Unlocking the Power of ETFs: A Game-Changer for Indian Investors

Exchange Traded Funds (ETFs) in India: Key features and investment strategies

The Rise of ETFs in India

Exchange Traded Funds (ETFs) are gaining popularity among Indian investors due to their many advantages over traditional investment options. According to a report by the Association of Mutual Funds in India, assets under management (AUM) for ETFs have grown by over 100% in the past year alone. In fact, the total AUM for ETFs in India reached INR 3 lakh crore as of August 2021, representing a significant shift towards passive investing. In this article, we will talk about the ETF market in India, types of ETFs available and will discuss ETFs investment strategies that have proven highly effective for the benefit of our readers.

This growth in popularity can be attributed to various factors such as lower costs, diversification benefits, and ease of trading on stock exchanges. Moreover, with improved regulatory frameworks and investor awareness programs, more investors are now turning to ETFs as a reliable investment option for their portfolios. As a result, many asset management companies are launching new ETF products across different sectors such as equity, debt and gold.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Here is a snapshot of ETF Market’s Journey in India between 2001 and 2021

Source: PrimeInvestor.in

The chart above is a snapshot of the 20-year history of ETFs in Indian markets. Between 2001 and 2013 the ETF market had had a very limited growth with very limited options for investors both in debt and equity side. However, the tide turned from 2014, and the ETF market picked up pace, gaining in both number of ETFs and inflows. Between January 2014 and December 2017 – i.e., a span of just 4 years – 33 ETFs were launched doubling the total number of ETFs to 66 both in equity and debt side. In equity, thematic and strategy ETFs were launched and in debt, apart from gilt, target-maturity funds emerged as a category – including both PSU bonds and SDL instruments as underlying instruments. The advent of PF money also caused a meteoric rise in ETF AUM (at close to Rs 4 lakh crore now).

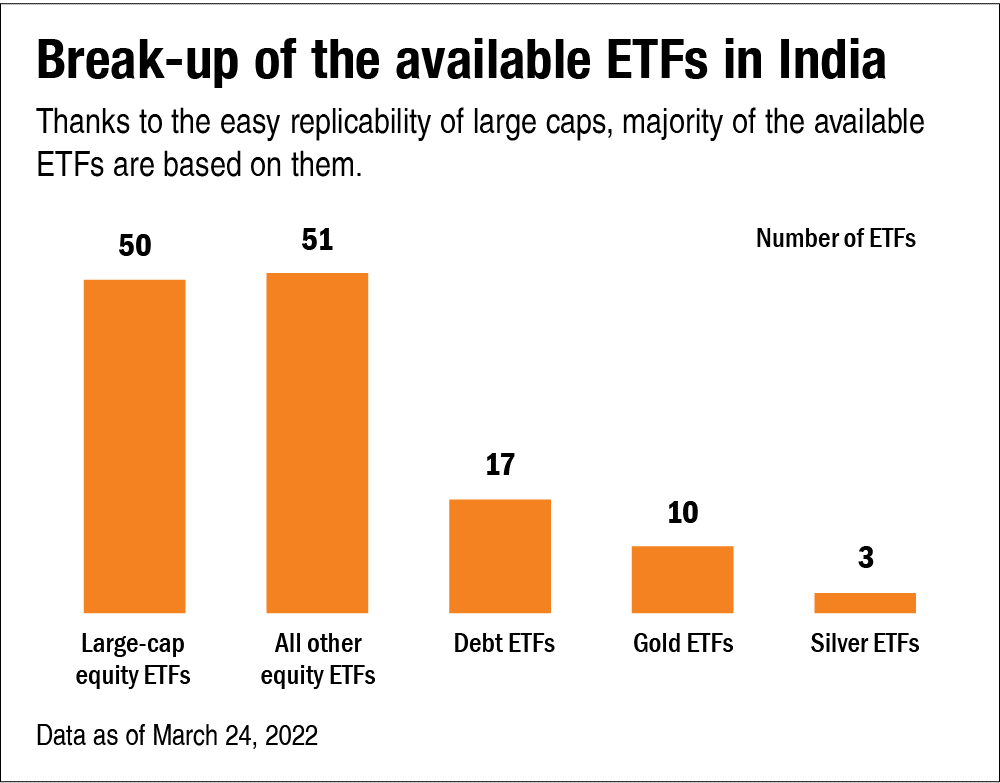

Now let us look into the kinds of ETFs available in India.

Source: PrimeInvestor

Understanding Exchange Traded Funds (ETFs)

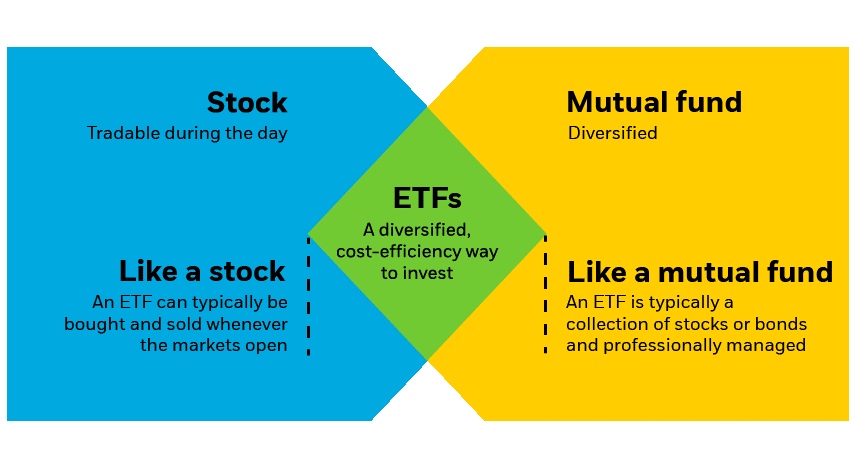

If you are new to the world of investing, you might be wondering what an ETF is. Simply put, an ETF is a type of investment fund that is listed and traded on a stock exchange like a regular stock. It provides investors with the ease of trading shares, diversification of investments, and cost advantages.

An ETF typically tracks a particular index or industry sector and holds a basket of underlying assets such as stocks, bonds, commodities or currencies. The objective of an ETF is to replicate the performance of its underlying assets and provide returns that are similar to those generated by the benchmark index it tracks.

ETFs have gained immense popularity over recent years as they allow investors to gain exposure to various asset classes with lower management fees and higher liquidity compared to traditional mutual funds. Moreover, they offer transparency in terms of their holdings, allowing investors to make informed decisions about their investments. Understanding how ETFs work can help you build a diversified portfolio while minimizing risks.

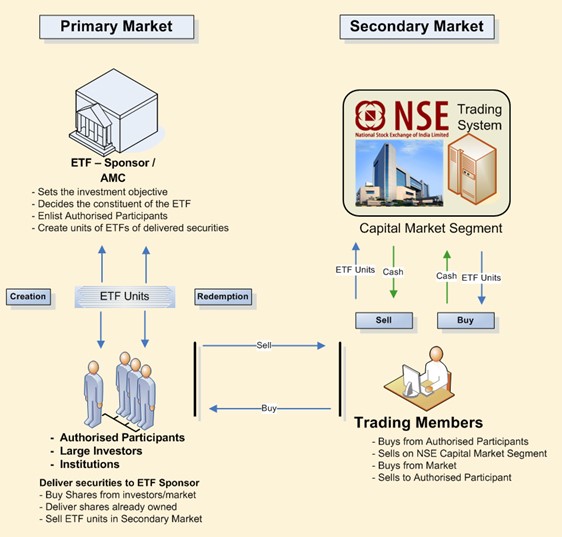

ETF Market Structure in India:

In the last 10 years, the managed funds in large cap category have been underperforming the benchmark and hence the attractiveness of passive investment increased. In August 2019, US passive industry crossed a milestone by crossing the asset managed under active managed fund (50.1% vs 49.9%). When we look at the trends in India, it is showing a staggering growth over the past few years, with ETFs holding close to 20% share and witnessing a strong positive flow into both active and passive funds. At this point, as an investor it is important to know about the market structure of ETFs.

Source: NSE, India

Different Types of ETFs in India

ETFs have emerged as a popular investment option in recent years due to their flexibility and cost-effectiveness. In India, there are several types of ETFs available for investors to choose from. Let’s take a closer look at some of the different types of ETFs in India:

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Index-based ETFs:

Index-based ETFs track a specific market index such as the Nifty 50 or Sensex. They invest in the same stocks that make up the index they are tracking, giving investors exposure to a broad range of companies. These funds are ideal for investors who want to invest in the stock market without having to pick individual stocks.

Sectoral/Thematic ETFs:

Sectoral/Thematic ETFs invest in stocks from specific sectors such as banking, healthcare, or technology. They are designed for investors who want to focus on a particular sector or theme. For example, an investor bullish on technology can invest in a thematic ETF that consists of tech-related companies.

Bond ETFs:

Bond ETFs invest primarily in government securities or corporate bonds. These funds are considered less risky than equity-based funds and provide regular income to investors through interest payments. They are suitable for conservative investors looking for stable returns.

Gold ETFs:

Gold is considered a safe-haven investment during times of economic uncertainty and inflationary pressure. Gold-based ETFs enable investors to invest in gold without having to physically buy and store it themselves. These funds track the price movements of gold and provide exposure to this precious metal.

Benefits of Investing in ETFs

Investors can reap several benefits by investing in exchange-traded funds (ETFs). First and foremost, ETFs provide diversification benefits that can help mitigate risks associated with investing in individual stocks. By investing in a single ETF, investors gain exposure to a basket of securities, which spreads the risk more evenly across assets and reduces the impact of market fluctuations on the portfolio.

Another advantage of investing in ETFs is their low cost compared to actively managed mutual funds. Since many ETF funds track an index or sector, they are passively managed and have lower expense ratios than actively managed mutual funds. This allows investors to save money on management fees while still achieving broad market exposure.

Key Features of ETFs in India

Exchange Traded Funds (ETFs) are becoming increasingly popular among investors in India because of their unique features. Unlike mutual funds, ETFs trade on the stock exchange like stocks and offer investors exposure to a diversified basket of securities. Here are some key features of ETFs in India:

Liquidity:

One of the main advantages of investing in ETFs is their liquidity. Since they trade on the stock exchange like stocks, they can be bought or sold at any time during market hours at market-determined prices. This makes it easy for investors to enter and exit positions quickly.

Diversification:

Another key feature of ETFs is diversification. In India, most ETFs track benchmark indices such as the Nifty 50 or Sensex, which means that they provide exposure to a diversified basket of securities across various sectors and industries. This helps reduce the risk associated with investing in individual stocks.

Low Cost:

ETFs are also known for their low cost structure compared to actively managed mutual funds. Since most Indian ETFs track an index, they do not require active management by fund managers, which reduces costs such as research and analysis fees.

No Lock-in Period:

Unlike some mutual funds that have a lock-in period, most Indian ETFs do not have any such restrictions. This means that investors can buy or sell units anytime they want without having to worry about penalties or exit loads.

Tax Efficiency:

Finally, Indian ETFs offer tax efficiency because they are treated as equities for taxation.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

How to Invest in ETFs

Investing in ETFs in India is quite easy and straightforward. Here are the steps to follow:

-

Step 1: Choose an ETF

The first step is to select an ETF that aligns with your investment objectives and risk tolerance. You can find a list of available ETFs on the websites of various fund houses or on the National Stock Exchange (NSE) website.

-

Step 2: Open a Demat Account

To invest in ETFs, you need to open a Demat account with a registered depository participant (DP). This account will hold your units of ETF just like it holds your stocks.

-

Step 3: Place Your Order

Once you have selected an ETF and opened your Demat account, you can place your order through any registered broker. You can buy or sell units of ETF just like individual stocks by placing an order with the broker.

-

Step 4: Monitor Your Investment

You should keep track of your investment just like any other investment. You can monitor its performance using the NAV (Net Asset Value) or price per share information available on various financial portals, including the NSE website.

If you are new to investing or don’t have time to pick individual stocks, investing in ETFs can be a great option for you. It offers diversification while reducing risks and costs associated with traditional mutual funds. With low expense ratios, transparency, and flexibility, investing in ETFs has never been easier in India.

ETFs vs Mutual Funds: Which is Better?

As an investor, you may be wondering whether to invest in ETFs or mutual funds. Both are popular investment options for those looking to diversify their portfolios, but they differ in several key ways. Here are some factors to consider when deciding between ETFs and mutual funds.

- One of the main differences between ETFs and mutual funds is how they are traded. ETFs trade on stock exchanges like individual stocks, so their prices fluctuate throughout the trading day. In contrast, mutual fund shares are priced at the end of each trading day based on the net asset value (NAV) of the underlying securities in the fund.

- Another important consideration is fees. Generally, ETFs have lower fees than mutual funds because they do not require as much active management. However, some mutual fund companies have introduced low-cost index funds that rival ETF costs.

- In terms of tax efficiency, both ETFs and mutual funds can be tax-efficient if managed correctly. However, because of their more passive nature, ETFs tend to be more tax-efficient than actively managed mutual funds.

All things considered; both options offer unique benefits depending on your investment goals and preferences. It’s important to thoroughly research both options before making a decision that works best for you.

Common ETFs Investment Strategies

ETFs are a popular investment tool because of their low costs, diversification, and liquidity. However, selecting the right ETF for your portfolio is just the start. Knowing how to use them in different investment strategies can help you optimize your returns.

Buy and Hold:

This strategy involves purchasing a diversified basket of ETFs and holding them for an extended period. This approach is ideal for investors who prefer a long-term investment horizon with minimal transactions. It allows you to benefit from the compounding effect of returns over time while minimizing trading fees.

Tactical Asset Allocation:

This strategy involves actively monitoring market conditions and adjusting your portfolio accordingly. You would typically invest in ETFs that align with your asset allocation goals but make changes based on market trends. For example, if you predict a downturn in one sector or asset class, you might reallocate funds to another sector or pull out altogether.

Income Generation:

This strategy aims to generate income through dividend-paying ETFs focused on high-yield bonds or stocks. These types of ETFs offer regular income payments that can be reinvested or used as passive income streams.

Momentum Investing:

This strategy involves identifying an asset class or sector that has shown consistent upward momentum and investing in an appropriate ETF. The goal is to ride the trend until there are signs of a reversal before selling off and seeking another opportunity.

Currency Hedging:

If you’re investing globally, currency fluctuations can significantly impact your returns. Currency hedging strategies aim to protect against these risks by using specialized ETFs.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Risks Associated with Investing in ETFs

While ETFs are a popular investment choice for many investors, there are still risks associated with investing in them. One of the main risks is market volatility. Just like stocks, ETFs can experience sharp price fluctuations due to various factors such as economic events, political instability, and company-specific news.

Another risk to consider is tracking error. Although ETFs aim to replicate the performance of a particular index or asset class, there may be slight differences in returns due to the fees and expenses involved in managing the fund. In addition, some ETFs may use complex investment strategies that increase their risk exposure.

Liquidity risk is also a concern for certain types of ETFs. If an ETF has low trading volumes or lacks active market participants, it may be difficult for investors to buy or sell shares at their desired price. Hence it is always advised to avoid the Small Cap ETFs.

Lastly, like any investment product, there is always the risk of losing money when investing in ETFs. Investors should carefully analyse their financial goals and risk tolerance before investing in any type of investment product including exchange-traded funds.

Tips for Successful Investing in ETFs

Investing in ETFs can be a smart choice, but only if you do it wisely. Here are some tips to help you make the most of your investments:

Diversify your portfolio:

A key advantage of investing in ETFs is that they allow you to diversify your portfolio across various asset classes, sectors and geographies. This can help reduce your risk and increase your returns.

Choose the right ETF:

With so many ETFs available in the market, it’s important to choose the one that aligns with your investment goals, risk tolerance and time horizon. Don’t blindly follow the crowd or get swayed by short-term performance.

Keep an eye on costs:

The expense ratio of an ETF can eat into your returns over time, so make sure to compare costs before making a decision. Look for low-cost options that provide similar exposure to the market.

Monitor your holdings:

While ETFs are passive investments that track an index or a basket of securities, it’s still important to keep track of what you own and how it’s performing relative to its benchmark. Regularly rebalance your portfolio if needed.

Stay disciplined and patient:

Investing in ETFs is a long-term game, so avoid getting caught up in short-term fluctuations or trying to time the market. Stick to your investment plan and stay focused on achieving your financial goals.

Investing in ETFs requires careful consideration and deliberate action on behalf of investors who want their money working as hard as possible for them within their comfort levels.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion: Why You Should Consider ETF Investing

Exchange Traded Funds (ETFs) have revolutionized the way investors in India invest in the financial market. ETFs provide a low-cost, tax-efficient and transparent investment option for investors of all backgrounds to build a well-diversified portfolio. With a wide variety of ETFs to choose from, investors can choose the exposure and appropriate ETFs investment strategies based on their risk tolerance, investment horizon and financial goals. By following a disciplined investment approach and conducting thorough research before making any investment decisions, investors can experience the benefits of investing in ETFs for years to come.

Bonus: Top ETFs to Watch Out for in India

Now that you have a good understanding of ETFs, it’s time to explore some of the best ETFs available in India. It’s important to remember that these are not recommendations, but rather a starting point for your own research and investment decisions.

Nifty 50 ETF:

This fund tracks the performance of the National Stock Exchange’s Nifty 50 Index, which represents India’s top blue-chip companies. With an expense ratio of just 0.05%, this fund is one of the most cost-effective ways to invest in large-cap Indian stocks.

ICICI Prudential Sensex ETF:

This fund tracks the performance of the Bombay Stock Exchange’s benchmark index, the S&P BSE Sensex. With assets under management (AUM) over INR 10 billion and an expense ratio of just 0.07%, this fund provides exposure to some of India’s largest and most prestigious companies.

HDFC Bank Nifty 50 ETF:

As one of India’s leading banking institutions, HDFC offers a range of high-quality investment products, including this popular Nifty 50 ETF. With low costs and strong liquidity, this fund can be an excellent way to gain exposure to some of India’s top-performing blue-chip stocks.