Introduction

Do you ever feel like building wealth through investing is only for the financially savvy? Or perhaps you think that investing requires a large sum of money upfront, making it inaccessible to those with smaller budgets?

If these thoughts sound familiar, then this article is for you. We will be discussing systematic investment plans (SIPs), a type of investment strategy that allows individuals to build their wealth through regular investing, without requiring significant upfront costs or in-depth financial knowledge.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding SIPs: What Are They and How Do They Work?

SIPs allow investors to invest in mutual funds by making small, regular investments over a period of time, as opposed to one large investment. SIPs work on the principle of rupee-cost averaging, which means that investors benefit from investing a fixed amount at regular intervals, regardless of market conditions. This allows investors to buy more units when prices are low and fewer units when prices are high.

The way SIPs work is simple: investors choose a mutual fund scheme and invest a fixed amount periodically – weekly, monthly or quarterly – for a specified period. The money is deducted automatically from the investor’s bank account and invested in the chosen mutual fund scheme. Over time, the investment grows due to market appreciation and generates returns for the investor.

The Benefits of Investing Through Systematic Investment Plans (SIPs)

There are several benefits to investing through SIPs, making them a popular choice for long-term wealth building:

Disciplined Investing

One of the key benefits of SIPs is that they encourage disciplined investing. Since investors have to make regular contributions over a long period, it helps them avoid impulsive decisions and invest with a long-term perspective in mind. This can result in better returns and improved portfolio performance over time.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Rupee Cost Averaging

Another major benefit of investing through SIPs is rupee cost averaging. Since investors contribute small amounts regularly, they end up buying more units when the prices are low and fewer units when the prices are high. This averages out the purchase cost per unit, reducing the impact of market volatility on overall returns.

No Need for Lump-Sum Investment

Unlike lump-sum investments, which require a large amount of capital upfront, SIPs allow investors to start with smaller amounts that can be increased gradually over time as their income grows. This makes it an accessible investment option for those who want to start building wealth but don’t have significant savings or capital to spare.

Diversification

By investing in mutual funds through SIPs, investors can also diversify their portfolios across different industries and asset classes. This reduces risk and enhances the potential for higher returns by spreading investments across different assets.

Tax Benefits

Finally, another significant benefit of investing through mutual funds via SIPs is tax savings. Investments made in equity-linked saving schemes (ELSS) via SIP are used to avail the tax benefits u/s 80C.

Investment Strategies for Systematic Investment Plans (SIPs): Choosing the Right Fund

When investing in SIPs, selecting the right mutual fund is crucial to achieving your financial goals. There are many factors to consider when choosing a fund, including its performance history, expense ratio, and asset allocation.

Firstly, it’s important to look at the past performance of a mutual fund before making any investment decisions. However, past performance does not guarantee future returns. Investors should also look at how consistently a mutual fund has performed over time.

The expense ratio of a mutual fund also plays an important role in determining its overall return on investment. An expense ratio is the annual fee charged by the mutual fund company for managing your investments. It’s essential to compare expense ratios between different funds and choose one that offers low fees without compromising on returns.

Last but not least, investors should consider the asset allocation of a mutual fund before investing in it through SIPs. A well-diversified portfolio that includes stocks from different sectors and industries can help minimize risk and maximize returns over time.

An investor must remember that SIPs are long-term investments and should be chosen based on their long-term financial goals rather than short term market trends.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

How to Start Investing in SIPs: Step-by-Step Guide

Investing in SIPs is easy and simple. Here are the step-by-step instructions on how to start investing in SIPs:

Step 1: Determine Your Investment Goals and Risk Profile

The first step is to determine why you want to invest in SIPs, what your investment goals are, and your risk appetite. This will help you identify the right investments and funds that align with your goals and objectives.

Step 2: Choose a Mutual Fund House or Asset Management Company

Select a mutual fund house or asset management company that has a good reputation, strong fund performance, experienced fund managers, and offers the types of funds that meet your investment goals. You can research different companies online or seek advice from a financial advisor.

Step 3: Register yourself through RTA portal.

You need to complete a video KYC procedure to authenticate your identity as an investor. This is done through the RTA portals run by CAMS and KFinTech. This is a mandatory procedure before you start investing.

Step 4: Choose the Right Plan and Invest Regularly

Select the type of plan – growth or dividend – based on your investment strategy. Decide on the amount you want to invest regularly through auto-debit instructions from your bank account.

Step 5: Track Your Investments Regularly

Stay informed and monitor your investments consistently for optimal growth and performance. Maintain a vigilant eye on your investment progress, ensuring alignment with your financial goals over time.

Systematic Investment Plans (SIPs) vs Lump Sum Investments: Which One is Better?

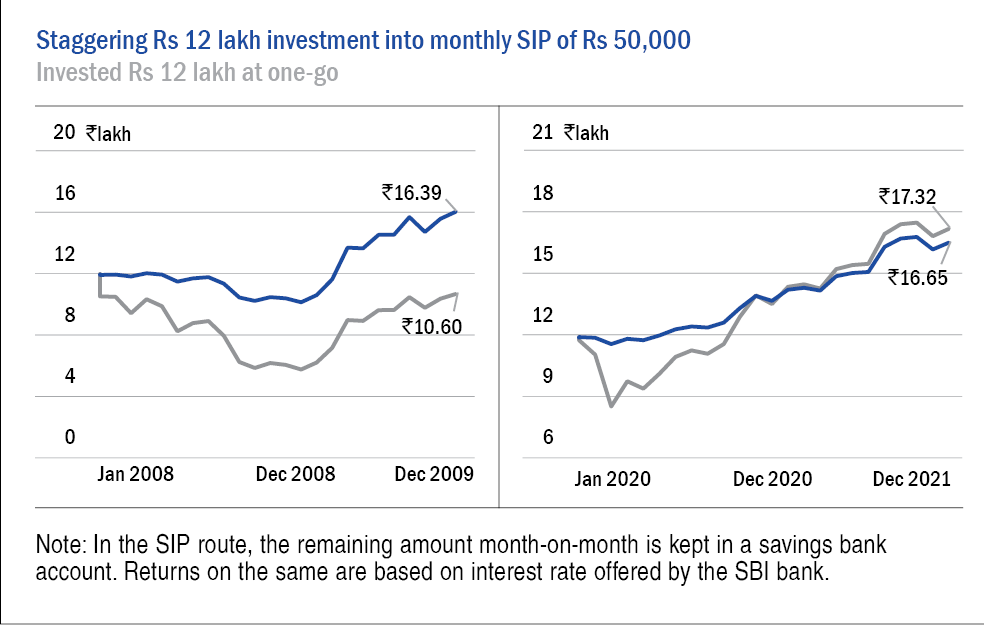

As an investor, one of the most crucial decisions you will make is choosing between SIPs and lump sum investments. Both options have their advantages and disadvantages, so it’s essential to understand which one is better suited for your investment goals and risk appetite.

SIPs are a great way to mitigate market volatility and build wealth over time. However, if you have a lump sum of money, investing it all at once may be tempting. It’s important to weigh the pros and cons of each option before making a decision.

One significant advantage of SIPs is that they allow investors to average out their costs over time. By investing a fixed amount regularly, you don’t have to worry about timing the market, as your investment will buy more units when prices are low and fewer units when prices are high. On the other hand, lump sum investments may provide higher returns in the short term but can be riskier if made at an inopportune time.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Ultimately, it boils down to personal preference. If you prefer a more stable approach with lower risks but slower returns on investment growth over time, then SIPs may be your best bet. But if you’re comfortable with taking higher risks for potentially faster returns on investment growth in a shorter amount of time than lump sum investments might work for you.

Tips for Maximizing Returns in SIPs

Investing in Systematic Investment Plans (SIPs) can be a great way to build wealth over the long term. However, to maximize returns on your investment, there are a few tips you should keep in mind:

Diversify Your Portfolio

One of the most important tips for maximizing returns in SIP investments is to diversify your portfolio. By investing across different asset classes such as equities, bonds, and gold, you can reduce risk and improve your chances of earning higher returns. Remember that diversification doesn’t mean investing in multiple funds from the same category; it means spreading your investment across asset classes.

Choose Funds Carefully

Choosing the right mutual fund scheme is crucial when it comes to generating high returns on your SIP investments. Look for factors such as consistent performance over a longer period, low expense ratio, and low portfolio turnover. Always research and analyse the funds before making an investment decision.

Stick with Your Investment Plan

The key to maximizing returns on your SIP investments is sticking with them for the long term. Do not panic during market volatility or stop investing during downturns. Keep investing regularly every month or quarter without trying to time the market – this way you can take advantage of rupee cost averaging which averages out cost of purchase over time.

In conclusion, by diversifying your portfolio, choosing funds wisely and sticking with your investment plan through thick and thin – you’re well on your way to maximizing potential returns through SIPs!

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding Risks in SIP Investments: How to Mitigate and Manage Them

Like any investment, Systematic Investment Plans (SIPs) also come with their fair share of risks. As an investor, it is important to thoroughly understand these risks and take steps to mitigate them.

The first risk associated with SIPs is a bull run in the market. If you are running an SIP and you are caught in the middle of a market bull run, you would be making less returns than what a lumpsum investment would have given you. This is simply because you will be buying units at a higher rate as you move along, which will limit you upside going forward and you would hope that market gets volatile soon. The value of your investments can fluctuate based on market conditions.

However, this risk can be mitigated by investing in a diversified portfolio of funds and continue with the investment when there is market downturn as that would average out your purchase prices. This is where most of the investors fail themselves, as they continue buying during the bull run but stop their SIP contributions during market downturn or volatility, when actually should be buying all the more. SIP should be continued as per the goal you have attached to the investment, as it is designed to ride through such volatility.

The other risk associated with SIP investments is liquidity risk. This only occurs when you invest in a fund which takes credit risk to generate return. However, this is true for both SIP and Lumpsum, if the corporates who borrowed money from the fund you have invested in, defaults, then you will not be able to find liquidity in the scheme as you need to sell your investments but cannot find a buyer. To mitigate this risk, it is important to select liquid funds or those that have high trading volumes in the market.

To effectively manage these risks, investors should regularly review their portfolio and adjust it as necessary based on changing market conditions and personal financial goals.

SIPs for Long-Term Wealth Building: Goal-Oriented Investing

Systematic Investment Plans (SIPs) are one of the most popular investment options for those aiming to achieve long-term financial goals. SIPs allow investors to accumulate wealth over a period of time by investing small amounts of money regularly, making it an ideal investment option for goal-oriented individuals.

The beauty of SIPs is that they can be tailored to meet different financial goals such as buying a house, funding your children’s education, or creating a retirement corpus. By setting specific financial targets and investing regularly through SIPs, investors can create a disciplined approach towards achieving their financial goals while minimizing the impact of market volatility on their investments.

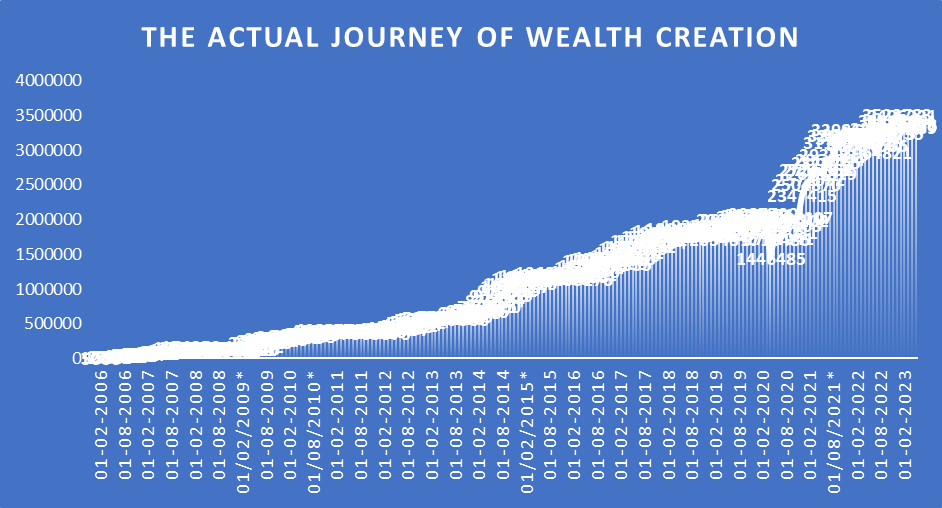

SIPs are particularly effective when it comes to long-term wealth creation as they offer the benefit of compounding. Over time, the power of compounding can work wonders in growing your investments and creating wealth. With SIPs, investors can start small and gradually increase their investments as their income grows or when they receive windfalls such as bonuses or salary hikes. The key is to stay invested for a longer period and have patience while you let your money work harder for you through compounding.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Real-Life Success Stories: Achieving Financial Freedom Through SIPs

One of the most inspiring aspects of systematic investment plans is the potential for long-term wealth building. Many people have achieved financial freedom and security through regular investing in SIPs. One such success story belongs to a woman who started investing in SIPs at the age of 25, in the year 2006 with an initial investment of just Rs. 5000 per month. Over the years, she continued her investment and today in 2023, her portfolio had grown to over Rs. 35.5 lakhs generating a return close to 13%. She continued to invest regularly even under acute market volatility, which allowed her to build this sizeable corpus today, which is helping her achieve financial independence.

Another success story comes from a young professional who started investing in SIPs while still in college. He realized early on that saving and investing regularly was key to building long-term wealth, so he started putting away a portion of his earnings into SIPs every month. By the time he turned 30, his portfolio had grown significantly, and he was able to purchase his first property with the returns earned through his investments! His disciplined approach towards investing is a testament to how effective regular investments can be when done consistently over time.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion:

Start Investing Through SIPs Today and Build a Brighter Financial Future

In conclusion, systematic investment plans (SIPs) offer a great opportunity for investors to build long-term wealth through regular investments. SIPs can help you reach your financial goals, whether it is saving for retirement or buying a house. By following the steps outlined in this article, you can start investing in SIPs today and take the first step towards creating a brighter financial future for yourself and your loved ones. Remember to always choose the right fund, have realistic expectations, and be patient with your investments. With dedication and discipline, you too can achieve financial freedom through SIPs.