Introduction:

Investing is a great way to grow your wealth and create a secure financial future. However, investing can be complex, especially when it comes to understanding risk and return trade-off and balancing an investment portfolio. With so many different investment options available in the Indian market, it can be challenging to know where to start.

In this article, we will explore the key concepts of risk and return in investing and why balancing your investment portfolio is essential. We will also discuss the various investment options available in the Indian market and how you can assess your risk tolerance. Finally, we will provide practical guidelines for building a diversified portfolio, regularly reviewing your investments, and rebalancing your portfolio to ensure that it remains aligned with your investment goals. By the end of this article, you will have a clear understanding of how to balance an investment portfolio in the Indian market for maximum returns with minimum risk.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

What is Risk and Return?

Before delving into the intricacies of a balanced investment portfolio, it’s essential to understand the concept of risk and return. In simple terms, risk refers to the probability of losing your money when investing in a particular asset or financial instrument. On the other hand, return refers to the profit you can earn from that investment.

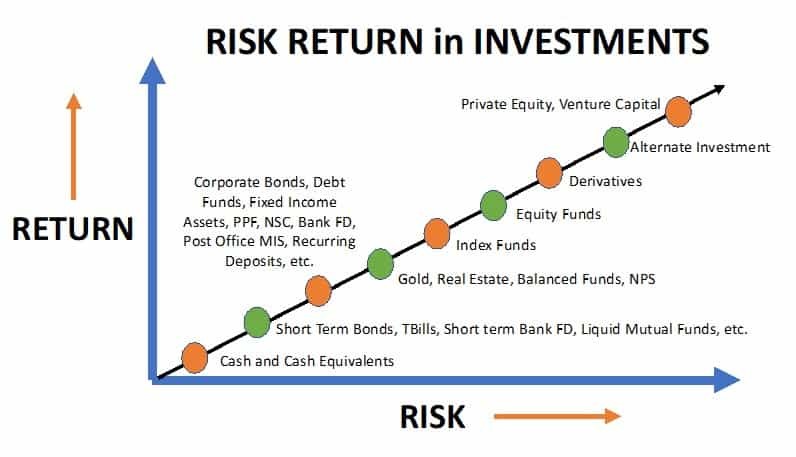

The relationship between risk and return is critical because investors need to be compensated for taking on higher risks with higher potential returns. Therefore, if an investment has a high potential for gains, it will also have a high possibility of losses. Conversely, investments with low risks tend to have lower returns. Understanding this correlation is crucial when balancing an investment portfolio as it helps investors determine their appetite for risk and identify assets that align with their financial goals.

Figure: Risk-Return trade-off

Why is balancing an investment portfolio important?

Investing in the Indian market can be a lucrative opportunity, but it comes with its risks. Balancing your investment portfolio is crucial because it helps you manage those risks and optimize your returns over time.

A balanced investment portfolio ensures that your money is not concentrated in a single asset or sector that may be affected by market volatility, economic conditions or company-specific issues. Diversification reduces the impact of market downturns and protects your investments from losses. A well-balanced portfolio allows you to tap into the upside potential of different asset classes while minimizing risk, giving you the best chance to achieve long-term financial goals such as retirement planning or wealth creation.

Figure: A story on how diversification happens at fund level

Let’s take an example of a Hybrid Fund, which is a category of Mutual Fund, having an combination of Equity, Debt and Arbitrage. The equity allocation of this fund is scattered with the Large and Mid-Cap space picking stocks from the top 250 companies across all sectors. Also, allocation to a particular stock can not be more than 10% of the total portfolio. This is to minimize the concentration risk in equity allocation. The remaining fund is allocated in debt securities which dilutes the risk of investing in equity as an asset class.

If we take a look at a pure equity portfolio, let’s say, in Large and Mid-Cap category, a sectoral diversification minimizes the risk.

While managing these funds on a daily basis, the fund manager would stick to the mandate given to him on the fund that he is managing and whenever the percentage allocation of the portfolio moves away from this mandate, he would do the required transactions to bring the portfolio back to it’s original mix. This process of rebalancing on a regular basis, helps investors manage risks by diversifying their assets across various sectors and classes while optimizing their returns over time. It provides a solid foundation for long-term financial growth and stability but it requires understanding risk and return trade-off.

There are different ways to balance an investment portfolio depending on your risk appetite, financial goals and time horizon. Some investors may choose to allocate more funds towards equity investments for higher returns, while others may prefer fixed income securities for stability and income generation. Either way, finding the right balance requires careful consideration of various factors such as risk tolerance, asset allocation strategy and periodic review.

What are the various investment options available in the Indian market?

India offers a vast array of investment opportunities to potential investors. These options range from traditional investment instruments like fixed deposits, equity shares, and mutual funds to alternative instruments like real estate and commodities.

One of the most popular investment options in India is equity shares. Investors can invest in blue-chip companies or upcoming start-ups. Mutual funds are also an attractive option for retail investors as they offer exposure to diversified portfolios managed by experienced professionals. Fixed deposits offered by banks and post offices are a safe option for investors who prioritize capital preservation over capital appreciation.

Real estate has traditionally been a popular investment avenue among Indian investors. It offers the potential for long-term capital appreciation along with regular rental income. Commodities like gold, silver, and oil offer an effective way to hedge against inflation and currency fluctuations.

It is important for investors to carefully consider their investment objectives, risk tolerance, and time horizon before choosing an appropriate investment instrument. Diversification across asset classes is also crucial as it helps mitigate risks associated with any particular asset class.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Understanding Risk and Return Trade-off

As an investor, it’s essential to understand the relationship between risk and return. Simply put, the higher the risk, the greater potential for higher returns, and vice versa. However, this does not necessarily mean that every high-risk investment will yield high returns or that low-risk investments will generate low returns.

The risk-return trade-off can vary depending on various factors such as market conditions, economic policies, company performance, among others. As such, it’s crucial to assess your risk tolerance level and invest accordingly to achieve a balanced portfolio that aligns with your investment goals.

Assessing Your Risk Tolerance

Before investing, it’s essential to understand your risk tolerance. Risk tolerance is the amount of market risk you can take before feeling uncomfortable. Some investors are more willing to take risks, while others prefer a more conservative approach. Assessing your risk tolerance will help you create an investment plan that aligns with your financial goals and comfort level.

It’s important to understand that your risk tolerance can change over time as your financial situation changes. Factors such as age, income, and personal circumstances may impact how much risk you’re willing to take on. Additionally, it’s important to consider how much time you have before needing the invested funds and the level of liquidity required for any unexpected expenses.

Building a Diversified Portfolio

As discussed earlier, a diversified portfolio is one of the most important aspects of balancing an investment portfolio. Diversification helps to minimize risks and maximize returns by spreading your investments across different asset classes, sectors, and geographical regions.

As an investor in the Indian market, it’s crucial to avoid putting all your eggs in one basket. Like a diversified mutual fund scheme would allocate funds across all sectors and multiple asset classes, a well-diversified investment portfolio for an investor can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and other alternative assets. When constructing your portfolio, consider your risk tolerance and investment goals.

Diversification is not just about holding different types of assets; it’s also about how much you allocate to each asset class. A rule of thumb is to allocate a percentage of your portfolio to stocks based on your age: subtracting your age from 100 should give you the percentage that should be invested in stocks; the remainder should be allocated towards bonds and other fixed-income investments. However, this rule is slowly moving towards obsolescence, as capital market is becoming a lot more matured than before, and investors are becoming more cautious about the risk – return trade off. Now the allocation is purely driven by the goal which is linked with a particular investment portfolio.

For example, a person aged 35 years, might be investing to accumulate a corpus to buy a new car within next 3 years, and a person aged 65 years, might be investing to accumulate a corpus which he would want to transfer to his next generation. In this scenario, the person aged 35 years will be significantly risk averse compared to the elderly person.

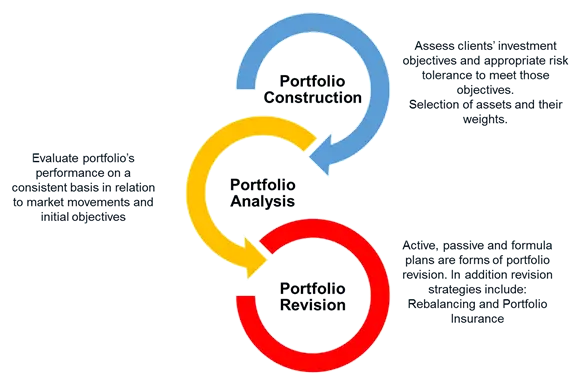

Importance of Regular Portfolio Review

One of the keys to keeping your investment portfolio balanced is to conduct regular reviews. This helps you assess whether your investments are performing as expected, taking into account any changes in market conditions or your own personal circumstances. A portfolio review can help you identify areas where you may be overexposed to particular types of investments and give you the opportunity to rebalance your portfolio accordingly.

By conducting regular reviews, you can also ensure that your investment strategy remains aligned with your long-term financial goals. It gives you the chance to adjust your portfolio based on any new information or changes in market trends, so that you can make more informed investment decisions going forward.

Regular portfolio reviews also help investors stay disciplined and avoid making hasty decisions based on short-term fluctuations in the market. By taking a longer-term view and focusing on the fundamentals of their investments, investors can avoid reacting impulsively to market volatility and instead maintain a more balanced approach to investing.

Figure: Portfolio Management

Rebalancing Your Portfolio

Rebalancing your investment portfolio is the process of adjusting the allocation of assets in your portfolio to bring it back to its original intended level. Over time, as some investments perform better than others, the original asset allocation can become unbalanced. This can expose you to more risk than you intended or limit potential returns.

Rebalancing is a critical aspect of maintaining a balanced and diversified portfolio. It ensures that you continue to invest in line with your goals and risk tolerance. It also forces you to sell assets that have done well and buy assets that have underperformed, which can be difficult but is necessary for long-term success. Rebalancing regularly (annually or semi-annually) helps investors avoid emotional decisions based on short-term market movements. Remember, while rebalancing may seem counterintuitive at times, it’s crucial for maintaining a healthy investment portfolio.

Investors have the option to conduct portfolio rebalancing either manually or automatically, with the latter being a more emotionless approach that removes some of the challenges that come with buying and selling at the right time. As a practical example, suppose an investor’s portfolio comprises stocks and bonds, with the goal of investing 35% and 40%, respectively, of the portfolio in each asset class. Suppose that, over time, the portfolio’s values shift accordingly. In this case, the investor must rebalance the portfolio to achieve their desired level of risk.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

The Process of Portfolio Rebalancing

Portfolio revision involves the process of rebalancing, which can vary depending on the type of investor. Automated rebalancing is distinct from rebalancing automation, which is commonly known as Robo rebalancing. Robo rebalancing involves the implementation of actionable and auto-generated trades, whereas rebalancing automation is related to the tools that facilitate the process. Rebalancing automation can streamline the process, but automated rebalancing fundamentally revolutionizes it by enabling scalability and improving the value proposition. Although automated rebalancing is not always fully automated, the robots can help with tasks that are challenging for humans. These tasks may include trade-offs, tax management, social screening, and asset class customization, among others. However, robots face certain issues, such as insufficient data, file transfer failures, and late processing of corporate actions. The quality of analytics is irrelevant if the data lacks integrity. Therefore, any automated workflow should have mechanisms for handling data integrity issues. This typically requires resolving the problems with the data before generating trades manually through the traditional process. Additionally, there are scenarios where a manual override becomes necessary, such as when a client requests a large transfer within a short timeframe. In such cases, temporary suspensions may be required, leading to common overrides.

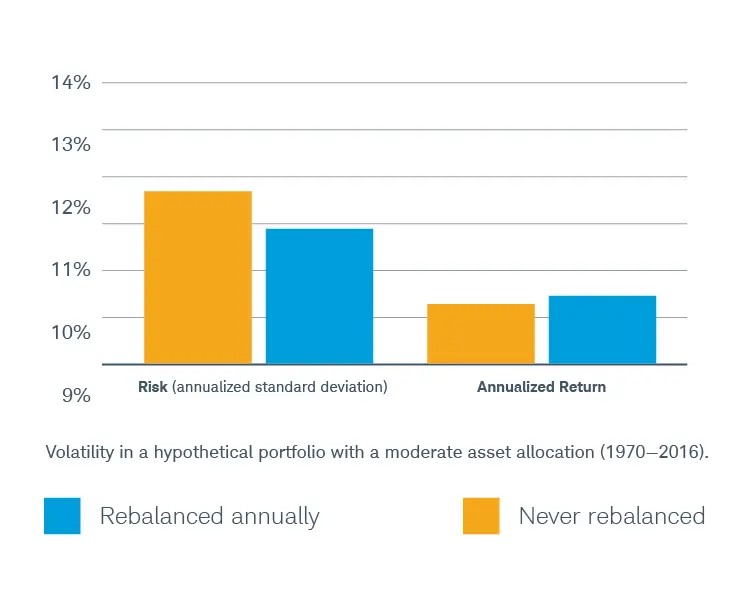

Benefits of Rebalancing Investment Portfolio

A balanced investment portfolio has several benefits that can help investors achieve their financial goals while minimizing risks. One of the primary benefits of having a properly balanced investment portfolio is that it helps to reduce volatility. By periodic rebalancing of investments across different asset classes, such as stocks, bonds, and cash, investors can minimize the impact of market fluctuations on their overall portfolio value.

In addition to reducing volatility, a balanced investment portfolio also provides the potential for higher returns while keeping risks under control. When investors diversify their investments across different asset classes and sectors within each class, they increase their chances of earning higher returns over time. Furthermore, a well-balanced portfolio allows investors to take advantage of various market conditions without exposing themselves to undue risk.

Figure: Benefits of rebalancing investment portfolio

Common Mistakes to Avoid

While creating an investment portfolio, investors often fall into the trap of making common mistakes that can lead to unfavourable outcomes. One of the most significant mistakes is failing to diversify investments. Investing in only one or two stocks or sectors can lead to significant losses in case there is a market downturn.

Another mistake that investors make is not reviewing their portfolio regularly. A portfolio that was once balanced and diversified may no longer be so due to market movements, changes in asset classes, or an individual’s change in risk tolerance. It is important for investors to review their portfolios periodically and rebalance them if necessary.

Besides these, other common mistakes include investing based on rumours or hearsay rather than doing proper research, chasing after hot stocks without considering long-term prospects and not understanding the tax implications of investments.

To avoid such errors, it is important for investors to conduct thorough research before making any investment decisions. They should also consult with financial advisors who can provide professional guidance on creating a well-diversified portfolio aligned with their risk profile and financial goals.

Avoiding these common mistakes will help investors achieve their financial objectives by ensuring they have a balanced investment portfolio that protects them from market downturns while providing a steady return on investments over time.

➤ Enquire now for CWM Program ➤ Download CWM Brochure

Conclusion:

Understanding risk and return is crucial to building a well-balanced investment portfolio. Investors in the Indian market have a range of investment options available to them, but it is important to assess their risk tolerance and build a diversified portfolio that suits their individual needs. Regular review of the portfolio and rebalancing can help investors stay on track towards their financial goals. By avoiding common mistakes and taking a disciplined approach to investing, investors can achieve long-term success and feel confident in their investment decisions. Remember: with patience, perseverance, and good planning, anything is possible.