Take Control of Your Finances, Achieve Your Goals, and Build a Secure Future with the Guidance of a Financial Coach

What is Financial Coaching? (And What Is It Not?)

Financial coaching has emerged as a powerful tool for individuals seeking to take control of their finances and achieve their long-term financial goals. Unlike traditional financial advising, which often focuses solely on investment strategies, it adopts a holistic approach to personal finance. It provides individuals with the knowledge, skills, and support needed to navigate the complexities of money management, budgeting, debt reduction, and wealth creation.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Is A Financial Coach the Same As A Financial Advisor?

Financial coaches play a vital role in helping clients work their way out of debt, build emergency funds, and improve their overall financial well-being. They provide mentorship and teaching, diving into the emotional, behavioral, and educational aspects of money. The coaching relationship is highly client-driven, with the coach supporting the client’s goals and values. Financial coaches offer education, guidance, encouragement, and accountability to help clients stay on track and develop positive financial habits.

While financial advisors and financial coaches have different focuses and target different types of clients, they are both important in helping people manage their money effectively and reach their financial goals. In fact, when clients have achieved certain milestones, such as positive cash flow and wealth accumulation, a financial coach may refer them to a financial advisor for comprehensive planning, as coaches are not typically licensed or experts in that area.

However, coaching clients how to manage their finance is not about quick-fix solutions or giving explicit investment advice. Instead, it is more about empowering individuals to develop a deeper understanding of their financial habits and mindset, enabling them to make informed decisions and cultivate healthy financial behaviors. It is about teaching clients how to manage their finances independently, so they can eventually become self-sufficient and no longer require the coach’s assistance. In this article, we will explore its essence, benefits, and how it differs from other financial services.

Who is a Financial Coach?

A financial coach is a professional who works closely with individuals or households to improve their financial well-being. They provide guidance, support, and education to help clients gain control over their finances, make informed decisions, and achieve their financial goals.

Financial coaching focuses on the fundamentals of personal money management, behavioral change, and accountability. They help clients develop a clear understanding of their financial situation, create budgets, manage debt, save effectively, and plan for the future. The primary goal of a financial coach is to empower clients with the knowledge, skills, and behaviors necessary to build wealth and improve their overall financial health.

Financial coaching focuses on the fundamentals of personal money management, behavioral change, and accountability. They help clients develop a clear understanding of their financial situation, create budgets, manage debt, save effectively, and plan for the future. The primary goal of a financial coach is to empower clients with the knowledge, skills, and behaviors necessary to build wealth and improve their overall financial health.

Financial coaches take a holistic approach to money management, addressing both the practical and emotional aspects of finance. They assist clients in identifying their financial values, beliefs, and attitudes, and work towards aligning their money decisions with their long-term aspirations.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

In a coaching relationship, the financial coach acts as a mentor and educator, providing personalized advice and resources tailored to the client’s specific circumstances. They may assist with setting financial goals, developing action plans, tracking progress, and adjusting strategies as needed. Financial coaches also offer motivation, accountability, and support to help clients stay on track towards their goals.

It’s important to note that financial coaches typically do not manage investments or sell financial products. They focus more on the foundational aspects of personal finance, such as budgeting, saving, debt management, and financial behavior.

Overall, a financial coach plays a vital role in empowering individuals to take control of their finances, build positive financial habits, and work towards their financial aspirations.

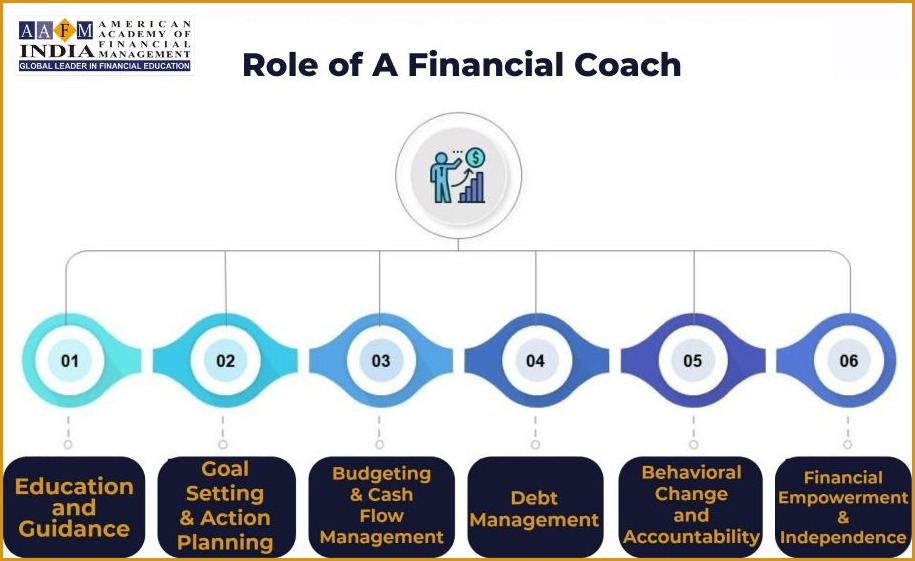

Understanding the Role of a Financial Coach

Here are some key aspects of a financial coach’s role:

Education and Guidance:

A financial coach helps clients understand essential financial concepts and strategies. They provide education on topics such as budgeting, debt management, saving, investing, and retirement planning. They simplify complex financial information and empower clients to make informed decisions.

Goal Setting and Action Planning:

Financial coaching assist clients in setting realistic financial goals based on their aspirations and circumstances. They help clients create action plans by breaking down goals into smaller, achievable steps. Coaches provide guidance on prioritizing goals and allocating resources effectively.

Budgeting and Cash Flow Management:

Financial coaches help clients create and maintain a budget that aligns with their financial goals. They work with clients to track income, expenses, and savings, and provide strategies to improve cash flow management. Coaches may also assist in identifying areas for potential savings and reducing unnecessary expenses.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Debt Management:

Many individuals struggle with debt, and financial coaches provide guidance on managing and reducing debt. They help clients develop strategies for paying off debt efficiently, negotiate with creditors if necessary, and establish healthy debt repayment habits.

Behavioral Change and Accountability:

Financial coaches address the behavioral and psychological aspects of personal finance. They help clients identify and overcome any negative money beliefs or behaviors that may hinder financial progress. Coaches provide motivation, support, and accountability to help clients stay on track and maintain positive financial habits.

Financial Empowerment and Independence:

The goal of a financial coach is to empower clients to take control of their financial lives. Coaches aim to build clients’ financial confidence, knowledge, and skills so they can make sound financial decisions independently. The goal is for clients to become self-sufficient and no longer rely heavily on the coach’s guidance.

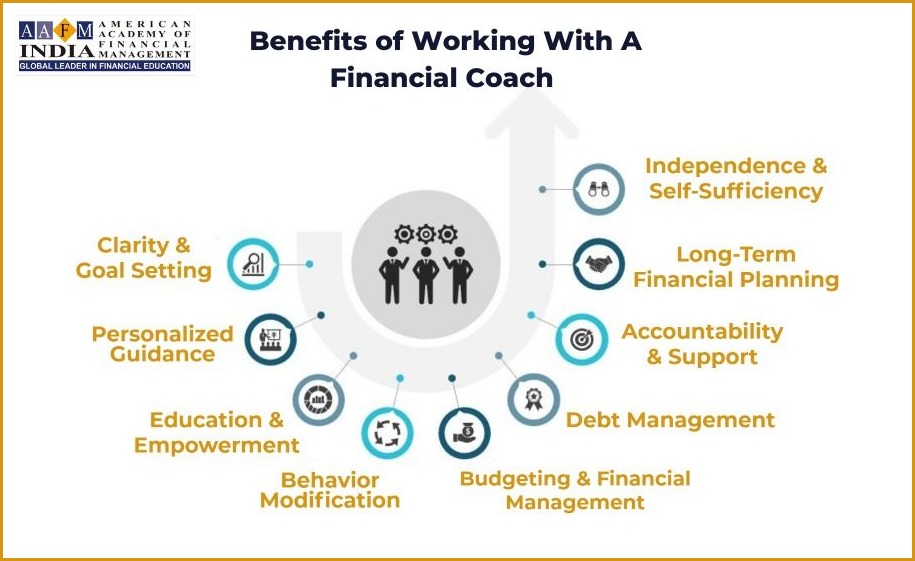

Benefits of Working with a Financial Coach

Financial coaching can provide numerous benefits for individuals seeking to improve their financial well-being. Here are some key advantages of engaging a financial coach:

Clarity and Goal Setting:

A financial coach can help you gain clarity about your financial situation and assist in setting realistic goals. They can help you identify and prioritize your financial objectives, whether it’s paying off debt, saving for a down payment, or planning for retirement.

Personalized Guidance:

Financial coaches offer personalized guidance tailored to your specific needs and circumstances. They take the time to understand your financial goals, challenges, and values, and provide recommendations and strategies that align with your unique situation.

Education and Empowerment:

Financial coach empowers you with knowledge and skills to make informed financial decisions. They educate you about financial concepts, budgeting, saving, investing, and other important topics, enabling you to build your financial literacy and confidence.

Behavior Modification:

One significant advantage of working with a financial coach is their focus on behavioral change. They help you identify and address any negative financial habits or attitudes that may be hindering your progress. Through accountability and support, they assist you in adopting healthier financial behaviors that lead to long-term success.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Budgeting and Financial Management:

Financial coaching can assist you in creating a budget and developing effective money management strategies. They help you track your income and expenses, identify areas for improvement, and develop a plan to achieve your financial goals. With their guidance, you can gain control over your cash flow and make more intentional spending decisions.

Debt Management:

If you’re dealing with debt, a financial coach can help you develop a debt repayment plan. They can provide strategies to pay off debt more efficiently, negotiate with creditors if necessary, and offer support to stay motivated throughout the process.

Accountability and Support:

A financial coach serves as an accountability partner, keeping you focused on your goals and providing support during challenging times. They offer encouragement, guidance, and motivation to help you stay on track and overcome obstacles along the way.

Long-Term Financial Planning:

Financial coaches assist in long-term financial planning, such as retirement planning or saving for major life events. They help you understand the steps needed to achieve your future goals and create a roadmap to reach them.

Independence and Self-Sufficiency:

The goal of a financial coach is to empower you to become self-sufficient in managing your finances. By equipping you with knowledge, skills, and confidence, they aim to help you make sound financial decisions independently and build a strong foundation for your financial future.

Working with a financial coach can provide valuable guidance, support, and education as you navigate your financial journey. With their expertise and personalized approach, they can help you make positive changes, achieve your goals, and build a more secure financial future.

Financial Coaching vs. Financial Advising

| Financial Coach | Financial Advisor |

| Focus on personal money management, behavioral change, and accountability to a client-driven spending plan. | Focus on implementing financial products and strategies. |

| Help clients build wealth and develop positive financial habits. | Help clients manage existing wealth and provide recommendations on investments and insurance. |

| Educate clients on basic financial concepts like insurance, investing, and diversification. | Provide specific recommendations on where to invest and manage investments. |

| Do not manage investments or sell insurance products. | Manage investments and may sell insurance products. |

| Work with clients who may be in debt or building emergency funds. | Work with clients who have already accumulated wealth and need comprehensive planning. |

| Emphasize mentorship, teaching, and emotional support. | Emphasize comprehensive financial planning and strategy implementation. |

| Highly client-driven relationship, focusing on the client’s goals and values. | Provide guidance based on expertise and industry knowledge. |

| Help clients become self-sufficient in managing their finances. | Continue to provide ongoing management and advice for clients’ existing wealth. |

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Finding the Right Financial Coach

Determining Your Financial Goals and Needs

Before searching for a financial coach, it’s crucial to have a clear understanding of your financial goals and needs. Take some time to assess your current financial situation and identify the specific areas where you need assistance. Determine whether you need help with budgeting, debt management, saving for specific goals, or overall financial planning.

Researching and Evaluating Potential Financial Coaches

Once you have a clear idea of your goals and needs, it’s time to research potential financial coaches. Here are some steps to follow:

Seek recommendations:

Ask friends, family, or colleagues if they have worked with a financial coach and if they can recommend someone. Personal referrals can be valuable in finding a trustworthy and effective coach.

Check credentials and certifications:

Look for financial coaches who hold relevant certifications or credentials, such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC). These designations indicate that the coach has met certain professional standards and possesses the necessary qualifications. Another high-value credential for a financial coach can be Chartered Wealth Manager (CWM®) offered by AAFM® that offers comprehensive knowledge of various financial domains and builds necessary skills to function as a professional practitioner or a coach.

Review experience and specialization:

Consider potential candidates’ experience and expertise in the field of financial coaching. Some coaches specialize in certain areas, such as debt management, retirement planning, or small business finances. Look for a coach whose specialization aligns with your specific needs.

Read client testimonials or reviews:

Look for testimonials or reviews from previous clients to get an idea of their experiences with the coach. Positive feedback and success stories can indicate the coach’s effectiveness and ability to help clients achieve their financial goals.

Evaluate communication style and approach:

Contact potential financial coaches and have initial conversations with them. Pay attention to their communication style, listening skills, and the overall impression you get from the interaction. It’s essential to find a coach who communicates effectively and makes you feel comfortable discussing your financial matters.

Selecting the Right Financial Coach for You

After researching and evaluating potential financial coaches, it’s time to select the right one for you. Consider the following factors:

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Compatibility and trust:

Choose a financial coach with whom you feel comfortable sharing personal financial information.  Trust and a good rapport are crucial for a successful coaching relationship.

Trust and a good rapport are crucial for a successful coaching relationship.

Alignment with your goals and values:

Ensure that the financial coach’s approach and philosophy align with your financial goals and values. They should have a clear understanding of your objectives and be able to tailor their guidance accordingly.

Clear expectations and pricing:

Discuss the coach’s services, fees, and what you can expect from the coaching relationship. Make sure you understand the coaching process, including the frequency and duration of sessions, as well as any additional support provided.

Contract or agreement:

It’s advisable to have a written agreement or contract that outlines the scope of the coaching relationship, confidentiality, and any other important details. Review it carefully before committing to the coaching engagement.

Remember that finding the right financial coach is a personal decision, and it’s essential to choose someone who can effectively address your specific financial needs and help you achieve your goals.

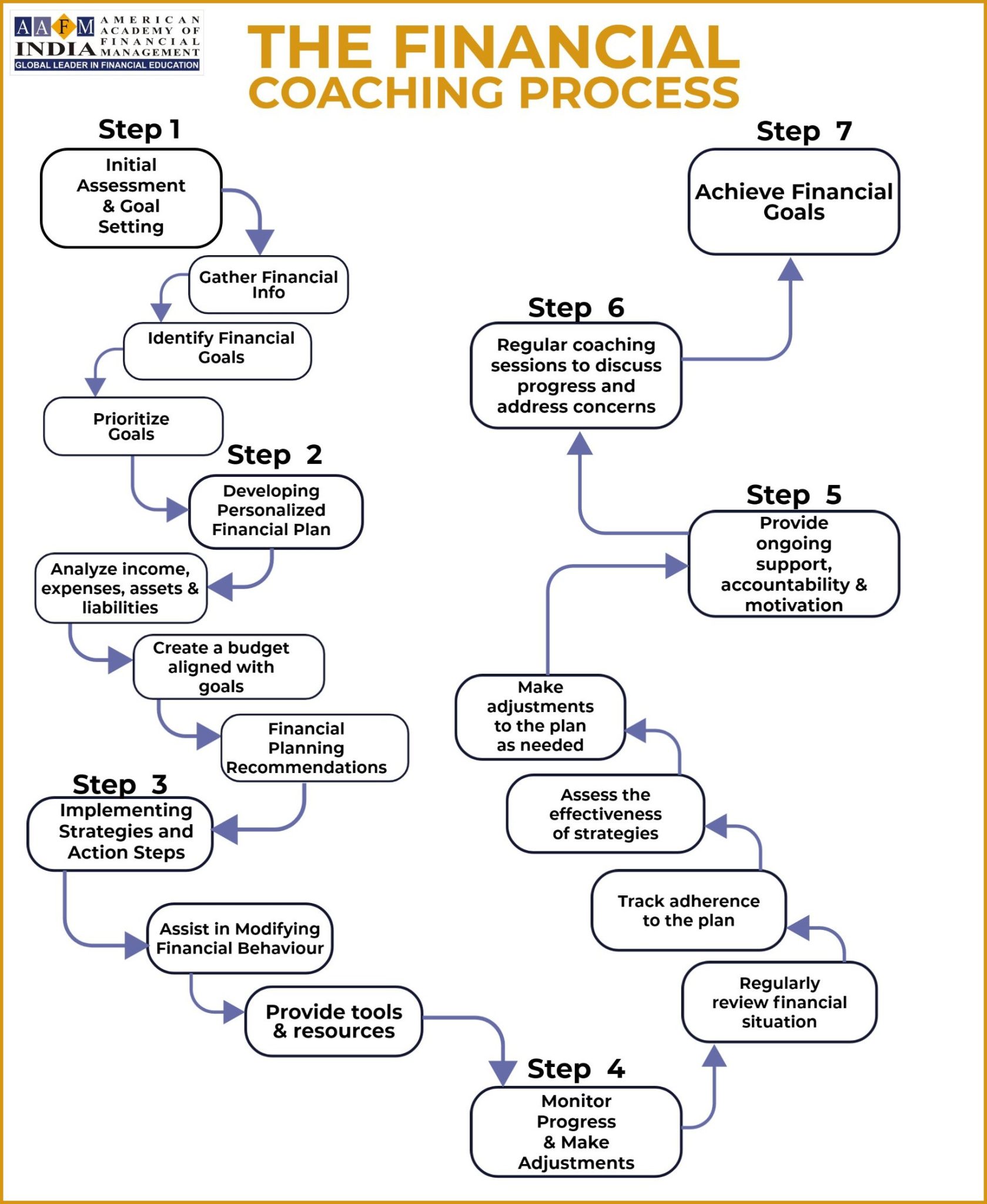

The Financial Coaching Process

Here we have simplified the relatively complex process of coaching clients and presented it in the form of a flowchart.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Initial Assessment and Goal Setting

The financial coaching process typically begins with an initial assessment and goal setting phase. During this stage, the financial coach will gather information about your current financial situation, including income, expenses, assets, liabilities, and financial goals. They will work with you to identify your short-term and long-term objectives, prioritize them, and set realistic and achievable goals.

Developing a Personalized Financial Plan

Once your goals are established, the financial coach will help you develop a personalized financial plan. This plan will outline the specific steps and strategies you need to take to reach your goals. The coach will analyze your income, expenses, and savings potential to create a budget that aligns with your objectives. They may also provide recommendations on debt management, saving strategies, investment options, and risk management, depending on your specific needs.

Implementing Strategies and Action Steps

After the financial plan is developed, the coach will assist you in implementing the strategies and action steps outlined in the plan. They will guide you through the process of making necessary changes to your spending habits, saving practices, and financial behaviors. The coach may provide resources, tools, and techniques to support your progress and help you overcome any challenges or obstacles along the way.

Monitoring Progress and Making Adjustments

Financial coaching is an ongoing process, and the coach will monitor your progress regularly. They will review your financial situation, track your adherence to the plan, and assess the effectiveness of the strategies implemented. If necessary, adjustments may be made to the plan to ensure it remains relevant and aligned with your evolving circumstances and goals.

The coach will provide ongoing support, accountability, and motivation to keep you on track towards your financial objectives. They may conduct regular coaching sessions to discuss your progress, address any concerns or questions, and provide additional guidance or education as needed.

Remember that this process is highly personalized and tailored to your unique financial situation and goals. The coach will work closely with you to ensure that the strategies and action steps are suitable for your specific needs and that you feel empowered and supported throughout your financial journey.

Qualifications and Training for Financial Coaches

Essential Qualifications for Financial Coaches

While there are no specific mandatory qualifications required to become a financial coach, certain skills and knowledge are essential for success in this field. These qualifications include:

Financial Knowledge:

Financial coaches should have a solid understanding of personal finance concepts, including budgeting, saving, debt management, investing, and basic financial planning. They should be well-versed in financial principles and practices to provide accurate and effective guidance to their clients.

Communication Skills:

Strong communication skills are vital for financial coaches. They should be able to explain complex financial concepts in a clear and understandable manner, actively listen to their clients’ concerns and goals, and provide guidance and support effectively.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Coaching Skills:

Financial coaches need to possess coaching skills to effectively guide and motivate their clients. These skills include active listening, empathy, asking powerful questions, goal setting, and helping clients develop action plans. They should be able to create a safe and supportive environment for clients to explore their financial behaviors and make positive changes.

Accredited Financial Coaching Programs and Certifications

To enhance their professional credibility and demonstrate their expertise, many financial coaches pursue  certifications and complete relevant accredited programs. Some of the well-known certifications and programs include:

certifications and complete relevant accredited programs. Some of the well-known certifications and programs include:

Certified Financial Planner® (CFP®):

The CFP designation is widely recognized in the financial industry and indicates comprehensive knowledge in financial planning, including areas such as investments, retirement planning, and estate planning.

Accredited Financial Counselor® (AFC®):

The AFC certification focuses on providing financial counseling and coaching services. It covers areas such as budgeting, credit and debt management, and financial education.

Chartered Wealth Manager® (CWM®):

Chartered Wealth Manager® (CWM®) is a global designation in wealth management that offers in-depth knowledge of advising and guiding clients to achieve their financial goals. The certification program covers every possible aspect of financial planning, investment management and Some of the key knowledge areas covered include investments, retirement planning, tax & estate planning, financial education and more.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Financial Coach Academy:

The Financial Coach Academy offers training and certification programs specifically designed for financial coaches. These programs cover various aspects of coaching clients on finance, including client assessment, goal setting, financial planning, and behavioral change techniques.

International Coach Federation (ICF):

The ICF is a globally recognized organization for professional coaches. Financial coaches can pursue ICF-accredited coach training programs to enhance their coaching skills and obtain professional recognition.

American Academy of Financial Management (AAFM):

AAFM is a global standard setting body in finance and wealth management industry that offers a number of exclusive business education programs with a focus on financial education. These programs are designed to equip candidates with knowledge of financial planning, behavioral finance, client relationship management, goal setting and strategic financial management.

Ongoing Professional Development for Financial Coaches

To stay current with industry trends, best practices, and emerging financial concepts, ongoing professional development is essential for financial coaches. This can involve attending conferences, workshops, and webinars related to personal finance and coaching. Coaches may also engage in networking opportunities and participate in mentorship or supervision programs to enhance their skills and knowledge.

Continual learning and professional development ensure that financial coaches provide their clients with up-to-date information and guidance that aligns with industry standards and best practices.

Note: It’s important to conduct thorough research and due diligence when selecting a financial coach. Consider their qualifications, certifications, experience, and reputation in the field before engaging their services.

Financial Coaching Services and Areas of Expertise

Budgeting and Cash Flow Management

One of the core services provided by financial coaches is assisting clients in budgeting and cash flow management. They help clients create a budget that aligns with their financial goals and priorities. Coaches can provide guidance on tracking expenses, identifying spending patterns, and making necessary adjustments to achieve a balanced cash flow.

Debt Management and Reduction Strategies

Financial coaches can help clients develop strategies to manage and reduce their debt effectively. They assess clients’ debt situations, provide tools and techniques for debt repayment, and offer guidance on prioritizing debts and negotiating with creditors. Coaches may also educate clients on debt consolidation, refinancing, and other debt management options.

Savings and Investment Guidance

Financial coaches assist clients in developing savings goals and creating a plan to achieve them. They educate clients on different savings strategies, such as emergency funds, short-term savings, and long-term investments. Coaches may provide insights into investment options, risk tolerance, diversification, and the importance of consistent savings habits.

Retirement Planning and Preparation

Preparing for retirement is a significant aspect of financial planning. Coaches help clients set retirement goals, assess their current financial situation, and create a personalized retirement plan. They guide clients on retirement savings, investment strategies, tax implications, and navigating retirement accounts and pensions.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Financial Education and Empowerment

Financial coaches emphasize financial education to empower their clients with knowledge and skills to make informed decisions. They educate clients on personal finance topics such as credit scores, insurance, taxes, and basic investment principles. Coaches also teach clients about financial behaviors, habits, and mindset shifts to foster long-term financial success.

These are some of the common areas of expertise and services offered by financial coaches. It’s important to note that the specific services provided may vary based on the coach’s specialization, certifications, and the unique needs of the clients they serve.

Financial Coaching Fees and Payment Options

Understanding Fee Structures Adopted by Financial Coaches

Fees can vary depending on factors such as the coach’s experience, expertise, location, and the complexity of the client’s financial situation. There are different fee structures commonly used:

Hourly Rate:

Some financial coaches charge an hourly rate for their services. Clients pay for the time spent in coaching sessions, consultations, and any additional support provided. Financial coaches may charge anywhere from 2000 to 25,000 INR per hour for their services.

Flat Fee:

In this structure, financial coaches may offer a package or program with a fixed fee. The fee covers a specific duration or set of services, such as a comprehensive financial plan or a series of coaching sessions. The flat fee for a package can range from 40,000 to 400,000 INR or more, depending on the complexity and duration of the engagement.

Monthly Retainer:

Some coaches offer ongoing support through a monthly retainer arrangement. Clients pay a fixed monthly fee to access regular coaching sessions and support throughout the month. Monthly retainer fees can range from 16,000 to 80,000 INR or more, depending on the level of ongoing support provided.

Percentage of Assets:

In certain cases, financial coaches may charge a percentage of the client’s assets under management. This fee structure is more common when the coach also provides investment advisory services.

It’s important to note that these are just approximate figures, and the actual costs may vary significantly based on individual circumstances and the coach’s pricing structure.

Exploring Payment Options and Plans

Financial coaches may offer various payment options and plans to accommodate their clients’ needs. These options may include:

Single Payment:

Clients can choose to pay the full fee upfront for the coaching services they require.

Installment Payments:

Coaches may offer the option to split the total fee into multiple installments, allowing clients to pay over a specified period.

Customized Plans:

Financial coaches may work with clients to develop personalized payment plans that align with their financial situation and ability to pay.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Additionally, some financial coaches may offer discounts for prepayment, referrals, or package deals. It’s always recommended to discuss payment options with the coach to find a mutually suitable arrangement.

Additionally, some financial coaches may offer discounts for prepayment, referrals, or package deals. It’s always recommended to discuss payment options with the coach to find a mutually suitable arrangement.

Remember, the fees for money coaching should be viewed as an investment in your financial well-being and long-term goals. The benefits gained from working with a qualified financial coach can often outweigh the costs, helping you achieve greater financial success and peace of mind.

Starting a Career in Financial Coaching

Acquiring Necessary Skills and Knowledge

To start a career in this specialized field, it’s essential to acquire the necessary skills and knowledge in personal finance, coaching techniques, and communication. Consider pursuing education and training in financial planning, behavioral finance, coaching methodologies, and client engagement. Pursuing a designation like Certified Financial Planner (CFP®), or Chartered Wealth Manager ®(CWM®) can be of great help in terms of acquiring desired skills and knowledge to function as a financial coach.

Building Experience and Expertise

Building experience and expertise in this field can be accomplished through various avenues:

Volunteer or Pro Bono Work:

Offer your services to individuals or organizations in need of financial guidance. This will help you gain practical experience and build your reputation.

Internships or Apprenticeships:

Seek opportunities to work with experienced financial coaches or financial planning firms. This can provide hands-on experience and mentorship.

Continued Learning:

Stay updated with industry trends, research, and best practices. Attend workshops, conferences, and webinars to expand your knowledge and network with other professionals.

Setting up Your Business As A Financial Coach

When setting up your business as a financial expert who specializes in coaching clients, consider the following steps:

Legal Structure:

Decide on the legal structure of your business, such as a sole proprietorship, partnership, or limited liability company (LLC). Consult with a legal professional to determine the most suitable option for your situation.

Business Plan:

Develop a comprehensive business plan that outlines your target market, services offered, pricing structure, marketing strategies, and financial projections.

Licensing and Certifications:

Licensing and Certifications:

Research and obtain any necessary licenses or certifications required to provide financial coaching services in your jurisdiction. This may include certifications such as Chartered Wealth Manager ®(CWM®) ,Certified Financial Planner (CFP®), Accredited Financial Counselor (AFC®), or similar credentials.

Insurance: Consider obtaining professional liability insurance to protect yourself and your clients in case of any unforeseen circumstances or potential legal claims.

Marketing and Promoting Your Services

To market and promote your coaching services to attract the right kind of clients, consider the following strategies:

Define Your Target Market:

Identify the specific audience you want to serve, such as young professionals, couples, or small business owners. Tailor your marketing efforts to address their unique needs and challenges.

Create an Online Presence:

Develop a professional website that showcases your expertise, services offered, testimonials, and contact information. Utilize social media platforms to engage with potential clients and share valuable content.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Networking:

Attend industry events, join professional organizations, and connect with other professionals in the financial and coaching fields. Networking can lead to referrals and collaborations.

Content Marketing:

Share informative and educational content through blog posts, videos, podcasts, or webinars. This establishes you as a thought leader and helps attract potential clients.

Client Referrals:

Provide exceptional service to your clients, as satisfied clients are more likely to refer your services to others. Offer referral incentives to encourage word-of-mouth marketing.

Starting a career as a financial coach requires dedication, continuous learning, and a passion for helping others achieve financial well-being. With the right skills, experience, and marketing strategies, you can build a successful coaching business.

Frequently Asked Questions about Financial Coaching

What Does a Financial Coach Do?

A financial coach provides guidance, support, and education to help individuals or couples improve their financial well-being. They assist clients in setting and achieving financial goals, developing personalized budgets, managing debt, saving, investing, and making sound financial decisions. Financial coaches focus on the behavioral and emotional  aspects of money management and help clients develop positive money habits.

aspects of money management and help clients develop positive money habits.

How Can a Financial Coach Help Me?

A financial coach can help you in various ways:

Goal Setting:

A financial coach can assist you in setting realistic and achievable financial goals based on your priorities and aspirations.

Budgeting and Cash Flow:

They can help you create a personalized budget that aligns with your goals, income, and expenses. They provide strategies to manage cash flow effectively and avoid overspending.

Debt Management:

If you’re struggling with debt, a financial coach can help you develop a plan to pay off debt faster, negotiate with creditors, and establish healthy financial habits to avoid future debt.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Savings and Investment Guidance:

A financial coach can provide guidance on saving for emergencies, short-term goals, and long-term objectives like retirement. They can also educate you about basic investment principles and help you develop an investment strategy.

Financial Education and Empowerment:

Financial coaches aim to empower clients by providing education on various financial topics, helping them build knowledge and confidence in managing their money effectively.

What Should I Look for in a Financial Coach?

When selecting a financial coach, consider the following factors:

Qualifications and Experience:

Look for a coach with appropriate qualifications, certifications, and relevant experience in financial coaching or related fields. Financial coaches who have earned CFP® or CWM® certification can be a reliable choice.

Compatibility:

Find a coach with whom you feel comfortable sharing your financial situation. Trust and rapport are crucial for an effective coaching relationship.

Specialization:

Specialization:

Consider a coach who specializes in areas that align with your specific needs, such as debt management, retirement planning, or small business finances.

Coaching Style:

Determine if the coach’s coaching style matches your preferred approach. Some coaches may be more directive, while others take a collaborative or supportive approach.

References and Testimonials:

Ask for references or testimonials from previous clients to gain insights into their coaching experience and outcomes.

How Long Do Client-Financial Coach Relationships Typically Last?

The duration of a client-financial coach relationship varies depending on the individual’s goals, needs, and progress. Some coaching relationships may last for a few months, while others can extend over several years. It ultimately depends on the complexity of your financial situation and the time it takes to achieve your desired outcomes. The coach and client typically assess progress regularly and determine the appropriate duration for the coaching engagement.

Can I Benefit from Guidance of a Financial Coach if I’m in Debt?

Yes, this form of coaching can be highly beneficial if you’re in debt. A financial coach can help you develop a realistic plan to pay off debt, prioritize your financial obligations, and manage your cash flow effectively. They can provide strategies for reducing interest rates, negotiating with creditors, and changing behaviors that contribute to debt accumulation. A seasoned financial coach can empower you to regain control over your finances, make informed decisions, and work towards becoming debt-free.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion

The Value of Financial Coaching

It offers significant value in helping individuals and couples improve their financial well-being. It goes beyond just providing advice or implementing financial strategies, focusing on the fundamental aspects of personal money management, behavioral change, and accountability.

Financial coaches help clients set  meaningful financial goals, develop personalized budgets, manage debt, save, invest, and make sound financial decisions. They address the emotional and behavioral aspects of money, guiding clients to develop positive money habits and attitudes.

meaningful financial goals, develop personalized budgets, manage debt, save, invest, and make sound financial decisions. They address the emotional and behavioral aspects of money, guiding clients to develop positive money habits and attitudes.

Through education, support, and guidance, financial coaches empower their clients to take control of their finances, make informed choices, and work towards their financial goals. They serve as a partner in the journey, providing encouragement, accountability, and expertise.

Taking Control of Your Finances with a Financial Coach

If you are looking to take control of your finances, a financial coach can be a valuable asset. They provide personalized guidance tailored to your specific needs and circumstances. Whether you are struggling with debt, want to build savings, plan for retirement, or simply improve your financial habits, a financial coach can help you navigate the path to financial success.

By working with a financial coach, you can gain the knowledge, skills, and confidence to make wise financial decisions and achieve your goals. They provide the support and accountability needed to stay on track and overcome obstacles along the way.

Remember, financial coaching is an investment in your financial future. The benefits gained from working with a qualified financial coach can far outweigh the costs. So, take the step towards financial empowerment and consider engaging a financial coach to help you on your journey to financial well-being.