’t hesitate to take those initial steps – start early, save consistently, and explore various avenues like scholarships and grants. Your efforts are not just about securing finances; they are about providing your child with the tools they need to navigate the journey ahead.

Every small contribution you make today is a building block for their success tomorrow. Your proactive approach will not only make their dreams achievable but will also instill in them the values of discipline, resilience, and the importance of planning for the future.

Conclusion

Creating a plan for your child’s education is like drawing a roadmap for their future. Starting early and saving regularly is like planting seeds that grow into a big tree over time. Choosing the right ways to save, like using Mutual Funds or fixed deposits, is like picking the best tools for the job. And looking for scholarships is like finding extra help along the way, making the journey a bit easier.

But it’s not just about making a plan and sticking to it. It’s about keeping an eye on how things are going. If something changes, like your money or your child’s goals, you might need to adjust the plan a bit. It’s like steering a ship to the right course.

As you review and keep up with your plan, you’re not just managing money. You’re making sure your child’s dreams have the best chance to come true. It’s like giving them a strong and sturdy boat to sail through the sea of opportunities ahead. So, to all the parents out there, cheers to your hard work! You’re not just saving money; you’re investing in a future where your child’s dreams can blossom and become a reality.