Introduction:

The Indian insurance industry has undergone a significant transformation, evolving from its early beginnings to becoming a dynamic and inclusive sector. This journey is marked by key milestones, phases, and advancements that have shaped the industry over the years. From historical reforms to embracing technology and customer-centric innovations, the Indian insurance landscape has seen remarkable changes. This article explores the evolution of the Indian insurance industry, highlighting the pivotal reforms, the adoption of new technologies, and innovative practices that have redefined the sector.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Establishment – Insurance Industry

Early Beginnings

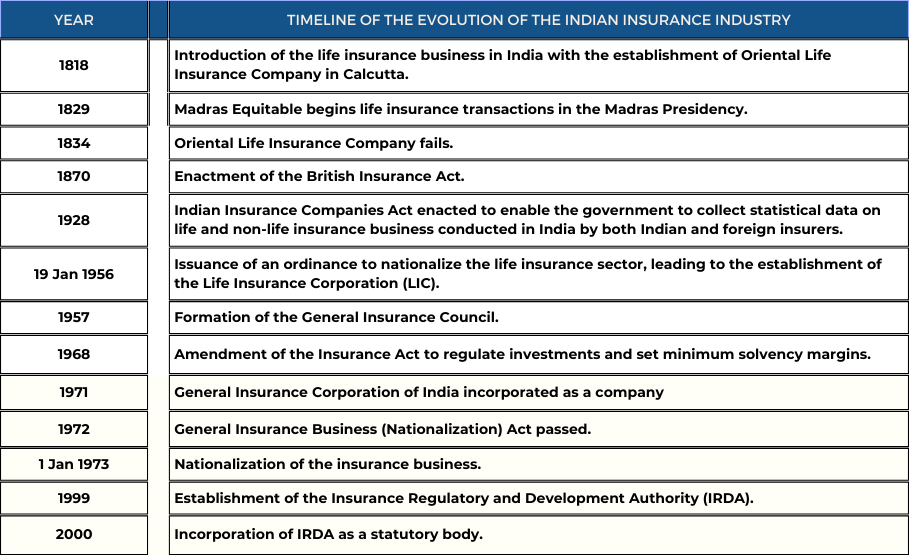

The advent of the life insurance business in India was introduced in 1818 with the establishment of the Oriental Life Insurance Company in Calcutta. However, this company failed in 1834. The Madras Equitable had begun transacting life insurance business in the Madras Presidency in 1829.

The British Era

The enactment of the British Insurance Act took place in 1870. In the last thirty years of the nineteenth century, several companies such as Bombay Mutual (1871), Oriental (1874), and Empire of India (1897) were established in the Bombay Residency. This period was dominated by foreign insurance companies like Albert Life Assurance, Liverpool and London Globe Insurance, and Royal Insurance.

Early Regulations

The Indian Life Assurance Companies Act of 1912 was the first statutory entity to regulate the life insurance business in the country. In 1914, the government of India began publishing the returns of the Insurance Companies in India. The Indian Insurance Companies Act was enacted in 1928 to enable the government to collect statistical data about both life and non-life businesses carried out in India by Indian and foreign insurers, including provident insurance societies.

Consolidation and Amendment

In 1938, the earlier legislation was consolidated and amended by the Insurance Act of 1938 with a view to protecting the interests of the insurance public. The Insurance Amendment Act of 1950 abolished Principal Agencies. The industry was characterized by a large number of insurance companies and high competition, often marred by allegations of unfair trade practices.

Nationalization of Insurance Business

On January 19, 1956, the life insurance sector was nationalized, and the Life Insurance Corporation of India (LIC) was established. The LIC absorbed 154 Indian, 16 non-Indian insurers, and 75 provident societies, totaling 245 Indian and foreign insurers. The LIC held a monopoly in the life insurance sector until the late 1990s when the insurance sector was reopened for private players.

General Insurance in India

Early Developments

The history of general insurance in India dates back to the Industrial Revolution in the West and the consequent growth of sea-faring trade and commerce in the 17th century, introduced to India during British occupation. The Triton Insurance Company Ltd. was established in 1850 in Calcutta by the British. In 1907, the Indian Mercantile Insurance Ltd. was established, becoming the first company to transact all classes of general insurance business.

Formation of Regulatory Bodies

In 1957, the General Insurance Council was formed, as a wing of the Insurance Association of India. The council framed a code of conduct for ensuring fair and sound business practices. The amendment of the Insurance Act in 1968 regulated investments and set minimum solvency margins.

Nationalization

The General Insurance Business (Nationalization) Act was passed in 1972, and the General Insurance Corporation of India (GIC) was incorporated as a company in 1971. On January 1, 1973, the insurance business was nationalized.

Establishment of IRDA

As per the recommendations of the Malhotra Committee report in 1999, the IRDA (Insurance Regulatory and Development Authority) was set up. It is an autonomous body responsible for the regulation and development of the insurance industry in India. In April 2000, the IRDA was incorporated as a statutory body.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Objectives of IRDA

The prime objectives of the IRDA include promoting competition in the insurance industry to enhance customer satisfaction through increased consumer choices and lower premiums. The IRDA ensures the financial security of the insurance market and has the power to frame regulations under Section 114A of the Insurance Act of 1938. Since 2000, it has issued various regulations covering the registration of companies for carrying on insurance business, protection of policyholders’ interests, and more.

Recent Developments:

Embracing Technology:

The integration of information technology has revolutionized the insurance industry, enhancing both operational efficiency and customer experience. Online platforms now allow customers to easily access policy details, make premium payments, and receive updates, streamlining the overall process. Technology has enabled insurance companies to improve communication, reduce operational costs, and offer personalized services, thereby increasing customer satisfaction and loyalty.

Bancassurance:

The collaboration between banks and insurance companies, known as bancassurance, has emerged as a powerful distribution channel. Banks leverage their extensive branch networks and customer relationships to sell insurance products, thereby extending the reach of insurance companies. This partnership benefits both parties: banks gain additional revenue streams through commissions and fees, while insurance companies access a broader market without significant additional infrastructure investment.

Online Sales:

The proliferation of online sales platforms has simplified the insurance purchasing process, making it more transparent and accessible. Customers can now compare products, read reviews, and purchase policies directly from insurers’ websites, bypassing traditional intermediaries. This not only reduces acquisition costs but also empowers consumers with greater choice and control over their insurance decisions.

Micro-Insurance:

Micro-insurance has been instrumental in promoting financial inclusion, especially among low-income populations. The IRDAI has facilitated the development of micro-insurance products that provide essential coverage at affordable premiums. These policies address the unique needs of underserved communities, offering protection against common risks such as health emergencies, natural disasters, and income loss, thereby enhancing their financial resilience.

Enhanced Grievance Redressal:

With the industry’s growth, there has been a concerted effort to improve customer service and grievance redressal mechanisms. The IRDAI’s establishment of a dedicated call center and the provision of toll-free numbers and email support have made it easier for policyholders to resolve their issues promptly. This focus on customer satisfaction has not only improved the industry’s image but also fostered greater trust and confidence among consumers.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion:

The Indian insurance industry has undergone a profound transformation, driven by regulatory reforms, technological advancements, and a shift towards customer-centric approaches. From its nascent pre-liberalization phase to the dynamic and innovative landscape of today, the industry has made significant strides in expanding its reach, enhancing accessibility, and improving customer satisfaction. As the industry continues to evolve, it stands poised for further growth and innovation, promising a more inclusive and robust insurance sector in India. This journey of growth, reform, and innovation underscores the industry’s commitment to meeting the diverse needs of its customers and contributing to the nation’s economic development.